Palantir shares, which are listed on the New York Stock Exchange (NYSE), have risen by 57.42% in the last three months. Since the beginning of the year, the increase has been over 153% (as of 10 October 2020), which is particularly remarkable given that the company is often the subject of controversy.

A controversial business model

Palantir Technologies (NYSE:PLTR), co-founded by Peter Thiel in 2004, specialises in data analysis. The Palantir Gotham division works closely with security agencies and intelligence services in Western countries. Since the company usually keeps its business and customers secret, it often remains shrouded in mystery.

Palantir profits from crises

According to ‘sharedeals.de’, geopolitical tensions play an important role in the recent rise in Palantir's share price. The escalating conflicts in the Middle East, particularly Israel's war in the Gaza Strip and Lebanon, as well as the threat of conflict with Iran, are increasing demand for Palantir's technologies.

In September, Palantir received a contract from the US Department of Defense worth almost $100 million. The US military uses Palantir's AI tool Maven Smart System, which is used, among other things, to identify targets for air strikes in the Middle East. In Ukraine, Palantir's software is also used by the army for military decisions.

Growth in the commercial sector

In addition to the public sector, Palantir is also growing in the commercial sector, particularly through the introduction of AIP, an AI solution that enables companies to integrate artificial intelligence and machine learning technologies into their own networks. This not only increases data security, but also reduces data transmission and storage costs.

In early October, Palantir announced a partnership with Edgescale AI. Together, they are developing ‘Live Edge,’ a platform that uses AI technology to process data from machines, sensors, and networks. This is intended to increase automation and productivity.

We believe this foray into the commercial sector is a very important step, as this market is likely even larger than the government market. So Palantir is still on the fast track.

So will the stock continue to rise, or is a correction coming? And if so, will it be a big one?

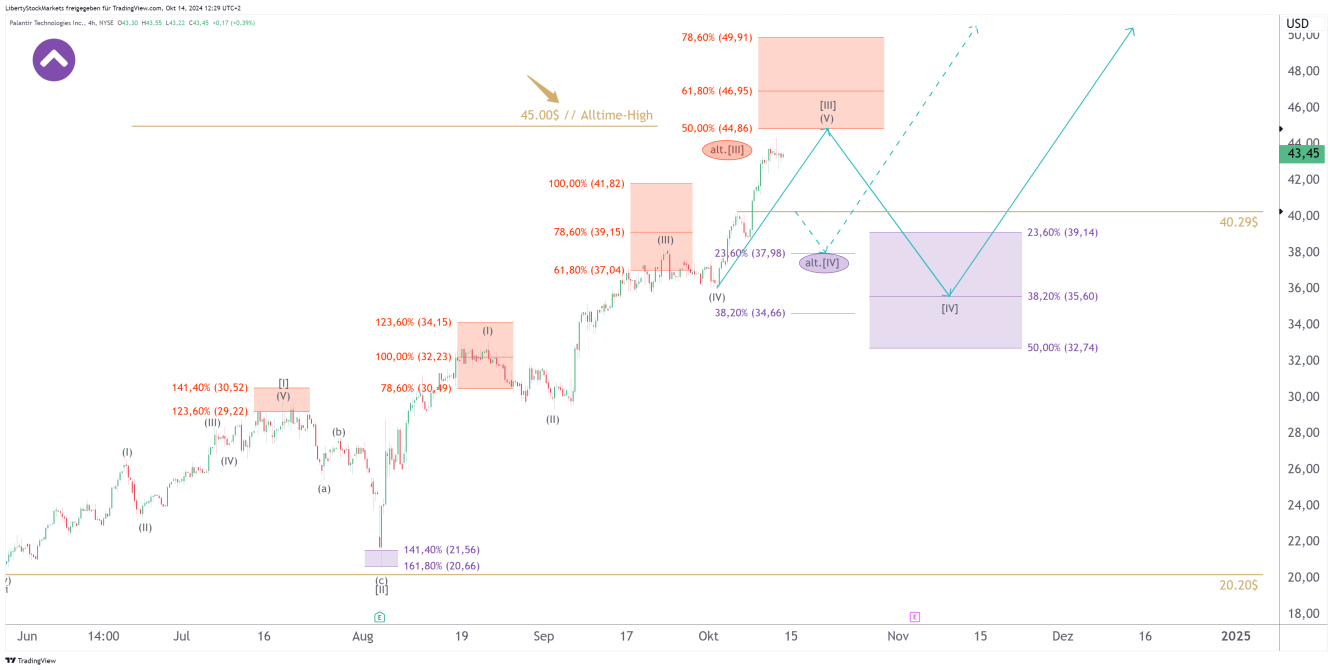

We think the stock has already run a long way and will need a breather soon. Either right now or only in the area of the red box at the top of the chart at $44.86 to $49.91, a significant high is to be expected. Then the stock should enter a correction, the target of which we see within the purple box at $39.14 to $32.74. This is an excellent opportunity to buy the stock, because further increases are to be expected afterwards.

What we should also know: the previous all-time high is exactly at $45.00. As a rule, stocks fail to break through this level on the first attempt. We can use this to buy the stock again at a lower price. In the long term, we expect prices well above the previous all-time high.

No matter where we look, We see opportunities. We are in an extremely strong bull market. Everyone should benefit from it. But to avoid mistakes, it's a good idea to have a strong partner at your side. With us, every portfolio turns a profit. You can find out more about us on our website (the link is above next to my profile picture). By the way: as part of our autumn promotion, you get a whopping 20% discount on all our analysis packages. Voucher code: LIBERTY.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Palantir – Impressive price gains. Is the stock overheated?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.