What did OPEC+ agree?

OPEC+ members met over the weekend to discuss production policy for the remainder of this year and 2025. It was a hybrid meeting with the wider group attending by video conference, while members making additional voluntary cuts met in person in Riyadh. The meeting coincided with Aramco’s $12bn secondary share offering on Sunday, which sold out within hours.

Heading into the meeting, OPEC+ would have been somewhat concerned about recent price action in the market. ICE (NYSE:ICE) Brent is down more than 10% from its April highs despite OPEC+ withholding a significant amount of oil from the market. There are clear signs of weakness in the physical oil market. Refinery margins have moved lower, raising the prospect of a reduction in refinery runs, while the prompt Brent timespread has seen its backwardation narrow significantly, suggesting less concern over near-term tightness in the market.

In addition to some softer fundamentals more recently, expectations were high for members to fully roll over their additional voluntary cuts into the second half of 2024. Recent price action and forecasts for the market to return to surplus without a rollover drove this view.

OPEC+ agreed on several aspects relating to its output policy at their various meetings on Sunday.

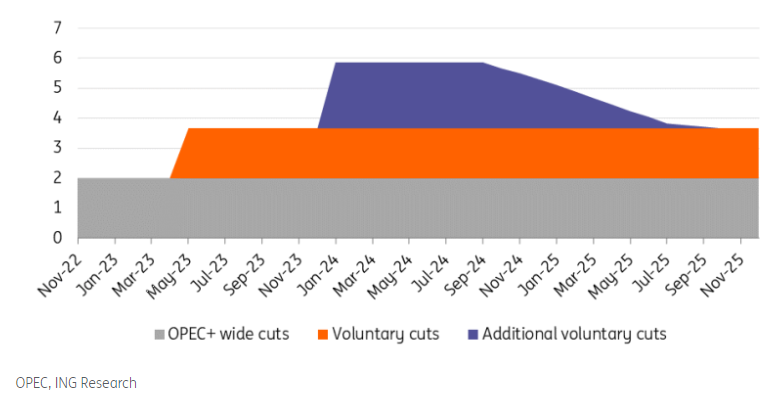

First was an agreement on the rollover of their group-wide cuts of around 2m b/d through until the end of 2025. These were previously set to expire at the end of 2024.

Secondly, a voluntary supply reduction amounting to 1.66m b/d from nine OPEC+ members – introduced in May 2023 – was also extended to the end of 2025. Similarly, these were initially set to expire at the end of this year.

Finally, the supply cuts the market was most interested in were the additional voluntary supply cuts of 2.2m b/d, which were set to expire at the end of June 2024. Members decided to extend these cuts until the end of September 2024, after which this supply will be gradually returned to the market through until September 2025. The return of these barrels to the market will largely depend on market conditions. It was largely expected that these additional voluntary cuts would be rolled over. If anything, the market would be fairly disappointed that they were only extended until the end of September rather than the end of 2024.

In addition, the UAE had its 2025 production target lifted by 300k b/d due to an increase in its production capacity.

In theory, the unwinding of additional voluntary supply cuts and an increase in the UAE production target means that from October 2024 through until the end of 2025, OPEC+ is planning to bring 2.5m b/d of supply back onto the market.

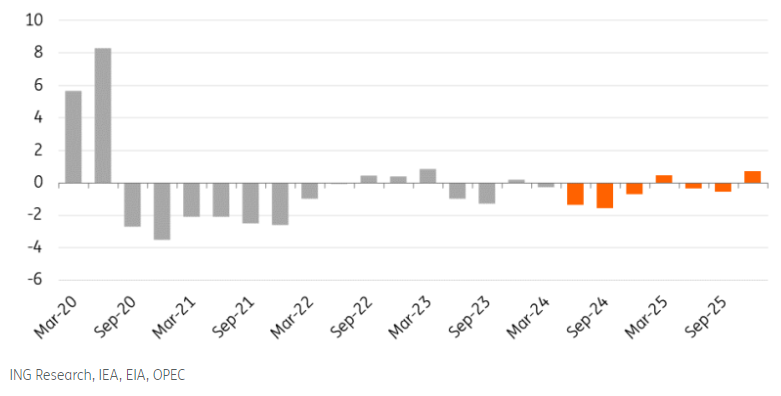

Rollover pushes the market into deficit for the remainder of 2024

Action taken by OPEC+ over the weekend will push the oil market into deficit for the remainder of this year, assuming no demand upsets. We expect a deficit of around 1.5m b/d in the third quarter of this year and 700k b/d in the fourth quarter. This deficit, particularly during the peak demand period of the third quarter, should see oil prices move higher over the summer months. Therefore, we retain our current Brent forecast of $88/bbl for this period. The risk of overtightening the market leaves some upside to this view, but much will depend on how demand plays out over the summer.

The planned return of oil supply from October and through much of 2025 should leave the market in marginal surplus over 2025, supporting the view that prices trend lower from a third quarter peak in 2024. Therefore, our average Brent forecast for 2025 remains unchanged at $80/bbl.

While the extension of cuts gives the market clarity and should support prices in the short term, there is still a level of uncertainty as we move closer to the fourth quarter of the year, despite the group providing a plan on how supply will be brought back onto the market. The unwinding of voluntary cuts is not set in stone and the group will likely have to react to market dynamics closer to the time.

However, longer-term, OPEC+ will eventually have to accept the idea of lower oil prices or risk losing further market share to non-OPEC+ producers.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI