Palace Capital's (LON:PCA) H122 results showed strong financial and operational improvement, including leasing progress, Hudson Quarter (HQ) apartment sales and strong rent collection. Q222 DPS was increased by 8.3% to 3.25p, the minimum that PCA expects going forward. We forecast strong returns from apartment sales gains, capital redeployment and reversionary income capture.

Strong asset sales and operational progress

IFRS profits of £8.0m in H122 showed a strong rebound from the H121 loss and substantial progress on H221. Development profits, valuation increases and disposal gains drove the headline result, but recurring earnings were also robust. This included strong leasing activity (all above ERV) and an increase in underlying occupancy combined with continuing strong rent collection. Q222 DPS increased by 8.3% to 3.25p, the minimum that management expects for the rest of FY22. EPRA NTA per share increased by 3.4% in the period to 362p and including DPS paid the six-month accounting total return was 5.2%. Of the 127 HQ residential apartments, 72 are now sold, exchanged or under offer to a value of £24m. Non-core asset sales have reached £26.3m including those exchanged or under offer, all above book value. Net LTV has reduced to 36%, allowing PCA to pursue reinvestment opportunities.

Organic upside and capital redeployment

Organic income and capital growth potential within the existing portfolio is strong. The £20.0m end-H122 estimated rental value (ERV) of the portfolio was £3.1m (18%) ahead of contracted rent. Void reduction in office assets is the key opportunity, including £0.9m of recently completed high-quality HQ commercial space. Sales of the Hudson Quarter residential apartments is generating trading gains and freeing capital for redeployment in yielding assets. The £30m non-core asset disposal programme is well on track and redeployment of the proceeds should at least replace the income foregone and improve overall asset quality. Combined, we expect £50m of redeployment, adding c £3m pa to rent roll.

Valuation: Not reflecting company growth targets

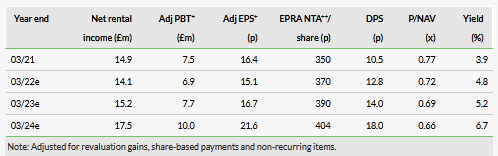

A c 4.9% prospective yield, with DPS fully covered by cash earnings and an almost 30% discount to H122 EPRA NTA per share is undemanding relative to peers and does not appear to reflect the potential for income and capital growth embedded in the existing portfolio or the opportunities for accretive new investment.

Share price performance

Click on the PDF below to read the full report: