During FY21 Quadrise (LON:QFI) made significant progress on trials in each of its target sectors: industry, marine, upstream and power; and launched a bio-fuel branded as bioMSAR. Progress has been slower than management expected, primarily because of COVID-19 restricting travel and site access. Nevertheless, the funds raised in March still provide the cash resources to progress the ongoing trial programmes to commercial revenues and positive sustainable cash flows even though management’s estimated timescale for this has slipped from calendar year (CY) Q422 to CY Q123.

Share price performance

Progress on three trial programmes despite delays

Following the signing of a joint development agreement in January 2021, Quadrise and MSC Shipmanagement could potentially start on-vessel, commercial-scale trials as early as CY H122. If successful, the trials may be followed by commercial roll-out of bioMSAR and/or MSAR across MSC’s global fleet. Recent tests on samples from Greenfield Energy’s site in Utah have confirmed that heavy sweet oil from the site is suitable for conversion to both MSAR or bioMSAR for potential power and marine applications. Quadrise and the customer in Morocco are preparing for a larger-scale industrial trial in early CY Q421 and a commercial trial later in the same quarter. Recent third-party tests on Quadrise’s new biofuel show CO2 savings that are materially ahead of existing biofuels.

Cash runway to sustainability maintained

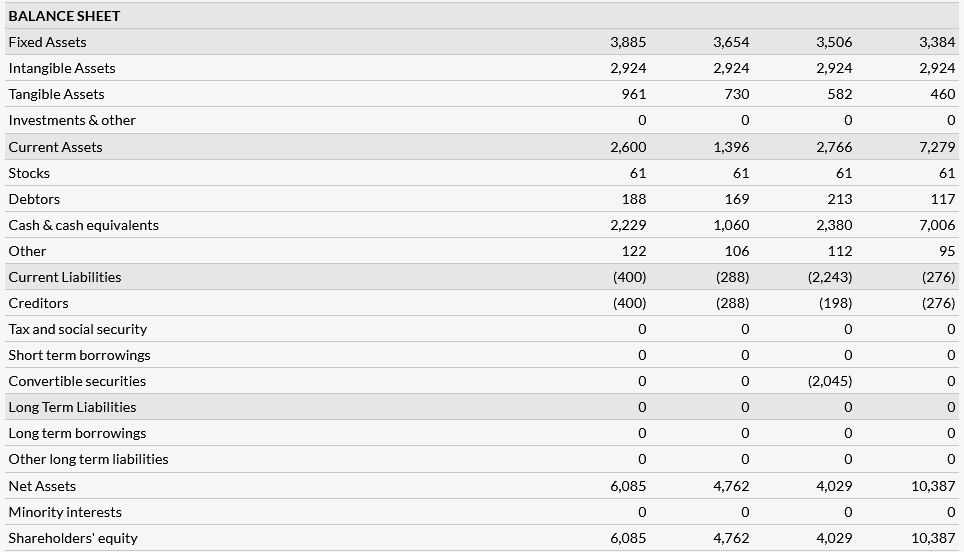

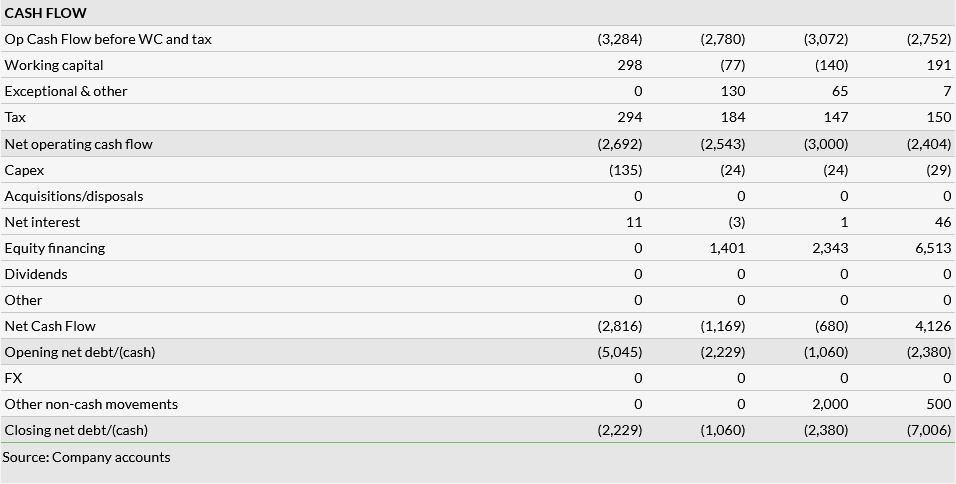

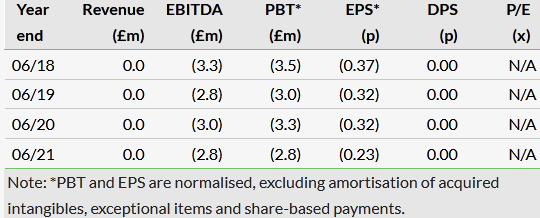

Quadrise is still pre-revenue. Stripping out share option and exceptional charges, operating losses narrowed by £0.3m y-o-y in FY21 to £2.9m, reflecting lower administrative costs. Free cash outflow decreased by £0.6m to £2.4m. Quadrise completed a placing and oversubscribed open offer in March, raising £7.0m (gross) at 2.7p/share, leaving the group with £7.0m cash, no debt and no convertible securities at end FY21. Despite the programme delays, management expects it has the cash resources to progress the ongoing trial programmes to commercial revenues and positive sustainable cash flows by CY Q123.

Valuation: Modest adoption transformational

Based on data from the company, our scenario analysis calculates that even modest adoption of MSAR would generate material profits. A single refinery producing MSAR equivalent to 1.9Mtpa heavy fuel oil (HFO) under a licensing model would generate $15.9m in annual EBITDA (see our November 2020 outlook note).

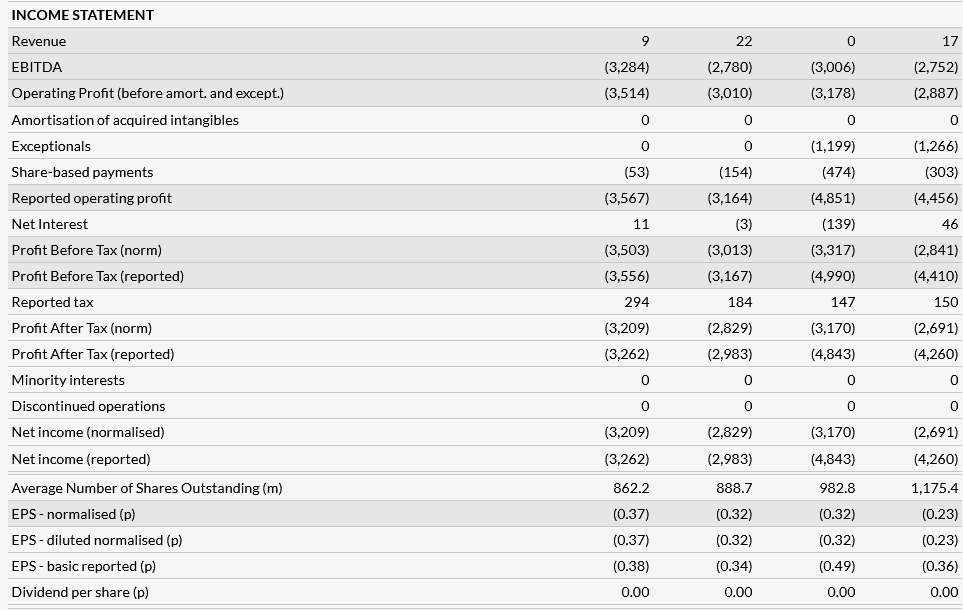

Exhibit 1: Financial summary