Due at least in part to significant recent share price depreciation, Pharnext (PA:PHARN) has announced a revision in the terms of its June 2021 convertible debt financing (OCEANE-BSA). Effective February 2022, the number of tranches will be reduced to 12 from 35, with the last five tranches to be issued between January and May 2022 for total proceeds of €15m. As of 28 December, the first six tranches have been drawn down for gross proceeds of €20.5m. This development has the potential, in time, to reassure investors, given that dilution had been a significant factor in driving down the stock price since the June 2021 debt issue. Separately, Pharnext also announced the appointment of Dr Elisabeth Svanberg as chairman of the board of directors (effective 1 January 2022), succeeding Michel de Rosen.

Deal terms amendment to mitigate dilution concerns

While the previous convertible debt agreement provided Pharnext with sufficient funds to conclude the clinical trials of PXT3003, a key concern has been the dilutive impact of the funding, an issue demonstrated by the sharp share price correction since June 2021. We believe Pharnext’s decision to truncate the number of tranches may have the potential to assuage some investor concerns, although the company will have to explore alternate financing options going into H222. The revision of the deal terms also requires Pharnext to share low single-digit royalties on PXT3003’s sales with the debt holder, Global Tech Opportunities 13, which will also have some impact on the company’s margins.

Dr Elisabeth Svanberg appointed as chairman

Pharnext also announced the appointment of Dr Elisabeth Svanberg as chairman of the board of directors, taking over from Michel de Rosen (chairman since June 2016), who will continue to serve as a non-executive director of the company. Dr Svanberg has more than two decades of experience across different therapeutic areas and has been associated with leading healthcare companies such as Bristol Myers Squibb (BMS) and Janssen Pharmaceuticals. This appointment follows a series of recent senior-level recruitments at Pharnext in an effort to successfully progress and commercialise PXT3003 in Charcot-Marie-Tooth Disease type 1A (CMT1A).

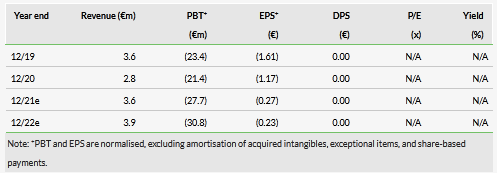

Valuation: €265.6m or €2.0 per basic share

We have revised our valuation to factor in the new share issue and slightly lower expected margins due to the royalty agreement with Global Tech Opportunities 13. While we have revised our total valuation down to €265.6m from €273.6m, the basic per share valuation comes down significantly to €2.0 (from €5.7), following additional equity issued to cover the conversion of tranches 3 and 4 (until 27 December) of the June 2021 convertible debt.

Share price performance

Business description

Pharnext is developing new therapies for both rare and common neurological disorders using its proprietary Pleotherapy platform, which unearths new therapeutic effects from drug combinations. Its lead programme is PXT3003 for Charcot-Marie-Tooth disease type 1A, which has entered pivotal Phase III trials. It also has PXT864 for Alzheimer’s disease, which has completed Phase IIa but has been deprioritised.

Click on the PDF below to read the full report: