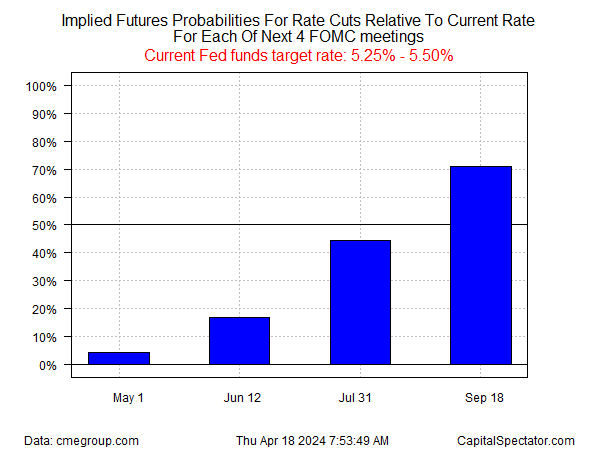

The only aspect of consistency in the market’s outlook for rate cuts lately has been pushing the expected date forward. Recent history falls in line with this trend and September is now seen as the earliest date for policy easing.

Fed funds futures this morning (Apr. 18) are estimating a roughly 71% probability that the Federal Reserve will reduce its current 5.25%-5.50% target rate at the Sep. 18 meeting, based on CME data.

Take it with a grain of salt, given the rise and fall of earlier tipping points. A month ago, for example, the odds-on favorite was a rate cut at the June 12 FOMC meeting — a forecast that has since faded to less than a 20% guesstimate.

For some economists, the wont-get-fooled-again mindset is now in high gear. Bank of America (NYSE:BAC) economists, for instance, advise that there’s a “real risk” that rate cuts will be delayed until March 2025 “at the earliest,” CNBC reports.

“We think policymakers will not feel comfortable starting the cutting cycle in June or even September,” BofA economist Stephen Juneau writes in a research note.

“In short, this is the reality of a data-dependent Fed. With the inflation data exceeding expectations to start the year, it comes as little surprise that the Fed would push back on any urgency to cut, especially given the strong activity data.”

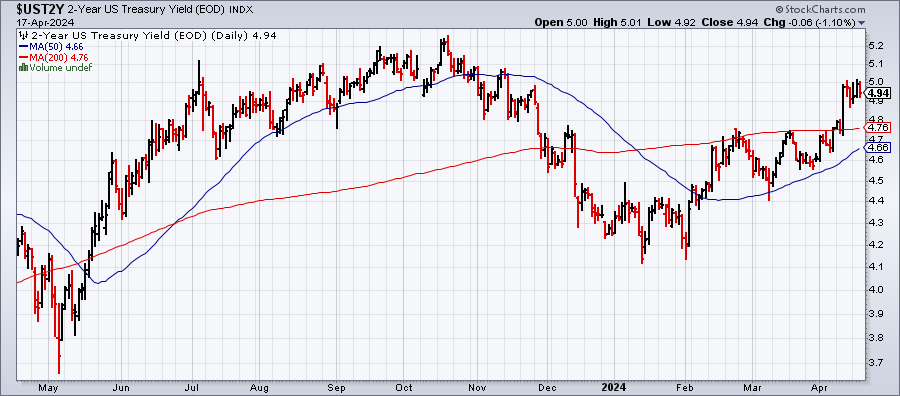

Meanwhile, the Treasury market is waiting for the next shoe to drop, or not. The policy-sensitive 2-year yield has run up recently, but has been in a holding pattern over the past five trading sessions through yesterday’s close (Apr. 17).

Hovering in the 4.9%-to-5.0% range, the 2-year rate appears to be waiting for the next round of inflation data before making a sharp move one way or the other.

The next major release for US inflation data is more than a week away – Friday, Apr. 26, when the government publishes PCE price data for March. Consensus forecasts are expecting a mixed bag for the one-year change: a slightly higher rise headline PCE to 2.5% and a tick down for core PCE to 2.7%.

The PCE forecasts echo the previously released March numbers for consumer price inflation. In other words, it’s not obvious that deeper clarity on the inflation outlook is near. In turn, a degree of stasis for Treasury yields and rate-cut expectations is a reasonable bet. But don’t get too comfortable… this too shall pass.