Key Points:

- Saudi Arabia signals potential extension to production cuts.

- Price action being pushed to the update by geopolitical risk.

- Medium term outlook remains unchanged despite recent rally.

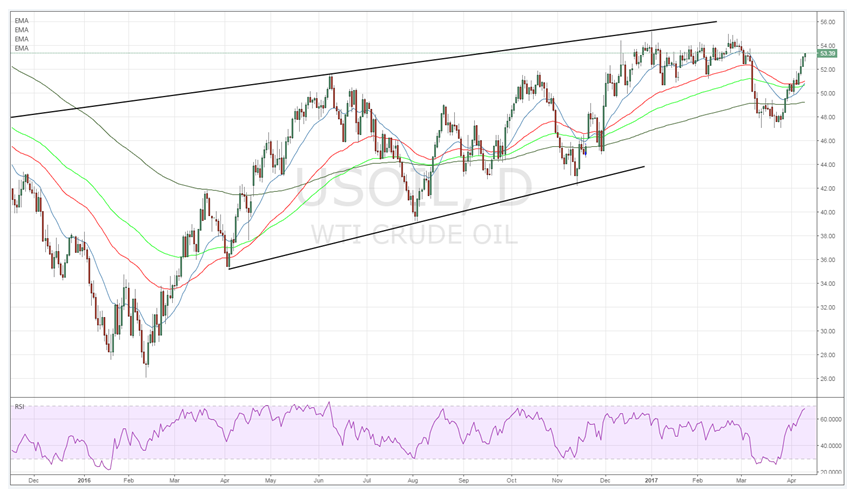

Crude oil prices have experienced a renaissance over the past week as concerted rallies have harkened back to the days of complete OPEC control. In particular, the price of West Texas Intermediate (WTI) has soared over the past 24 hours as, a combination of geopolitical risk and further potential supply cuts from Saudi Arabia, have buoyed the commodity. Subsequently, WTI prices currently trade around the $53.39 a barrel mark but it remains to be seen if oil can retain this level over the medium term.

The Saudi announcement that they will seek an extension to the current production cuts during the May OPEC meeting was certainly well received by the market. Future prices immediately spiked on the prospect of additional production constraints but the reality is that this is far from a done deal given the various OPEC members propensity to cheat on production cuts. This risk is amplified given the fact that many OPEC members are currently experiencing pressures upon their foreign currency reserves and require the market share to balance their books. Subsequently, there are plenty of external pressures to suggest that the May meeting could be contentious.

Additionally, the success of any future production cut agreement is likely to hinge upon the participation of a range of non-OPEC members. In the new oil reality, OPEC no longer is able to control the globally integrated oil markets without the tacit agreement, or direct collusion, of external producers. However, this is difficult to see given the levels of crude production currently being obtained in the Canadian oil sands and U.S. shale operations. It is relatively clear that advances in North American oil extraction is strongly altering the balance of power within the marketplace and sorely testing the cartel’s ability to respond.

Realistically, once most of the geopolitical risks around Syria and North Korea ebb away, so too will the upward pressure on oil prices. Rebalancing is still occurring within global markets and the rise in WTI prices is simply a distraction as U.S. shale production activity is likely to now increase, in response to the price rises. The reality is that there is plenty of pain still required before supply is balanced to a sustainable level globally.

In addition, there are also some specific concerns over the current level of demand as we head into what is effectively the driving season for the United States. There are some indications that consumer sentiment is slipping ahead of a planned tightening phase from the Federal Reserve. This could have a marked impact on crude prices, especially if we continue to see growing inventory figures emanating from the EIA.

Ultimately, Crude prices are unlikely to persist at their current level in the medium term, even with an extension of the OPEC production cut agreement. As long as we manage to avoid a conflict in either Syria or North Korea the price of oil is likely to slide back towards the $50.00 handle over the next month. This will especially be the case of EIA inventory figures continue to disappoint the market with builds. Subsequently, realise that the long play is running out of momentum and that the downside is beckoning regardless of any OPEC action.