In a challenging market environment, Picton Property Income (LON:PCTN) produced a resilient H124 financial performance, supporting fully covered DPS. This was underpinned by continued portfolio outperformance of the MSCI UK Quarterly Property Index, building on a long-term track record of upper quartile performance since inception. Rents continued to grow, asset management initiatives are in place, aimed at capturing reversionary income potential, and borrowings are mostly long term and fixed rate.

Rents continued to increase in H124

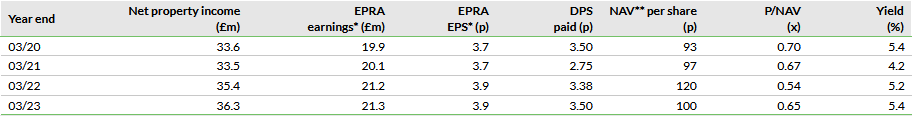

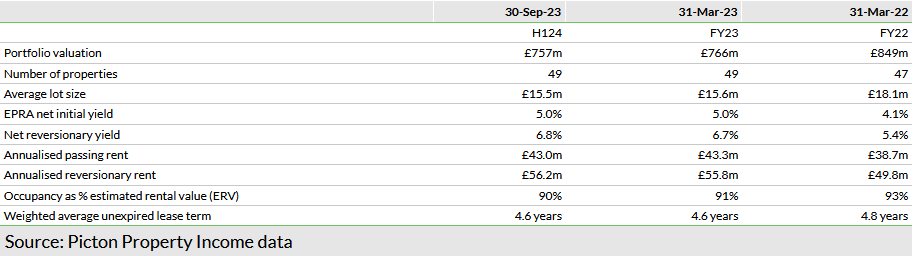

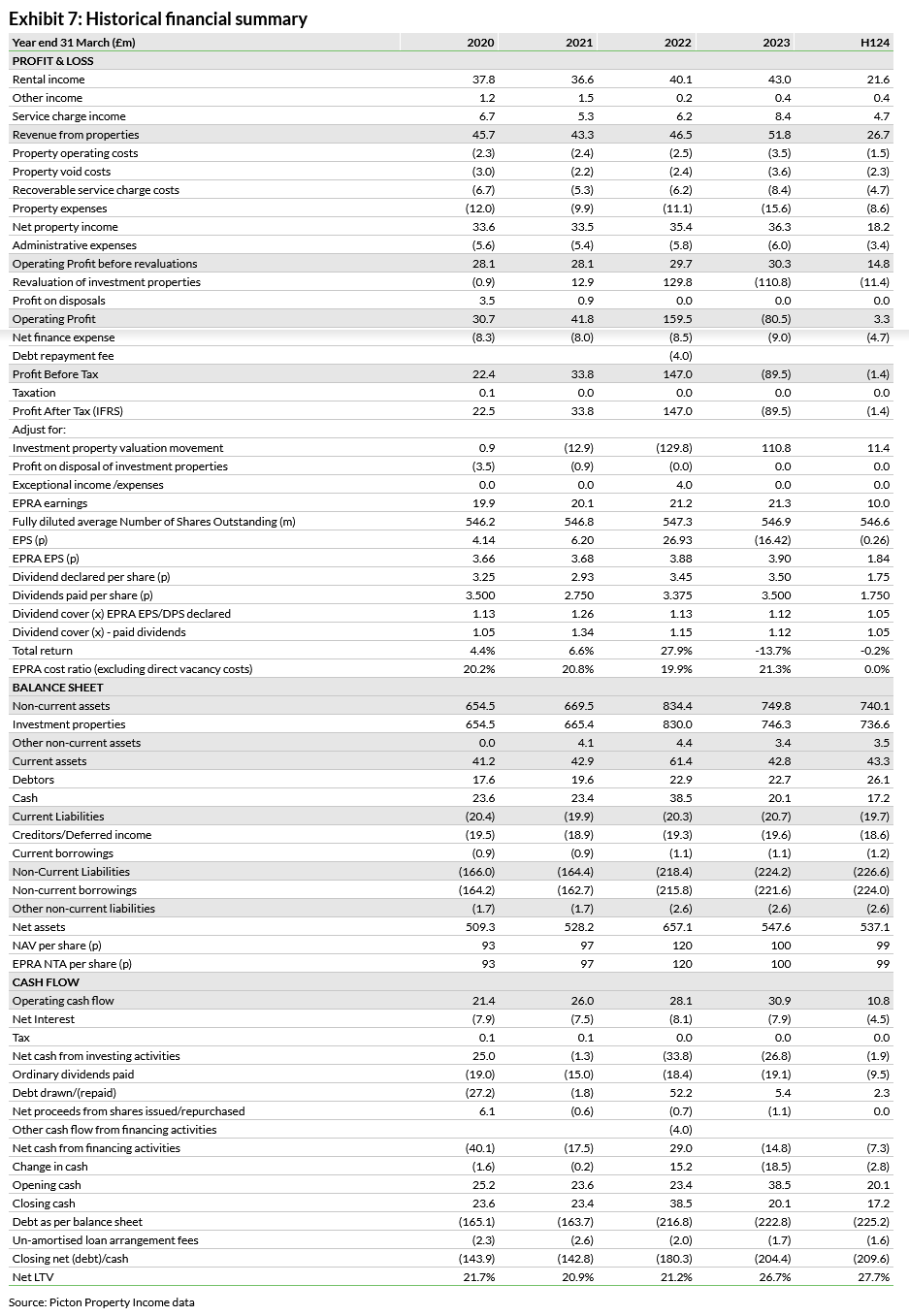

H124 EPRA earnings of £10.0m or 1.8p per share were lower than H123 (£10.7m/2.0p per share) with higher income more than offset by rising property and administrative costs, including inflationary impacts. DPS was covered 1.05x with Q2 cover increasing versus Q1, in line with management expectations. Portfolio rents continued to increase, as was true of the market, and the wide £13.2m gap between current passing rents and estimated rental values represents significant additional income potential. Active asset management plans, including repurposing of selected office properties, are aimed at unlocking this. The portfolio valuation was relatively stable, down 1.2% on a like-for-like basis, and the portfolio total return of 1.0% compared favourably with the MSCI UK Quarterly Property Index (the index) return of -0.5%. NAV per share was 99p (end-FY23: 100p) and adjusted for DPS paid the accounting total return was -0.2%.

Seeking to lever long-term performance

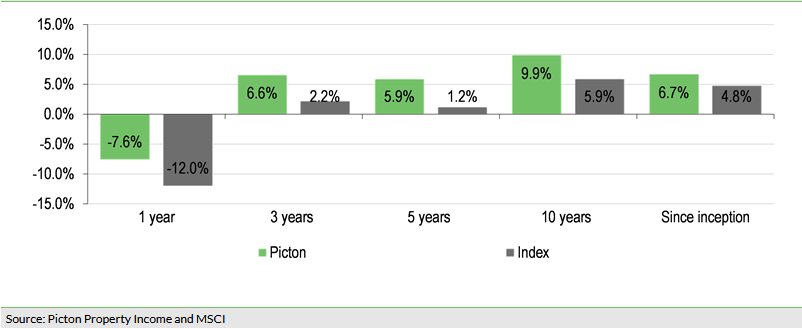

Through an occupier-focused, opportunity-led approach, Picton aims to be one of the consistently best performing diversified UK REITs. Accounting return (without dividends reinvested) has averaged 10.1% pa in the 10 years to end-H124. At a portfolio level, Picton has outperformed the MSCI index in each of the past 10 years and has delivered upper quartile performance since inception in 2005. The company has repeatedly expressed that, mindful of the consolidation taking place in the sector, it would be proactive in pursuing appropriate opportunities that add value for shareholders. On 8 November, Picton confirmed discussions with UK Commercial Property REIT (UKCM) regarding a possible all-share merger, on an EPRA NTA for EPRA NTA basis. Further announcements will be made in due course.

Valuation

The current annualised rate of DPS (3.5p) represents a yield of 4.3%. The H124 P/NAV is c 0.67x.

Interim financial results and operational performance

In this report we review the H124 and operational performance in detail. In view of Picton’s merger discussions with UKCM, we do not provide forward-looking guidance or forecasts. The company has said that there can be no certainty that an offer will be made and on 21 November announced that it had been informed by UKCM that its largest shareholder, Phoenix Life Limited, which controls c 43% of UKCM’s share capital, does not support the possible merger on the terms that have been proposed. Picton has until 6 December 2023 to make clear whether it does or does not intend to make a firm offer for UKCM, although this deadline can be extended with the consent of the Panel on Takeovers and Mergers (the Takeover Panel). A further announcement will be made in due course.

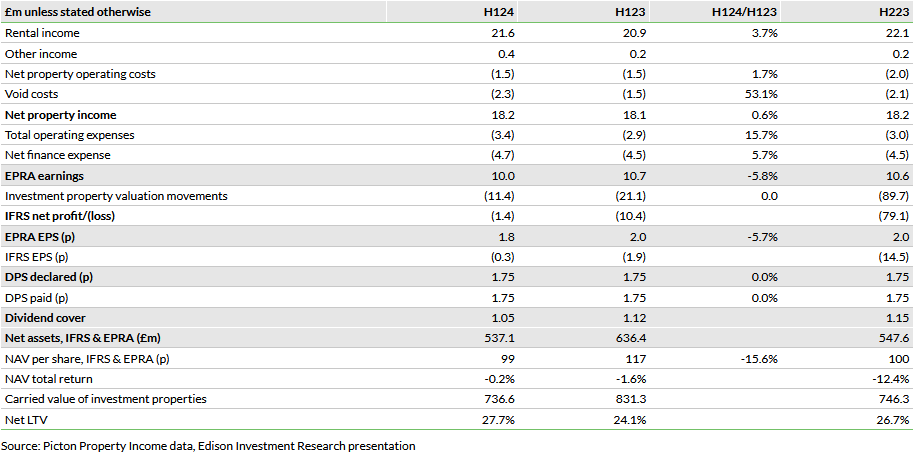

Exhibit 1 provides a summary of key H124 financial data, starting with EPRA earnings and a reconciliation to statutory IFRS earnings.

Comparisons are to H123 unless stated otherwise.

- Rental income increased by 4% or £0.7m to £21.6m and other income by £0.2m, primarily due to dilapidation receipts.

- Net property costs and void costs also increased, primarily reflecting the impact of inflation.

- Net property income of £18.2m was at a similar level to H123 and H223.

- The increase in administrative expenses, by £0.5m to £3.4m, included inflationary impacts, additional staff costs and some non-recurring expenses related to the internalisation of the company secretarial activities.

- With most debt at fixed cost, finance expenses increased only marginally, reflecting the impact of higher interest rates on debt drawn from the floating rate revolving credit facility (RCF).

- In addition to £10.0m of EPRA earnings, IFRS earnings included £11.4m of property valuation losses. The total IFRS loss for the period was £1.4m.

H124 earnings benefited from mostly fixed rate debt

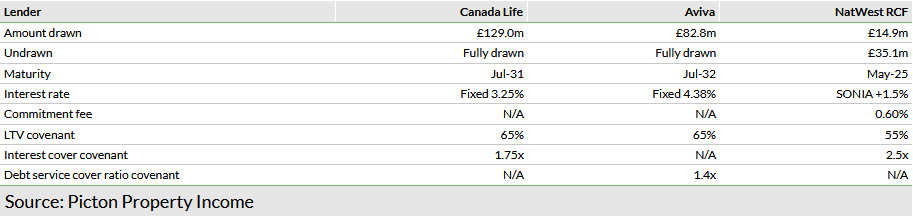

In the year to 30 September 2023 (end-H124) the Bank of England base rate increased by 350 basis points (3.5 percentage points) to 5.25%. With most borrowing long term and fixed rate, the impact on H124 finance expense was minimal.

The company has two long-term credit facilities, maturing in 2031 and 2032, with the interest cost fixed at a blended average rate of 3.7%. A shorter-term floating rate RCF2 of £50m was c £15m drawn at end-H124. Total drawn debt at end-H124 was £226.8m at a blended cost (including the RCF drawings) of 3.9% with a weighted average maturity of 7.8 years. Adjusting for cash of £17.2m, net debt was £209.6m and the loan to value (LTV) ratio was 27.7%.

1 The RCF provides the ability to draw and repay during the term of the loan.

Portfolio income

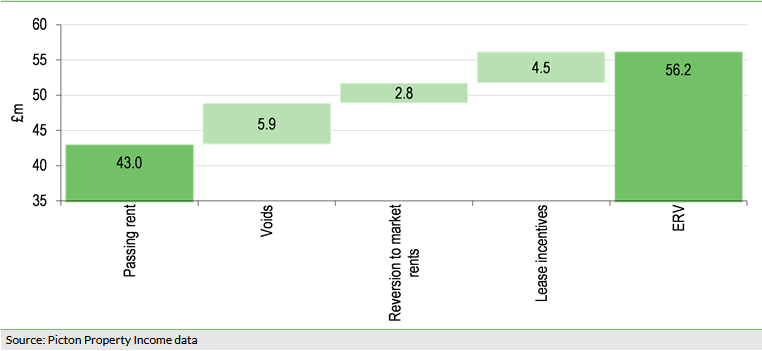

During H124, the externally assessed estimated rental value (ERV) of the portfolio increased by 0.7% to £56.2m pa, reflecting market-wide rental growth and portfolio-specific asset management initiatives. Portfolio contracted rents also increased slightly (0.4%) to £45.8m.

ERV growth was achieved across each sector, with the industrial portfolio ERV up 0.6%, offices up 0.8% and retail and leisure up 0.3%.

Contracted rent benefited from new lettings, renewals and regears, and reviews, all on average above March ERV and/or previous contracted rents, including:

- 13 new lettings, on average in line with the March ERV, generating £0.9m pa of additional rental income.

- 20 lease renewals and regears at an average 2% above March ERV, and 12% above the previous contracted rents, securing an additional £0.2m pa of income.

- Five rent reviews at an average 1% above ERV, securing an uplift to passing rent of £0.2m or 15%.

- Additionally, two lease variations to remove occupier break options secured £0.7m of existing income.

Encouragingly, 54% of the new leases (six transactions) and 60% of the lease renewals and regears (eight transactions) related to office properties, despite the wider challenges to the office market. Related to two of the properties where Picton is pursuing change of use strategies (Angel Gate, in London EC1, and Longcross, in Cardiff) four leases were surrendered to facilitate vacant possession, contributing to a 0.8% decline in passing rent, to £43.0m3 pa.

2 The annual rental income currently receivable. Excludes rental income where a rent-free period is in operation.

Taking account of all the leasing activity above, as well as lease maturities, on an EPRA basis, occupancy reduced to c 90% from c 91% at end-FY23. Excluding the impact from the change of use assets, Longcross and Angel Gate, occupancy was 92%, a similar level to that of the index.

At end-H123, ERV was £13.2m above the annualised passing rent of £43.0m. This difference comprises £5.9m pa of additional potential income from letting vacant space, £2.8m pa of income where ERVs are higher than contracted rent and £4.5m pa from the expiry of rent-free periods and stepped rents.

Most of the potential upside from contracted rents converging on ERV sits within the industrial portfolio, with most of the void reduction potential within office properties. The top five portfolio voids, accounting for 63% of the total, are all office properties, and reducing voids can often bring twin benefits from increased income and reduced empty property costs. Notwithstanding the positive leasing and regear activity that Picton achieved in its office properties in H124, it has identified opportunities to respond proactively to significant changes in the market by adapting some of its assets to alternative use.

Asset repurposing

There are currently four projects under way where the company is seeking planning permission for change of use to healthcare, residential and student living occupation. In addition to Angel Gate and Longcross, these are at Charlotte Terrace, in London W14, and, to a lesser extent, at Colchester Business Park.

At Angel Gate (14% of the portfolio void), during H123, Picton identified an opportunity to secure planning consent for the conversion of 30,000 sq ft of vacant office space to residential use, with plans for 34 dwellings. After extensive dialogue with the local authority, the company has since been able to release from (Article 4 restrictions) the remaining 34,000 sq ft, enabling residential use across the whole property. Picton says that it is now in the process of bringing this asset to the market for disposal in early 2024.

At Longcross (12% of the portfolio void), contracts have been exchanged for its sale to an experienced purpose-built student accommodation developer. The transaction is conditional on planning permission, which will be submitted by June 2024. The sale price is dependent on the exact planning consent obtained and, in particular, upon the number of rooms secured, subject to a collar and cap. Picton says that in all scenarios the transaction is NAV accretive.

Charlotte Terrace (11% of the portfolio void) comprises four adjoining buildings, which total 28,500sq ft of office space and 4,400sq ft of retail space, arranged over five floors. It is located close to Olympia, which is currently undergoing a £1bn redevelopment delivering a new creative district, with a new theatre, entertainment venue, hotel, office, retail and leisure space, which is expected to enhance the surrounding area. Having achieved vacant possession in one of the four buildings, a planning application has been submitted for alternative residential use.

On a lesser scale, but nonetheless reflective of its active approach to asset management, at Colchester Business Park (14% of the portfolio void), Picton secured planning permission for the change of use of a vacant office suite, enabling it to be let to a healthcare occupier. An office building became vacant on the last day of the period, accounting for 60% of the void, with the majority of the remaining void, a recently refurbished industrial unit, under offer.

Index outperformance in H124

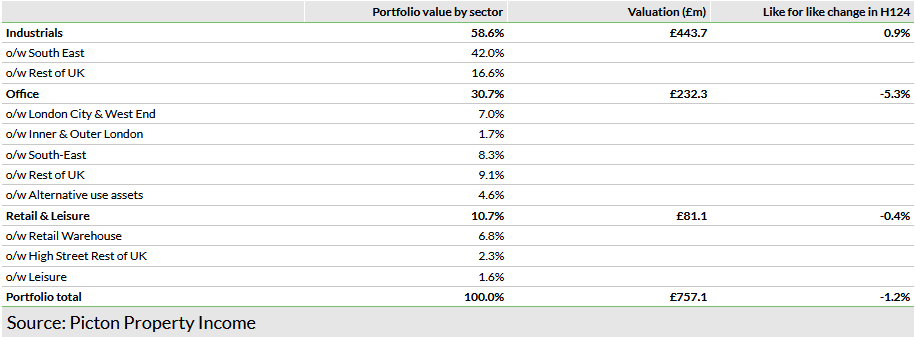

During H124, Picton’s portfolio valuation decreased by 1.2% on a like-for-like basis, with valuations generally stabilising in September. Over the same period, the MSCI UK Quarterly Property Index recorded a capital value decrease of 2.7%. Within the company’s portfolio, the industrial sector saw a 0.9% valuation increase over the half year, with the office sector showing a negative valuation movement of 5.3% and the retail and leisure portfolio decreasing by a nominal amount. Including both capital and income returns, the total return on the Picton portfolio in H124 was a positive 1.0% compared with a negative 0.5% index return.

Exhibit 5 provides detail on Picton’s outperformance of the index in each of the past 10 years and upper quartile performance since inception in 2005.

Across the sectors, the company says:

- Within the industrial sector, there is good demand at its multi-let industrial estates, allowing it to capture rental growth through new lettings, renewals and rent reviews. The five distribution warehouses remained fully leased and a lease at York was extended. The occupational market is remaining resilient, albeit rental growth has slowed but remains positive. There is continued investment demand for good quality assets.

- In the office sector, occupational demand is weaker and more linked to the type of building, with the very best space attracting most occupiers. Investment demand has weakened, but there is still demand for best-in-class space with good environmental credentials.

- The retail sector is still suffering from higher vacancy rates, especially on the high street, which has not been helped by the demise of retailers such as Wilko. Leasing demand is improving, however there is investment demand for better quality product where the income position is more certain.

In addition to sector diversification, the portfolio is spread across 49 assets, let to around 400 occupiers. The end-H124 external valuation reflected a net initial yield of 5.0% and a reversionary yield of 6.8%.

General disclaimer and copyright

This report has been commissioned by Picton Property Income and prepared and issued by Edison, in consideration of a fee payable by Picton Property Income. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom