Data suggests sudden tightening of GBP liquidity conditions

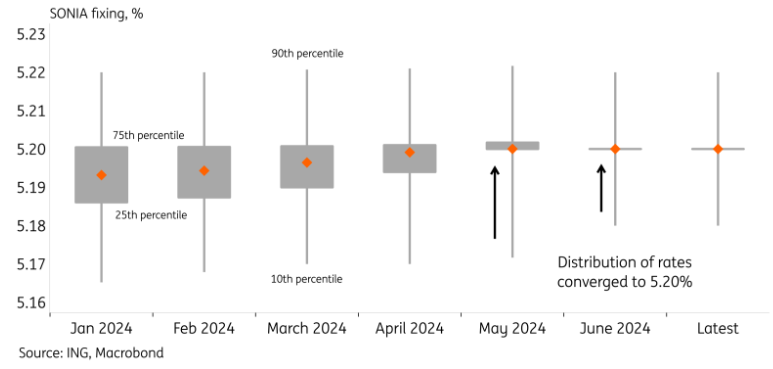

The Sterling Overnight Index Average (SONIA) benchmark rate has been creeping up since the beginning of the year, and the recent value of 5.20% makes us believe that GBP liquidity conditions have suddenly tightened significantly. The SONIA rate is based on the (trimmed) average rate of overnight sterling transactions, which the Bank of England publishes daily. Since the beginning of the year, the SONIA rose by only 1bp, but when looking at this number in a broader context, liquidity conditions seem to have tightened rapidly since May for the following three reasons:

Firstly, the percentile distribution of the SONIA shows a strong convergence to 5.20%, suggesting banks overall are paying more for attracting liquidity. The chart below shows that the convergence of the SONIA to 5.20% happened when the 10th and 25th percentiles, reflecting the 10% and 25% transactions with the lowest overnight interest rate, also rose significantly. Up to April, the distribution converged relatively slowly, but since May, the convergence has happened much faster.

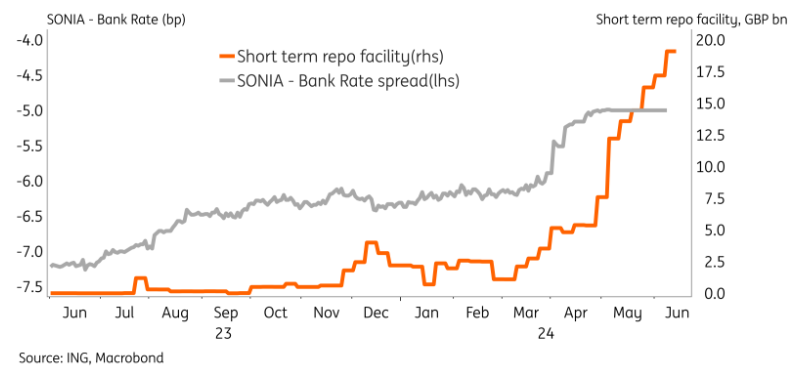

Secondly, the convergence coincided with a sharp increase in the short-term repo facility, which offers liquidity at the BoE Bank Rate of 5.25%. At the beginning of this year, the usage of this facility was negligible, but since May, the uptake has increased substantially. The rapid increase is a clear sign that market liquidity is tightening and some borrowers are willing to pay 5bp above SONIA for their funding. At around £19bn, the total amount is still manageable, but with the current trend, this number can increase considerably.

Thirdly, the published number of the SONIA benchmark rate seems to be stuck at exactly 5.2000%, which may be a statistical detail that suggests the underlying number could actually be higher. The BoE usually publishes the SONIA daily with a precision of four decimal places (e.g., 5.1984%). But since the 25th and 75th percentiles data has coincided in May, the rate has been 5.20%, raising our hypothesis that the BoE is now only reporting two decimal places. The exact reason is unknown, given that the official documentation specifies publication with four decimals.

In practice, this means that the trend of higher SONIA rates should probably have continued to drift higher, but that the rounding approach has capped this so far. We could have had another 0.5bp of spread tightening without that being visible. In the chart above you can see that the SONIA vs Bank Rate spread is suspiciously stable at exactly 5.0bp now.

Tighter liquidity conditions an omen for EUR markets

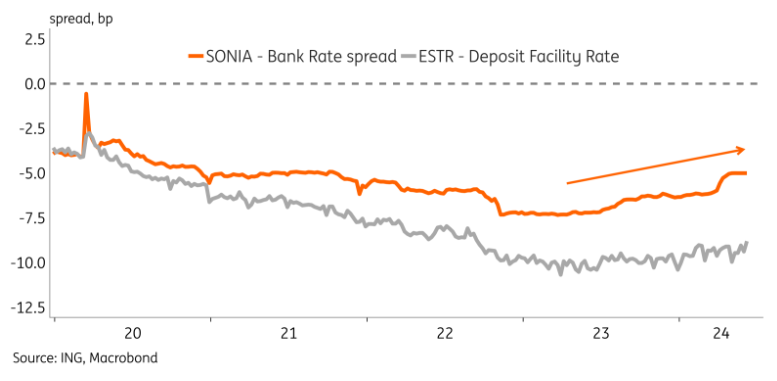

The sudden tightening of GBP liquidity conditions should be seen as a warning of what we can expect in the eurozone. With the unwinding of central bank balances, the amount of bank reserves is drawn from the system, reducing liquidity. Currently, Euro Short-Term Rate (ESTR) still seems relatively stable and does not show the same increase visible for SONIA, as you can see in the chart below. That said, the speed at which the SONIA increased in May is telling of the highly nonlinear and changeable nature of liquidity conditions and, thus, warrants close monitoring.

Whereas the BoE sets a bank rate that is equal for borrowing and lending (5.25%), the European Central Bank has a corridor of 15bp (from September onwards) between the deposit rate and the refinancing rate, which can amplify the impact of tighter liquidity conditions. This means that tightening liquidity conditions, as currently seen for GBP, could have a more profound effect on EUR markets. In the case of drying liquidity, eurozone banks will have to access a refinancing facility that is likely more than 15bp above the ESTR. In contrast, for the BoE the gap is currently only 5bp.