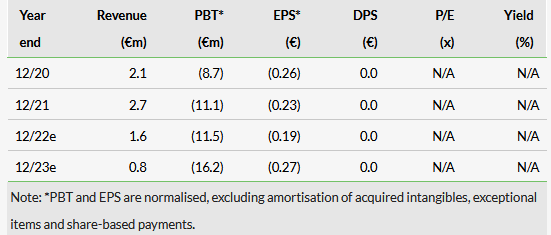

Pixium Vision SA (PA:ALPIX) FY21 results were mostly in line with our forecasts, as the company continues to advance its wireless Prima bionic vision system (BVS) through the PRIMAvera pivotal study. The company finished 2021 with €14.5m gross cash, which we believe should fund operations into 2023. After rolling forward our estimates and adjusting forex and net cash, we obtain an equity valuation of €135.1m or €2.31 per basic share.

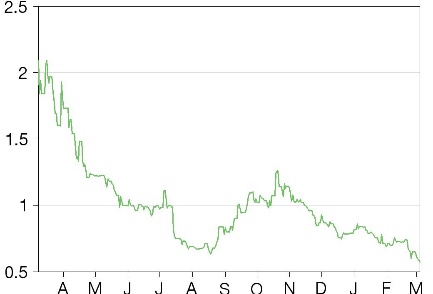

Share price performance

Business description

Pixium Vision develops bionic vision systems for patients with severe vision loss. Its lead product, Prima, is a wireless subretinal implant system designed for dry-AMD. The company started implantations as part of a European pivotal study in early 2021.

European feasibility study highlighted in Nature

A recent article in Nature highlighted 18–24 month interim data from the five-patient, 36-month European feasibility study (PRIMA-FS). The authors concluded that the PRIMA-FS study confirmed the safety and stability of the Prima BVS over the study period and noted that all patients with subretinal implantation and electronic magnification could demonstrate visual acuity (VA) exceeding 20/100. Altogether, while assisted by magnification, these measures are markedly superior to the baseline pre-implantation VA levels. The authors also reiterated that the Prima-implanted patients were able to simultaneously use their prosthetic vision and their residual natural vision from both the study eye and the other eye.

FY21 in line, 2022 to focus on PRIMAvera study

Pixium’s FY21 results were generally in line with our forecasts, as the operating loss of €10.3m exceeded our €9.7m projection, but net operating cash ouflows (€8.8m) were better than our estimate (€11.7m outflow). We expect the company to prioritise continued advancement of the PRIMAvera registration-enabling pivotal study, designed to assess the Prima BVS in 38 patients with geographic atrophy (GA) associated with dry age-related macular degeneration (dry-AMD). Assuming no significant new COVID-19 restrictions affect the European study sites, we are confident that Pixium can meet its guidance of enrolment completion by year-end FY22. We maintain our estimate that primary 12-month data will be released in late 2023 or early 2024, leading to potential European approval in H125.

Valuation: Rolling forward our forecasts

After rolling forward our estimates and making minor adjustments to our model (including adjusting our forex assumptions to $1.10/€, from $1.13/€ previously), we obtain a pipeline rNPV of €130.0m (vs €115.1m previously). After adding €5.1m in Q421e net cash (€14.5m gross cash minus €9.4m estimated Q421 debt), we obtain an equity value of €135.1m or €2.31 per basic share (versus €2.11 previously). Assuming full exercise of the July 2021 warrants, our fully diluted equity valuation would be €2.24 per share (versus €2.06 previously).

Click on the PDF below to read the full report: