Osirium Technologies PLC (LON:OSIO)'s update on trading year to date confirms that it is seeing a return to pre-COVID levels of ordering. Nine new customers so far in Q1 at higher average contract values than a year ago mean that order intake is ahead of this period a year ago. We have upgraded our bookings and revenue forecasts for FY22 and incorporate the recent conditional £1m fund-raise.

Positive order momentum year to date

Osirium has announced that it has signed nine new customers so far this year, with four of the contracts of greater value than any deal signed in FY21. Osirium signed its largest ever number of new customers in FY21, benefiting from adoption of its secure back-up solution by a number of NHS trusts. This year’s new customers have signed up on higher average contract values, back to pre-COVID levels, with overall bookings ahead of this period a year ago. The company sees further opportunities in the NHS, both for new contracts and expansion of existing agreements, as well as good prospects in the higher education, retail and financial services sectors.

Upgrading order forecasts

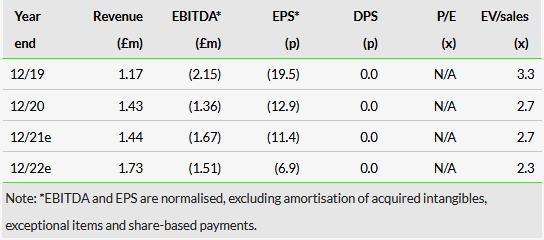

We have revised our forecasts to reflect a more positive order outlook for FY22. We have increased our growth forecast for orders from 28% to 50%, noting that £1.5m worth of contracts are due for renewal this year. Our revenue forecast for FY22 increases 5%, reflecting the fact that bookings are typically for multi-year contracts, and the EBITDA loss reduces from £1.60m to £1.51m. We have also reflected the recent £1m fund-raise, assuming shareholders approve the issue of the remaining 69% of the placing at the general meeting on 7 March. Our end-FY22 net debt forecast reduces from £5.6m to £4.3m. The company indicated when the placing was announced that it intends another raise in H222.

Valuation: Bookings growth the key trigger

At 2.3x FY22e sales, Osirium is trading at a discount to peers on an EV/sales basis (the UK software sector is trading at 4.5x current year and 3.6x next year sales). Key to closing this gap will be evidence of sustained bookings momentum translating to revenue growth and progress towards break-even.

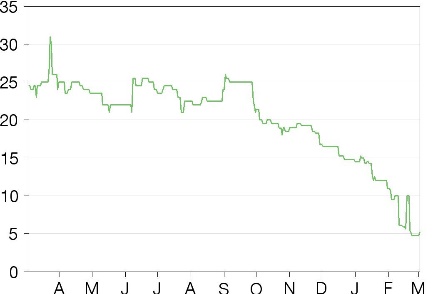

Share price performance

Business description

UK-based Osirium Technologies designs and supplies subscription-based cybersecurity software. Its product portfolio includes privileged access management (incorporating privileged access, task, session and behaviour management), secure process automation and privileged endpoint management software.

Positive order momentum year to date

Osirium has announced that it has signed nine new customers so far this year, with four of the contracts of greater value than any deal signed in FY21. Osirium signed its largest ever number of new customers in FY21, benefiting from adoption of its secure back-up solution by a number of NHS trusts. This year’s new customers have signed up on higher average contract values, back to pre-COVID levels, with overall bookings ahead of this period a year ago. The company sees further opportunities in the NHS, both for new contracts and expansion of existing agreements, as well as good prospects in the higher education, retail and financial services sectors.

Upgrading order forecasts

We have revised our forecasts to reflect a more positive order outlook for FY22. We have increased our growth forecast for orders from 28% to 50%, noting that £1.5m worth of contracts are due for renewal this year. Our revenue forecast for FY22 increases 5%, reflecting the fact that bookings are typically for multi-year contracts, and the EBITDA loss reduces from £1.60m to £1.51m. We have also reflected the recent £1m fund-raise, assuming shareholders approve the issue of the remaining 69% of the placing at the general meeting on 7 March. Our end-FY22 net debt forecast reduces from £5.6m to £4.3m. The company indicated when the placing was announced that it intends another raise in H222.

Valuation: Bookings growth the key trigger

At 2.3x FY22e sales, Osirium is trading at a discount to peers on an EV/sales basis (the UK software sector is trading at 4.5x current year and 3.6x next year sales). Key to closing this gap will be evidence of sustained bookings momentum translating to revenue growth and progress towards break-even.

Click on the PDF below to read the full report: