PPHE Hotel Group (LON:PPH) has accompanied news of continued strong leisure-based recovery with an EPRA NAV per share of £20.85 at June 2021, almost unchanged in H121 despite COVID-19 restrictions, highlighting the company’s resilience from a property perspective. Encouragingly, the recent joint venture on prime London assets (Riverbank and art’otel hoxton) not only endorsed this valuation (44% premium to current share price), but also released £114m for future growth to management with an impressive development record, notably a return on Waterloo of c 100% in just four years. Consequently reinforced finances (£238m headroom at June 2021) are enabling steady progress with a £200m+ pipeline and an appetite for post-pandemic opportunities, such as in new areas of Europe and branding.

Share price graph

Bull

- Diversified estate in prime locations with £200m+ pipeline, backed by powerful branding (Park Plaza) and distribution (inclusion in Radisson Hotel Group’s systems).

- Strong record of asset development (pre-pandemic EPRA NAV of £25.93p per share).

- Asset-backed balance sheet with £178m cash and £60m of undrawn facilities at June 2021 and net bank debt leverage of 32% (29% pre-COVID-19).

Bear

- Uncertainty about international travel restrictions and the economic impact of the pandemic.

- Execution risk in terms of expansion but good track record.

- Tightening labour markets mitigated by award-winning career initiatives.

Measured rebound

After the severities of Q121 with demand confined to essential stays and contracted group business (occupancy 7% and year-on-year revenue down 90%), a progressive easing of COVID-19 restrictions across PPHE’s markets saw ‘some return’ of domestic leisure custom in the UK (the company’s key market) in Q2 and a buoyant Croatia in June, given land access from the main feeder countries. Also of note, in terms of security of revenue and marketing, were quarantine hotel contracts from the UK government (c 800 London rooms at full occupancy until end 2021) and an exclusive agreement for Westminster Bridge to serve as official player and support team hotel for the Wimbledon Championships. This positive momentum has continued to date, headed by leisure-driven Croatia with August revenue at pre-pandemic levels. Despite justifiable uncertainty about the rate of recovery by meetings and events, PPHE reports a return to a normal level of enquiries while corporate, still subdued, enjoys short lead times.

Value creation despite difficult times

Unlocking substantial equity at full market value (£114m) in June via its JV on Riverbank and art’otel hoxton bodes well for PPHE’s varied development pipeline. Projects include repositioning the iconic Brioni in Istria, a conversion in Zagreb and two mixed-use developments in London apart from flagship hoxton (opening 2024).

Valuation: 30% market discount to EPRA NAV

EPRA NAV per share of £20.85 at June 2021 means an excess of c £600m over book value. Planned investment and likely trading recovery should accentuate this materially, given PPHE’s strong development record.

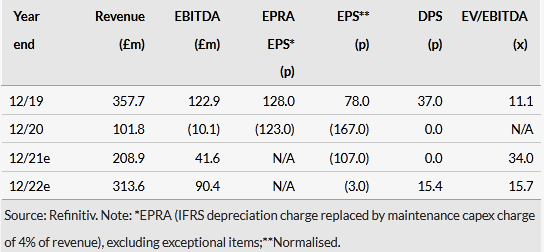

Consensus estimates