With the Russian economy recovering to pre-pandemic levels and ecommerce activity continuing its strong pace of growth, the Russian warehouse market, in which Raven Property Group (LON:RAVP_p) is a leading long-term investor, is performing strongly. Low vacancy, a lack of new supply and increased construction costs are driving accelerated rental growth, and this is supporting capital values, despite a significant rise in interest rates.

Share price performance

Increasing rents and property valuations

Raven operates in roubles but reports in sterling. In underlying rouble returns, H121 performance was strong. Including high occupancy (93% at end-H121 and 96% today), and an increase in average rouble rents per square meter to RUB5,062 from RUB4,833 in H120, NOI increased from RUB5.2bn to RUB5.4bn. Although the rouble was stable during the period, the average rate versus H120 was c 15% lower, affecting the reported sterling results. In sterling, NOI was 13% lower although underlying earnings improved to £17.3m (H120: £10.4m loss). The balance sheet showed little FX impact and including a c 3% increase in rouble property values, driven by market rent growth, sterling denominated NAV increased by c 13%. NAV per share increased by 25%, further benefiting from accretive share repurchases. This included the ordinary and preference share repurchases from a major investor, removing a substantial share overhand, at 21.6p and 90.8p respectively.

Positive income outlook, tempered by debt costs

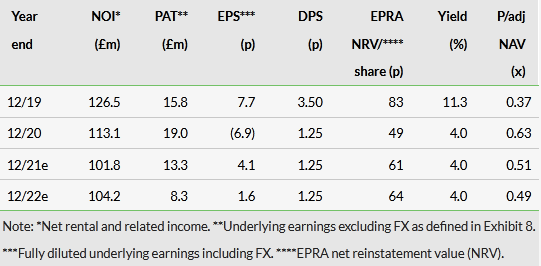

We expect a continuation of the positive operating environment, and our updated earnings forecasts include continuing growth in rents and rental income but more than offset by the increase in rouble debt costs. Rouble interest rates have increased from 4.25% to 6.5% ytd and our FY22e underlying earnings are reduced from £14.1m to £8.3m. Positively, rent growth should drive further valuation growth in a supply constrained market, and the shares are geared to this. However, conservatively we have not assumed this, nor that inflation may moderate and interest fall back, nor that higher interest rates may see the rouble strengthen. We provide a sensitivity analysis that indicates that each 1% increase (or fall) in underlying property values adds c 4% to our forecast NAV.

Valuation: Positive total returns the driver

While rising debt costs squeeze income, capital growth is likely to drive near-term returns. Strong growth in H121 net assets per share leaves the ordinary shares on a c 50% discount to our estimated H121 EPRA NRV of 61p per share despite the recent rise in the share price. The preference shares currently yield c 10%.

Company description: A leading investor in the Russian logistics warehouse sector

Raven Property Group is a self-managed, long-term investor in modern, Grade A, warehouse assets in Russia, where it has a leading position. At 30 June 2021, the portfolio comprised c 1.8m sqm of logistics warehouse property (of which c 70% is in the Moscow region) and 48k sqm of office property in St Petersburg, with a total portfolio market value of £1.13bn. End H121 portfolio occupancy was a strong 93% but has since increased to 96%. Warehouse tenants are predominantly large Russian or international companies operating mainly across the retail, distribution, manufacturing and third-party logistics sectors, with e-commerce growing quickly in line with market trends. The investment property division is the core of the group’s operations, which also include a third-party logistics business in Russia (RosLogistics).1

The company’s income-focused strategy has remained constant since IPO, but in recent years has adapted to meet the challenges of volatile economic and currency/oil market conditions as well as sanctions. The Russian warehouse market is now performing strongly, supported by strong demand-supply fundamentals, a recovering economy, and continued strong growth in e-commerce activity, in step with most other markets. With warehouse penetration and rents low in an international context we see strong opportunities for this to continue.

The ordinary shares are listed on the Main Market of the London Stock Exchange (LSE), with secondary listings on the Moscow and Johannesburg stock exchanges. The group also has preference shares that are listed on the LSE.

Click on the PDF below to read the full report: