Peloton, which manufactures and sells premium, large-screen, stationary fitness bikes and treadmills, as well streaming subscriptions for classes aimed at those using the equipment, is expected to go public sometime in the next few months. It will IPO on the NASDAQ using the ticker “PTON.”

The vertically integrated company, designs its equipment and creates its own classes for a global customer base. Nonetheless it bills itself neither as a manufacturer, nor as a service provider, but rather, quoting the third sentence of its S-1 filing, as a "technology company."

That's certainly an overstatement. Customers may enjoy a premium exercise experience in their homes, but 'technology' is really only a small part of the offering, and Peloton's business model. Though the company may be building a strong and visible brand, the viability of that business model seems highly suspect.

Revenue and Losses

Revenues are driven primarily by equiment sales. In the U.S. the bikes cost $2,245; treadmills go for $4,295 apiece.

The subscription for streaming classes is $39 a month and Peloton describes them as “engaging-to-the-point-of-addictive.” We'll address that below, in the 'Subscription Model' section.

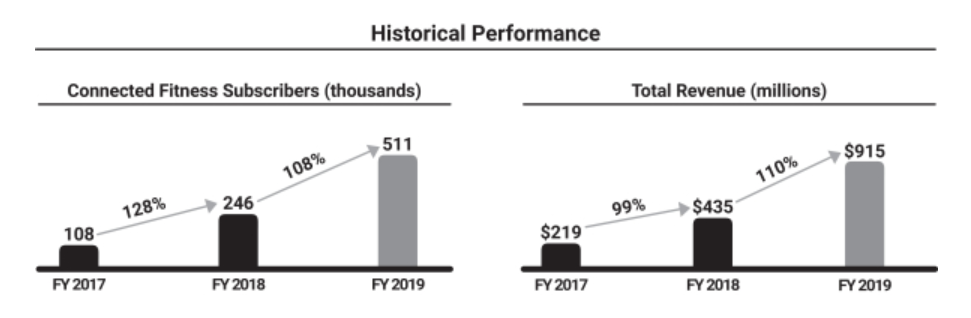

Total revenue for fiscal 2019, which ended in June, was $915 million. That's significant growth, 110% over the same period the prior year, when the company brought in $435 million. For Peloton, fiscal 2019 was the second year of significant expansion, after it grew 99% in 2018—from $219 million to $435 million.

However, the New York-based company's bottom line is far less attractive. Peloton lost $202 million from operations in fiscal 2019. Plus the company plans to ramp up its operating expenses, including marketing and research and development, to support growth for the foreseeable future.

Peloton's expectation is that ultimately profitability will come from subscriptions to its fitness media service. Nonetheless, in fiscal 2019, equipment sales brought in the vast majority of the company’s revenue, a trend that doesn't appear to be ending anytime soon.

Bikes and treadmills accounted for $720 million of the total $915 million in revenue, or 78% of the business. The company, which was founded in 2012, says in its filing it has “little history with which to evaluate and predict the profitability of our subscription model.” And that's only a part of the rub insofar as actual business growth is concerned.

Brand

Peloton's pricing structure clearly targets an upper class demographic, which makes sense if the company is trying to build an exclusive brand. In recent years, Peloton's premium equipment has been on the radar of an array of celebrities such as Virgin's Richard Branson, olympic sprinter Usain Bolt and actor Hugh Jackman.

This has helped create a cult-like following of exercise enthusiasts who swear by Peloton's equipment and classes. Unfortunately the S-1 says Peloton's potential customer base includes households with a $50K per year income. Given the high price-point to entry in the Peloton universe, that's doubtful.

Plus it's unlikely equipment prices will come down any time soon. The company spent $324 million on sales and marketing in 2019, at the same time that it spent $410 million manufacturing bikes.

Aside from the feasabilty of its user projections, there are a number of faulty assumptions on the branding front too. As an example, Apple (NASDAQ:AAPL) products are considered ‘premium.’ Nonetheless, they remain affordable for the most part. A $900 smartphone is a much likelier purchase for less wealthy customers than a $2,200 stationary bike.

Additionally, Apple is arguably the biggest cash cow currently operating in financial markets. Its margins for both software and hardware are impressive: in 2017, TechInsights estimated that the iPhone 8 had gross margins of 59% while the iPhone X provided gross margins of 64%; by our estimates Peloton's margins are currently -21%. Finally, when Apple) IPO'd in 1980, it was already profitable.

As for a strong brand, look no further than Tesla (NASDAQ:TSLA). The automaker may have a cult following, but it can't get its financials in order.

Subscription Revenue Model

Peloton currently has 511,000 subscribers, up 108% from the year prior. Nonetheless, it suffers from the same seasonality problem that plagues traditional gyms—sales during the quarters surrounding the winter holidays and the new year account for 63% of annual sales.

Perhaps more alarming, churn—meaning cancellations minus reactivations—is highest in the spring, at 0.79%. Over the course of 2019, the company had an average monthly churn of 0.65% or 8% annualized.

That's not insignificant considering how limited the potential customer base for Peleton's equipment will likely be. And though the company offers a $19-a-month subscription that's exclusively for streaming yoga and stretching classes which don't depend on the equipment for viewing, churn for this product isn't reported, though the company says it currently has 102,000 subscribers.

Valuation

Though Peloton raised $550 million during its last funding round in August 2018 on a valuation of $4.15 billion, its exact IPO valuation has still not been determined. Bloomberg reported in February that the valuation could be more than $8 billion.

Companies such as Peloton, which are revenue negative at IPO, are often not immediately judged on their fundamentals, but rather on hype and the hopes of strong future revenue growth. In our view, the growth potential of this stock will all come down to the proposed valuation and how realistically it will hew to future revenue potential.

A long-term investment in Peloton is legitimate if you believe it will disrupt gym membership significantly by penetrating the U.S. mainstream, even as it gets customers to upgrade equipment, all while building significant revenue from subscriptions.

We’re more inclined to believe it will suffer the same fate as other fitness trends such as Fitbit (NYSE:FIT), now down 94% from its all-time high, reached three months after its 2015 IPO.