OPG Power Venture (LON:OPG) (OPG) has modern thermal power generation assets and a strong balance sheet to see it through the current coal price headwind, which is also masking the short-term valuation. Future value generation could also come from the intention to expand renewables activities, which could benefit from the group’s current roster of captive customers.

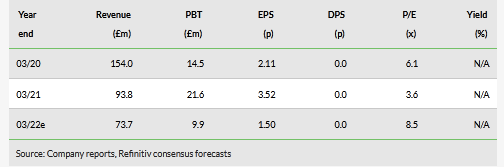

Results in brief

OPG reported positive H1 results with a strong recovery from the impact of COVID-19 in the previous year as highlighted by the rise in demand for power across India, which increased by 12.7% in the period. The group generated 1.3 billion units (kWhs) +63% with a plant load factor (PLF) of 71.3%, up from 46%, although tariff rates were marginally softer at R5.47/kWh from R5.60/kWh. Total sales were £55.6m, up 54%, and operating profit at £8.7m was lower than the £16.2m the previous year, which benefited from credit recoveries of £9.6m. The operating margin was 15.6%. Cash generation was strong with net debt reduced to £5.0m (£16.2m at 31 March 2021, £34.9m at 30 September 2020).

Outlook

The price of Indonesian coal has surged due to demand, particularly from China. The price roughly quadrupled to the end of October and, while having halved, is still approximately twice the previous year’s level with freight prices also remaining elevated. Hence management has reduced generation (PLF in October/November averaged 20.6%). As a consequence, profitability will be significantly affected in the second half and full year.

ESG

OPG is continuing to work on its forward strategy. This will include meeting the Indian emissions requirements by December 2023 for which capex has already been allocated. In addition, management is looking to expand the group’s renewables activities where current industrial customers using OPG thermal power, could provide an opportunity as they look to decarbonise their own activities.

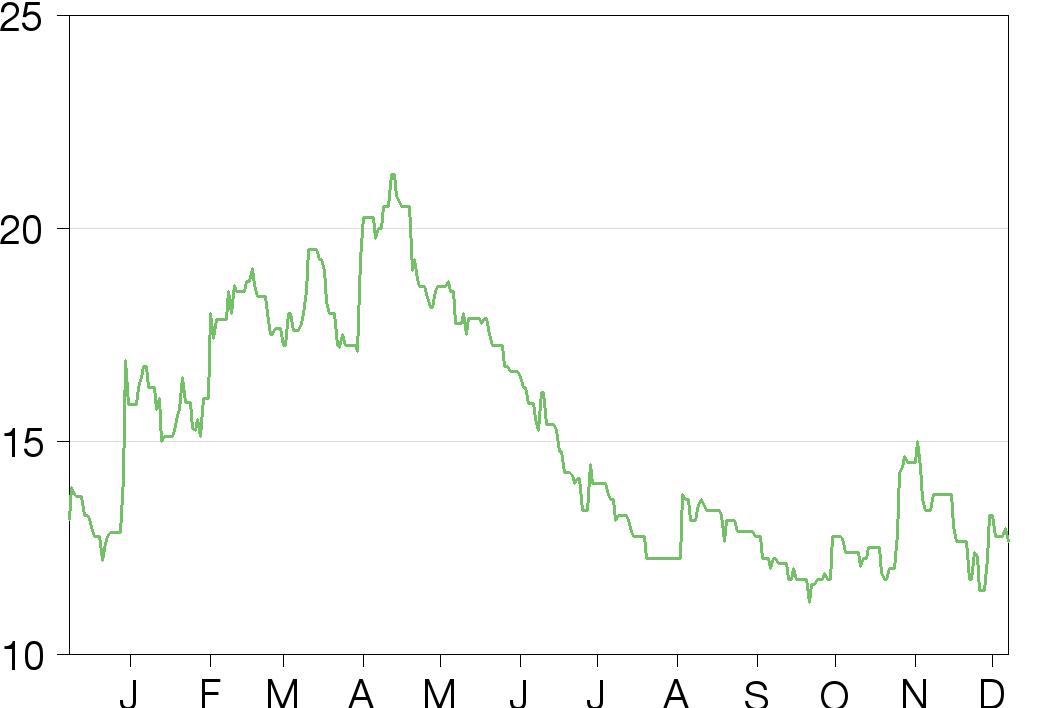

Valuation overshadowed by the coal price spike

The coal price machinations are affecting profitability and hence short-term valuation metrics. The underlying valuation is highlighted by the pre COIVD-19 2020 P/E of 6.1x or the 69% discount to net asset value (41.0p/share).

Share price graph

Business description

OPG Power Ventures is an independent power producer based in Chennai, India. Its key asset is a 414MW coal-fired thermal power plant in Chennai and it also has 62MW of solar assets in Karnataka (31% interest). The majority of power (c 80%) is sold to independent commercial captive consumers, permitting preferential tariffs, improved payment terms and reduced concentration of risk with over 200 individual captive consumers.

Bull

- Strong cash flow generation from a mature asset base (no development risk) and rapidly deleveraging balance sheet.

- Exposure to the high-growth Indian economy.

- Opportunities from nascent renewables business funded through solar investment disposal.

Bear

- Coal price volatility against fixed-price tariffs affects margins (negatively and positively).

- Environmental legislation likely to require additional capex at the Chennai plant.

- Recent low solar tariff bid levels affect the returns available from new investment.

Click on the PDF below to read the full report: