Income visibility and security continue to be the hallmark of Primary Health Properties (LON:PHP), now in its 26th year of unbroken dividend growth. FY21 showed strong progress despite a competitive market for acquisitions, driven by rent reviews and asset management, and operational and financial savings from management internalisation and debt refinancing.

Share price performance

Business description

Primary Health Properties is a long-term investor in primary healthcare property in the UK and the Republic of Ireland. Assets are mainly let on long leases to GPs and the NHS or HSE, organisations backed by the UK and Irish governments, respectively. The tenant profile and long average lease duration provide an exceptionally secure rental income stream.

Management action supports underlying growth

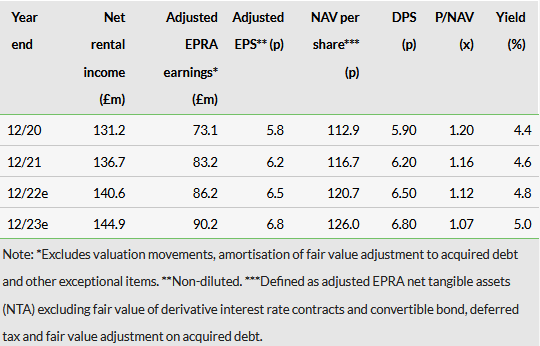

FY21 adjusted EPRA EPS increased 6.9% to 6.2p, fully covering 6.2p of DPS (+5.1%). A Q122 DPS of 1.625p represents an annualised 6.5p (+4.8%). Adjusted EPRA NTA increased to 116.7p with property revaluation gains, driven by yield tightening and rent growth, partly offset by non-recurring items. Including DPS paid, the total return was 8.9%. Including c £4.0m pa of cost savings from management internalisation the EPRA cost ratio fell further to a sector leading 9.3% (FY20: 11.9%). Refinancing of high cost, legacy debt reduced average debt costs to 2.9% (end-FY20: 3.5%), with most of the £5m pa benefit to come in FY22. With 25% of rents index-linked and a positive outlook for open market settlements his should accelerate to at least 2% in FY22. Our forecasts are little changed.

Well placed to meet health service investment needs

The long-term need for primary healthcare facilities is driven by demographic trends and is relatively unaffected by economic conditions. In both the UK and Ireland, populations are growing and ageing, with more complex healthcare needs. There is no sign that the pandemic has reduced the need for primary care facilities, despite the use of online and telephone appointments, particularly for front-line triage. Indeed, the need for modern, integrated, local primary healthcare facilities is becoming yet more pressing to relieve the pressure being placed on hospitals. PHP is well-placed to help meet this need for investment and grow further; it has c £320m of available funding headroom and a strong pipeline of identified potential acquisitions, asset management projects and developments of more than £400m.

Valuation: Securely growing income

PHP’s valuation is driven by its income visibility and security, with strong prospects for further growth in income and dividends. Leases are long and substantially upward-only leases, 90% backed directly or indirectly by government bodies, with little exposure to the economic cycle or fluctuations in occupancy. The FY22e DPS of 6.5p fully covered by Adjusted EPRA earnings, represents a yield of 4.8%, while the P/NAV has compressed to c 1.1x.

Click on the PDF below to read the full report: