Market pricing for 2024 ECB cuts looks stretched

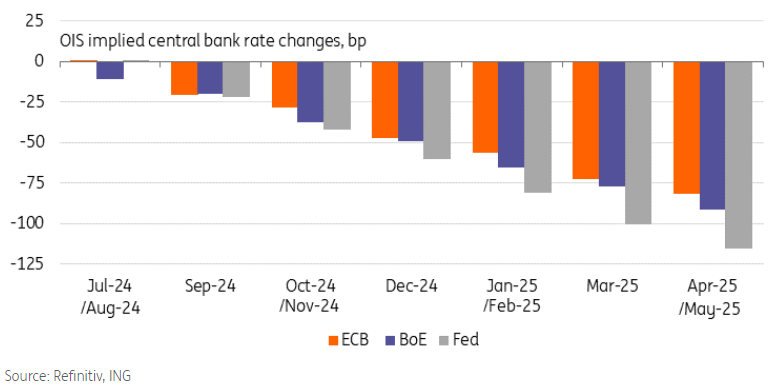

Euro rates are now pricing in 48bp of cuts for 2024, which is just 2bp shy of two full 25bp cuts. In our baseline case, we also see scope for two more cuts this year, but the pricing seems stretched. To justify such pricing, a non-negligible probability should be assigned to three more cuts, because only one cut is also still on the table.

Squeezing in a third cut in October is unlikely given the European Central Bank is pacing its quarterly projections. Governing Council member Knot voiced his preference earlier for sticking to quarterly rate-cutting decisions so as to await updated economic forecasts. A 50bp cut in a single meeting is similarly implausible as inflation numbers show stickiness and recession risks remain low.

The latest US CPI numbers were the main driver of the recent move towards more ECB cuts in 2024, but the spillovers should have their limits. In the US the rate-cutting narrative continues to build much stronger and with 63bp of Fed cuts priced in by December, we think more is possible. The 2Y USD-EUR swap differential can, therefore, tighten further as the downside for the front end of the EUR curve is limited.

Three UK rate cuts still on the table this year

In the UK, markets are also pricing in two 25bp cuts for 2024, but for the Bank of England, that still seems realistic given the inflation backdrop and a weakening of the labour market. In fact, we have three cuts in our baseline. At 5.25%, the policy rate is significantly higher than that of the eurozone which leaves more scope for cuts.

Today’s UK core CPI number was expected to come in at 3.4%, though with a considerable number of economists forecasting 3.6%. The 3.5% can therefore be seen as mildly disappointing but by itself unlikely to change the broader picture that cuts are coming. However, the odds for an August interet rate cut will likely be pushed back towards the view that September will see the first Bank of England cut.

Today’s events and market view

Tonight the Fed will release its Beige Book – an anecdotal survey on the state of the US economy – which officials have placed more weight on since questions became louder about the quality of macro data. As for industrial production, the weakness in the ISM report and regional manufacturing surveys suggests a much more subdued performance in June after the surprise strength in May. Fed speakers – today Barkin and Waller will be watched for any change in tone in the wake of the latest CPI data.

In primary markets we have 30Y auctions from Germany (€2bn), a 5Y gilt auction (£4bn) as well as a 20Y UST auction (US$13bn) later in the day.