We see a case for the bond rally to extend in the near term but we expect the move to run our of steam ahead of the next weeks’ inflation and employment data

Drift lower in yields to continue for a few days but is increasingly running on fumes

We didn’t have a potential OPEC output increase on our list of reasons why bonds should continue to rally this week but it clearly doesn’t hurt. Our reasoning had more to do with classic bond fundamentals. Even if winter has proved mild so far, and this may well change, we expect PMIs’ gradual slide lower to drive home the message that Europe is headed for a recession. What’s more, the Federal Open Market Committee minutes are likely to paint a less hawkish picture than Powell’s press conference did after the meeting. Both would be supportive for bonds, and help them extend their already impressive rally.

The odds of a snapback higher in yields are rising

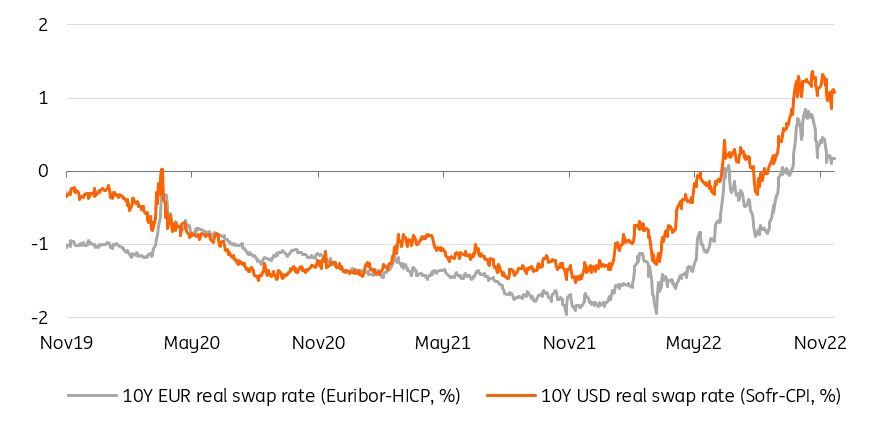

There is one problem, however. We think this is the wrong macro move and the odds of a snapback higher in yields are rising. For one thing, the all-important batch of employment and inflation releases that starts next week could well trigger a wave of position-squaring from short-term longs. More importantly, volatility in economic releases, and the solid performance of US employment data so far in this cycle, means the bar for a further bond rally is higher and less likely to be met. Finally, as bond real rates drop, the odds of a pushback from central banks increases.

In the case of 10-year German Bund, this means any dip below 2% in yields is unlikely to last past the end of this week in our view. In the case of US Treasuries, any test of 3.75% to the downside is likely to set up another jump back towards 4%.

The drop in real rates is a headache for central banks fighting inflation

Source: Refinitiv, ING

Today’s events and market view

Today’s European economic releases consist of the eurozone current account figures, as well as consumer confidence. The latter is expected to edge up slightly after its spectacular fall earlier this year. The UK Office for Budget Responsibility (OBR) testimony will also be closely watched by sterling investors given the controversy surrounding the government’s budget and economic forecasts.

The European Central Bank speakers list features Robert Holzmann, Olli Rehn, and Joachim Nagel.

Germany will make up today’s supply slate with a €3bn 5-year sale. The US Treasury will sell $35bn 7-year T-notes. The UK will sell 50-year inflation-linked gilts.

The US economic calendar brings an update to the Richmond Fed manufacturing index. Fed speakers are likely to have a hawkish tone thanks to Loretta Mester, Esther George, and James Bullard all due to make public comments.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more