By Kathy Lien and Boris Schlossberg.

Top Forex Themes For 2016

Since the next two weeks are generally the quietest periods in the financial markets, we want to take this opportunity to think longer term and share with you our currency forecasts for 2016. We’ll start with an initial review of the top themes and explore them in further detail as the week progresses in our outlook for each of the major currencies.

But first -- 2015 has been a big year for the foreign-exchange market. Divergences in monetary policies led to strong moves in currencies with the U.S. dollar as the best performer. The U.S. saw its first rate hike in nearly a decade while other major central banks in the Eurozone, China, Canada, Australia, New Zealand and Japan eased. In response, the greenback climbed to multiyear highs and this strength translated into significant weakness for many major currencies -- along with a collapse in commodities.

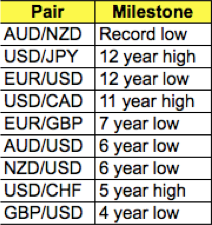

That said, here are some of the FX milestones reached in 2015:

The greatest risk for the financial markets and the global economy in the coming year is the feedback loop from the dollar and Fed policy. While the quarter point hike in December represents only a nominal increase in U.S. rates, the Federal Reserve expects to tighten 4 additional times next year, which will have broad ramifications for currencies, equities and commodities. In mid-December, we published a piece outlining the Consequences of a Strong Dollar and a lot of these issues will return to focus in 2016.

The first few months of the year should be good for the dollar as long as Fed officials don’t backtrack on their hawkish views. There will be more hawks voting on the FOMC in 2016 than 2015 so the balance swings in favor of continued tightening. Between the warm El Nino weather and gas prices below $2.00 a gallon in some states, consumer spending should also rise in the first quarter. So while the dollar is rich, the path of least resistance is still higher. However our outlook changes in the second half of 2016 as we believe rate hikes and the strong dollar will force the Fed to slow its tightening, marking a top for the greenback and the bottom for other major currencies.