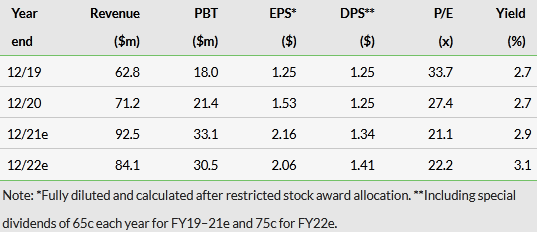

While elevated US equity market volumes drove up OTC Markets Group's (OTC:OTCM) (OTCM) trading revenues 40% ahead of our expectations, higher P/E multiple divisions of Market Data Licensing and Corporate Services also exceeded (by 9% and 15% respectively). Net acquisition of corporate clients has accelerated, which bodes well despite a likely normalisation of trading activity. We raise our EPS forecast by 12% for 2021 and 19% for 2022. Management’s confidence in the business has prompted it to increase the quarterly dividend to $0.18 from $0.15 and we expect the group to pay a special dividend of 65c in 2021 and 75c in 2022.

Share price performance

Q221 summary: Boosted by strong trading volumes

OTCM reported a very strong second quarter, with gross revenues of $25.5m, up 49% compared with Q220. Segmentally, this was led by OTC Link (+110%), which benefited from elevated US equity trading levels (albeit lower than Q121). Market Data Licensing (+25%) and Corporate Services (+40%) were also strong. Expenses, including redistribution fees and transaction-based expenses, increased by 33%, reflecting volume-related costs and incentive compensation as well as increases in base salaries. This left pre-tax profit up 90% illustrating the operational gearing and, after a higher tax charge, diluted EPS increased by 65%.

Trading to normalise, but underlying trends positive

Following Q221, there are further signs that US equity trading activity continues to normalise, and we have assumed this in our forecasts while acknowledging that it is not possible to estimate with any degree of confidence. We reflect these trends in our estimates for OTC Link and, to some extent, Market Data Licensing. The positive trend in corporate clients joining OTCQX (530, up 10% quarter-on-quarter and 28% year-on-year) and OTCQB (1,020, up 6% quarter-on-quarter and 15% year-on-year) is likely to have longer-lasting benefits. We have increased our 2021 EPS estimate by 12%, which reflects a normalisation in trading but stronger market data and corporate services revenue, while our 2022 estimate has increased by 19%, reflecting a lower than expected decline in revenue in 2022.

Valuation

Following our estimate changes, the shares trade on a 2022 P/E of 22.2x, below the average for global exchanges (nearest peers) of 24.3x (see Exhibit 9). For both years, the multiples remain significantly below those of information providers (35.2x). The high proportion of subscription-based revenues and longer-term potential for development of OTCM’s cost-effective markets are supportive factors.

Q221 results analysis

Exhibit 1 provides a summary of profit and loss figures, comparing the Q221 results with Q121 and Q220. In the comments below, we are comparing Q221 with Q220 unless stated.

Gross revenue increased by 49%, with the largest increase coming from OTC Link (a FINRA member broker-dealer that operates two Securities and Exchange Commission (SEC) registered Alternative Trading Systems), where trading volumes on OTC Link ECN and messaging volumes on OTC Link ATS drove a 110% increase in revenue ($4m absolute increase, $3.4m was driven by OTC ECN). OTC Link’s commitment to ensuring the reliability of its core systems was validated by this period of continued high activity.

Market Data Licensing (distributes market data and financial information) revenue increased by 25%, with the main contributor being the growth in non-professional users as retail participation in equity markets increased. Growth in professional users and price increases were among the other factors at play.

Corporate Services (operates the OTCQX and OTCQB markets and offers issuers disclosure and regulatory compliance products) revenue growth of 40% was generated by a combination of strong additions in new clients for OTCQX and OTCQB markets (see Exhibit 2), price increases and increased demand for Virtual Investor Conferences’ services.

Re-distribution fees, which relate to market data services, grew by 6% and transaction-based expenses (payments for liquidity provision on OTC Link ECN) were up 310% as a result of higher transaction activities.

Operating expenses (before depreciation and amortisation) were up 19%, with the main contributors being personnel costs and clearing and regulatory costs resulting from the expansion of ECN trading (see further detail in Exhibit 4).

At the pre-tax profit level, the increase was 90% to $9.1m, while a higher tax charge of 22.7% versus 11.9% left diluted earnings up 65% at $0.59 from $0.36.

Click on the PDF below to read the full report: