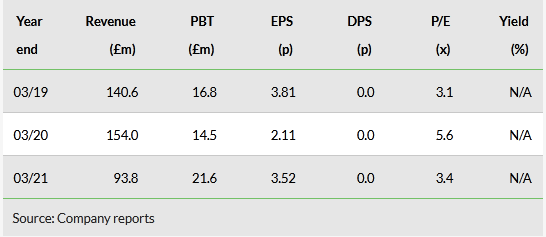

OPG Power Ventures (LON:OPG) reported a strong year in profit and cash generation despite COVID shutdowns and lower power consumption in India. A significant increase in the coal price is providing a headwind. The strong financial position and captive model provide confidence, while the historical valuation (last three-year average P/E of 3.7x and EV/EBITDA of 1.9x) is compelling.

Historical results

Share price graph

Bull

- Strong cash flow generation from a mature asset base (no development risk) and rapidly deleveraging balance sheet.

- Exposure to the high-growth Indian economy.

- Opportunities from nascent renewables business funded through solar investment disposal.

Bear

- Coal price volatility against fixed-price tariffs affects margins (negatively and positively).

- Environmental legislation likely to require additional capex at the Chennai plant.

- Recent low solar tariff bid levels affect the returns available from new investment.

Results in brief

The number of units generated declined by 13% and plant load factor declined from 75% to 58% due to COVID, leading to a 39% fall in revenue to £93.8m. Operating profit increased from £24.0m to £27.5m, assisted by credit recoveries of £9.4m against expected credit losses of £3.0m. Operating margins increased from 15.5% to 29.3%. EPS increased by 67% to 3.52p. Cash generation was strong, assisted by credit recoveries/working capital and limited capex requirements. Net debt reduced from £53.4m to £16.2m, leaving net debt/EBITDA at 0.5x. In light of uncertainties due to the rapid escalation of the coal price management has decided not to pay a dividend in order to preserve balance sheet strength and flexibility.

Outlook

The key metric for a thermal power generator is the dark spread, the margin over the coal price. OPG primarily uses Indonesian coal, where prices have more than doubled in recent months. Freight costs have also been rising. OPG is partially covered through fixed price agreements for coal and freight in FY22 but remains exposed to market fluctuations for the unhedged element. Hence management feels unable to provide forward guidance until there is greater stability.

ESG

OPG’s first ESG report highlights progress in reducing emissions including NOx, SOx and particulates, low water consumption, a strong health & safety record and a range of community actions. This will form part of the future strategy to develop the group’s sustainability credentials, including commercial opportunities arising from the Indian government’s latest National Energy Policy (NEP) 2021.

Valuation

The rising coal price is likely to affect short-term earnings until it reverses or is passed through under the group’s captive model. Hence it is more insightful to look at the historical results valuation. Using an average of the last three years, the shares trade on a P/E of 3.7x and EV/EBITDA of 1.9x. In addition, the solar investments translate to 4.1p/share at the carrying value of £16.4m.