The stock market had a wild ride yesterday. It traded sharply higher in the morning, gave it all back, and ripped into the close.

The on-closing imbalances have played a role in the last two days of trading, but yesterday, the imbalance was just $650 million on the buy side and certainly didn’t contribute to moving higher.

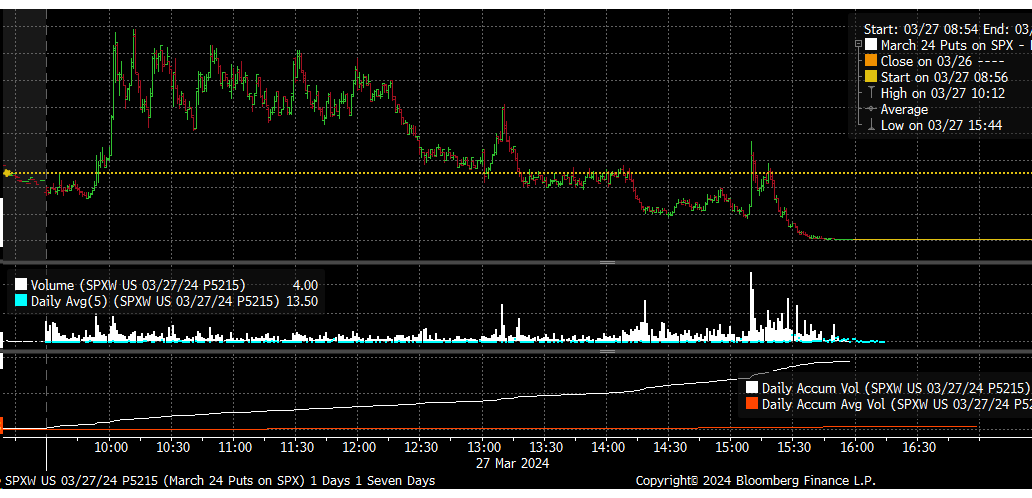

I think the most likely answer is that the 5,215 puts for expiration yesterday were among the most actively traded options and likely served as a “put wall” for 0DTE.

Heading into the day's end, traders likely started to sell their puts to take their gains. It is easy to see the spike in the volume after 15:00.

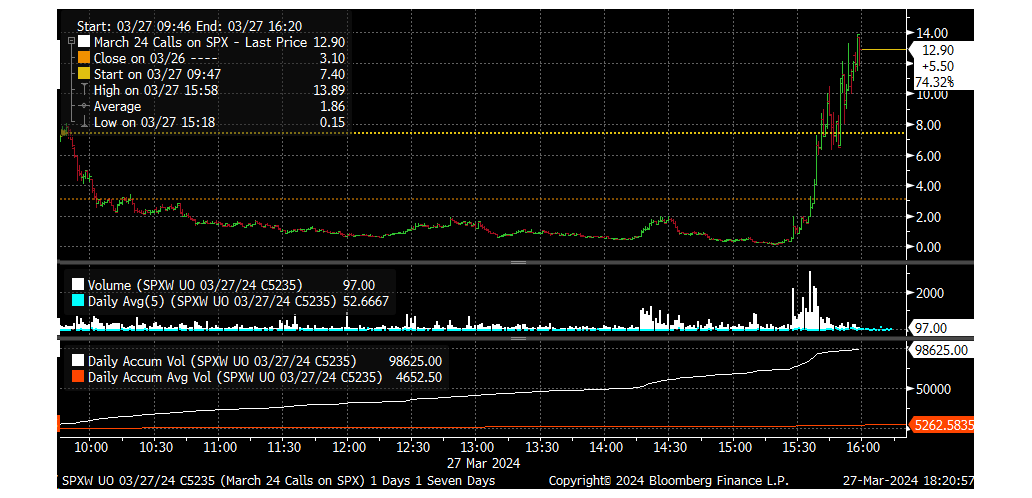

Notably, the massive spike in volume started at around 15:30 in the S&P 500, with 5235 calls for March 27 expiration. The value of the calls ran up from near zero to around $13 in the 30 minutes of trading.

While we can’t be sure if this 0DTE trading activity was the sole driver of the move higher, it certainly looks like it could have been.

If it were just because of option flows for yesterday’s expiration, then it certainly would not be surprising if the gains we witnessed yesterday were erased today.

Yesterday, the 10-year rate fell back to around 4.18% after three days of solid treasury auctions on the 2-year, 5-year, and 7-year Treasury notes.

So the bigger question is whether the 10-year rate will increase from here. One would think that it would move higher, given the more dovish stance of the Fed, the more robust economic data, and rising inflation expectations.

But to this point, that just happened yet. The 10-year may be just consolidating or waiting for another piece of data; perhaps that data comes Friday with the PCE? For now, though, the trend is still higher.

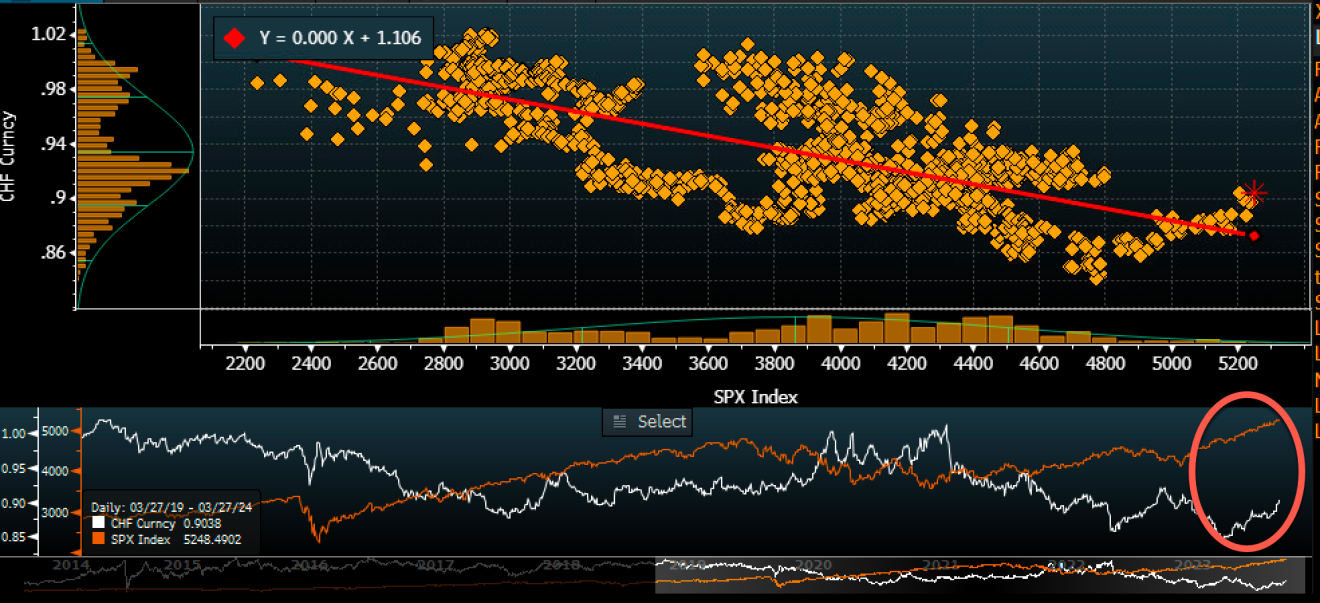

Meanwhile, the US dollar continues to strengthen versus the Swiss franc, rising to around 0.90. This is an interesting FX pair because of its historical relationship with the S&P 500 over the longer term.

It has an inverse correlation of around -0.71 and R^2 of 0.51, suggesting a solid inverse relationship.

However, since the beginning of January, they have both been trending higher, which is not usual when going back to 2019. This oddity can undoubtedly last longer, but it is a sign that something is missing and something to pay attention to.

As a final note, today will be the last trading day of the week, and things may be quirky. The JPMorgan (NYSE:JPM) collar will likely cause some disruptions, but we also know that Jay Powell will speak on Friday, and the PCE report will come on Friday morning.

So, we could quickly do some hedging activity heading into the weekend, and that would be noted by watching the VIX 1-day. If it rises, it likely means that hedging is being put in place.