Primary Health Properties (LON:PHP) has announced refinancing measures that enhance debt duration and significantly reduce the running cost of debt. Our forecasts for earnings and fully covered dividend growth are increased. Sustainability linked terms in the new debt facilities are a first for PHP and will potentially further reduce debt costs over time.

Share price performance

Business description

Primary Health Properties is a long-term investor in primary healthcare property in the UK and the Republic of Ireland. Assets are mainly long-let to GPs and the NHS or HSE, organisations backed by the UK and Irish governments, respectively. The tenant profile and long average lease duration provide an exceptionally secure rental income stream.

Asset management supporting liability management

PHP has secured a new £200m 15-year debt facility with Aviva (LON:AV) Investors at a fixed rate of 2.52%, using the proceeds to repay legacy facilities, also with Aviva, amounting to £177m, with a blended fixed rate of 5.0% and remaining term of a little under six years. The early termination costs for the legacy loans are £24m. At the same time, PHP has renewed its £100m revolving credit facility with NatWest for a further three-year term, with extension options. Both facilities incorporate sustainability KPIs which, if met, will reduce loan margins. Before these potential additional savings, the new arrangements reduce PHP’s current average cost of debt from 3.4%to 2.9%, while the marginal cost of debt remains 1.7%. The annualised interest expense saving is c £5.0m and the weighted average debt maturity of seven years is similar to H121 despite the passage of time.

FY22 EPS forecast increases by 5.5%

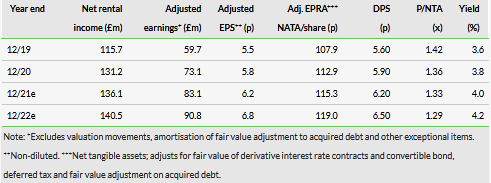

We have adjusted our forecasts to reflect the refinancing transactions with no other changes. There is a modest uplift to FY21 adjusted earnings and EPS, while on a full-year basis our FY22e adjusted EPS increases by 5.5%. Further interest savings are possible as PHP implements its ESG initiatives published earlier in the year. We have increased our FY22 DPS forecast from 6.4p to 6.6p with cover of 103%. EPRA NTA reduces by c 1.8p due to the early repayment cost. As anticipated, acquisition activity has stepped up in H221, but post the financing significant funding headroom remains with uncommitted cash and undrawn loan facilities of £237m.

Valuation: Securely growing income

PHP’s valuation is driven by strong income visibility with good prospects for growth: long and substantially upward-only leases, 90% backed directly or indirectly by government bodies, with little exposure to the economic cycle or fluctuations in occupancy. The FY21 DPS of 6.2p represents a yield of 4.0%, with good prospects for DPS growth, fully covered by adjusted earnings, and supports the premium to NAV.

Click on the PDF below to read the full report: