Fed June optionality is already priced by the US curve

Lack of tangible progress in debt ceiling talks helped to draw a line under the global bond market sell-off late in yesterday's session, and we think the proximity of the May Federal Open Market Committee minutes publication is another reason for investors to remain cautious today. It would make sense for the Fed to keep as much optionality as possible with regards to the June meeting and, for this reason, we doubt the minutes will wholeheartedly embrace the market's pause narrative, even if we think the May hike was indeed the last in this cycle.

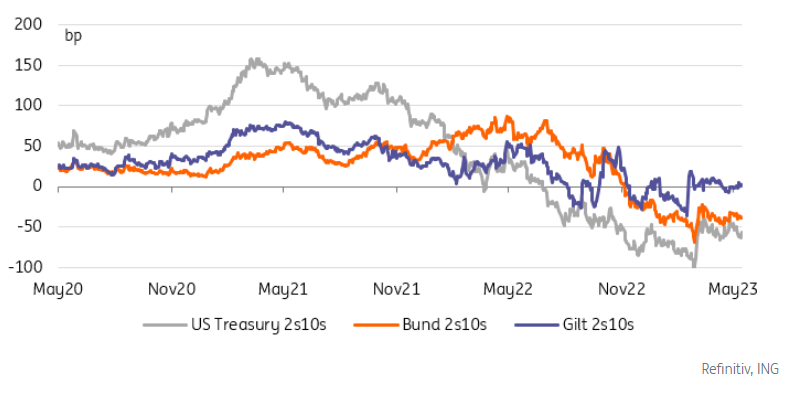

We consider the minutes of FOMC meetings to be a fully-fledged communication tool so it is reasonable to expect that, if the Fed has a message to send to markets, the minutes are fair game. In this instance, the more nuanced discussions within the committee seem an ideal channel to show that no decision has been taken yet about whether to hike in June. This needs not come as a shock to investors. Market-implied probability has risen to around 30% thanks to hawks pushing their higher for longer narrative. Accordingly, the US curve has been under re-flattening pressure with the 2s10s segment of the US Treasury curve back to its flattest level since the Silicon Valley Bank failure, around 65bp inverted.

Sterling bonds take it on the chin, as often the case when global rates rise

Sterling rates continued their rise even before this morning’s hotter than expected core UK inflation data. The curve has consistently priced more aggressive tightening than the Bank of England (BoE) is signalling since the start of this cycle. Governor Andrew Bailey was at pains to signal yesterday that the additional two hikes priced by the curve at the time it refreshed its forecast for the monetary policy report, were enough to cover the Bank for upside risk to inflation. Inflation persistence remains the buzzword for UK rates however, and higher Sonia forwards signal that markets aren’t as optimistic as the BoE is about it reverting to target. The continued sell-off in GBP rates since the May meeting may also reflect the fact that continued talk of inflation upside risk validates its more hawkish read on the BoE’s path than ours.

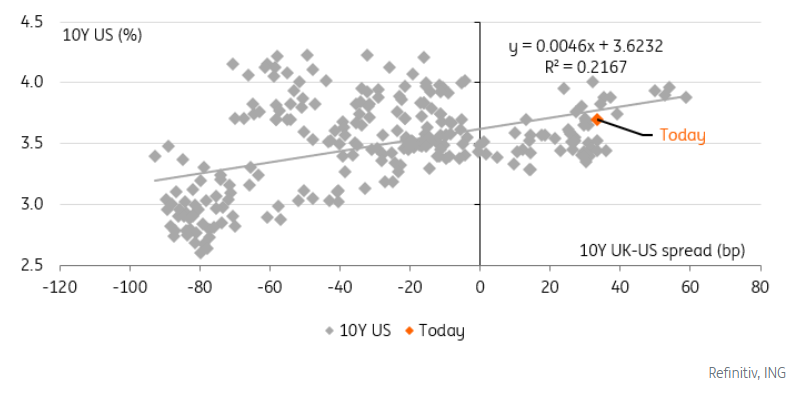

No matter that Bailey was also stressing that a lot of the policy tightening already implemented has yet to reach the economy. Besides doubts about the inflation trajectory, we think GBP rates’ greater beta to global developed market rates is also to blame for their faster rise relative to their international peers. That relationship has not been constant over time but there has been clear instance where the sterling market’s greater volatility has led to an underperformance of gilts relative to US Treasuries for instance. As the Fed approaches the end of its hiking cycle, we wouldn’t be surprised if this dynamic is at play once again. With a longer timeframe in mind, we think long-dated GBP rates (especially in forward space, for instance 5Y5Y) should not trade at a pick up to their USD peers but, as the past days have shown, this spread take time to revert.

Today’s events and market view

The April UK CPI report published this morning showed a moderation of headline inflation thanks to energy prices but, more importantly, an acceleration of core (from 6.2% to 6.8%) and services inflation. GBP-denominated bonds have been on their back foot in recent days (see above) and the release goes some way towards validating investors' concerns.

Germany’s Ifo follow hot on the heels of the May PMIs released yesterday. Disappointing manufacturing figures in particular might weigh on today’s Ifo, reinforcing the impression that sentiment data are catching up to less than stellar economic momentum.

Germany is scheduled to sell bonds in the 15Y sector, and the UK in the 10Y sector. The US Treasury will auction 2Y floating rate notes and 5Y T-notes.

The main central bank event today is the release of the May Federal Open Market Committee minutes in the US session but there will also be speeches from the BoE’s Bailey, and ECB's Lagarde.

The article was first published on Think.ing.com.