AMD (NASDAQ:AMD) has introduced new AI accelerators and server chips to compete with Nvidia (NASDAQ:NVDA) and Intel (NASDAQ:INTC). CEO Lisa Su wants to make AMD the leading force in artificial intelligence (AI). While Nvidia dominates the market, AMD plans to attack with a combination of graphics and computer processors.

A look back at AMD's successes

When Su took over as CEO of AMD in 2014, the company was on the verge of bankruptcy. By focusing on affordable, high-performance processors, AMD recovered and gained market share in PC processors and data centres. Today, the company's EPYC processors have a 34% market share and are successfully competing against Intel's Xeon series.

The challenge in the AI market

However, the big competition is in the field of AI accelerators, where Nvidia currently holds an 80% market share. AMD is focusing on lower prices and has launched a successful AI accelerator, the MI300. Now, the MI325X is following, which is said to be 1.4 times more powerful than Nvidia's Hopper chip in inference. In the future, AMD plans to continue to catch up with annual product cycles.

Opportunities and strategies

AMD is focusing on inference, the application of trained AI models, and is working with companies such as Meta, Oracle (NYSE:ORCL) and even OpenAI. Su believes that computer processors will continue to play a central role in data centres and is building an alternative to Nvidia's proprietary Cuda ecosystem with the open-source ROCm platform. To stay competitive, AMD has acquired Finnish AI specialist Silo AI and data centre hardware manufacturer ZT Systems this year.

Nvidia's lead remains

Although AMD has market opportunities, Nvidia remains unchallenged for the time being. Analysts expect Nvidia to generate over $100 billion in revenue from data centres alone in 2024, while AMD will generate five billion in this segment. The market valuation also reflects this difference: Nvidia is currently worth $3.2 trillion, while AMD is only worth $276 billion.

Nevertheless, AMD has potential, especially if the market for AI continues to grow and hyperscalers like Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) continue to expand their data centres. Investors could benefit from AMD's position as the runner-up in the future, even though it will take some time to get there.

The stocks also reflect this from a chart technical point of view. From this perspective, even Intel would have enormous potential.

INTEL

Intel has every chance of catching up with AMD. The stock has reacted perfectly to our purple target field between $19.83 and $15.11 and is showing a sign of life with a rise. However, this increase has been hesitant so far. There is still an extreme risk that the stock will collapse and slide down to the region of the violet circle at $7.38 to $0.9706.

If Intel can defend the previous low, the long-term path to the upside will be clear. The potential of the stock is a whopping 361% from the current price up to the long-term target red box at $110.01 to $131.54. We will continue to keep an eye on this and take our chance as soon as the stock can really confirm the bottom. We will wait for that.

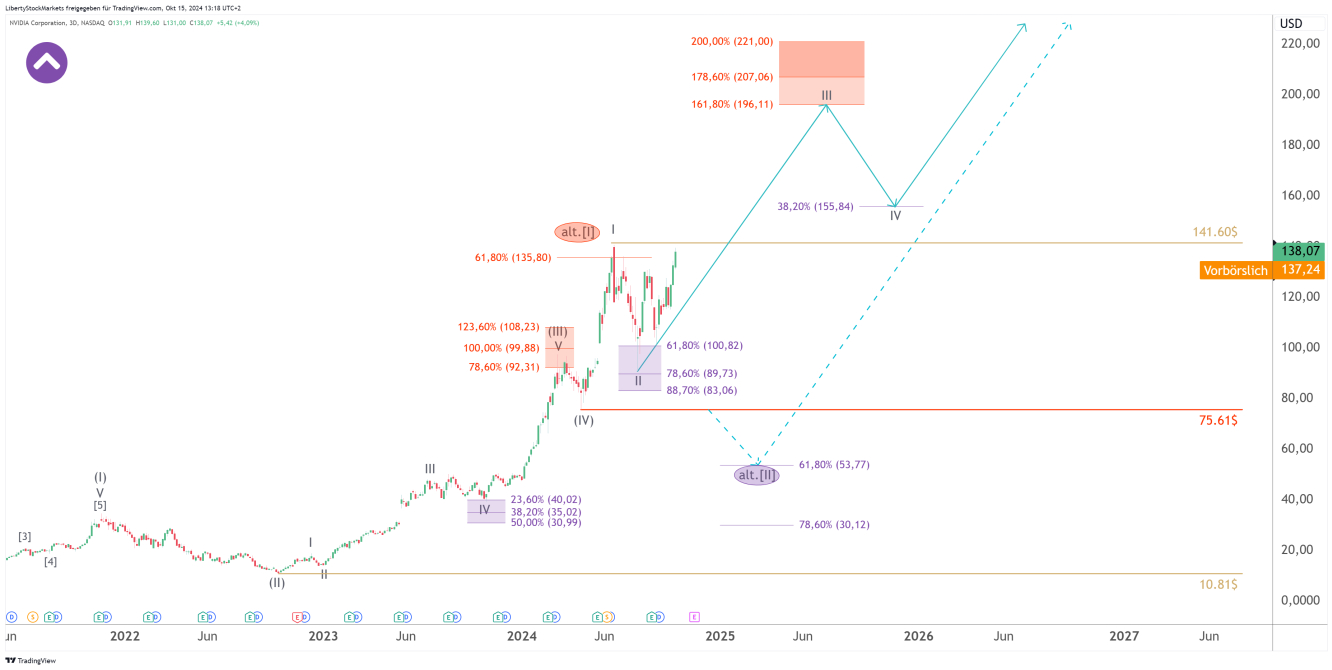

NVIDIA

Here, too, we can see that the stock initially followed our forecast perfectly. It fell exactly within the purple box from $100.82 to $83.06 and has since experienced a very strong turnaround. We assume that the stock is back on an upward trend and can reach the next target at the top of the chart at $196.11 to $221.00 in the medium term. That's about 40% upside potential, which the stock will easily achieve.

We have been invested for several years and have taken many opportunities to buy more Nvidia shares. It is one of the strongest stocks in our portfolio and will probably remain so for a long time. We will probably use the next period of weakness to buy the stock again. This story is not over yet.

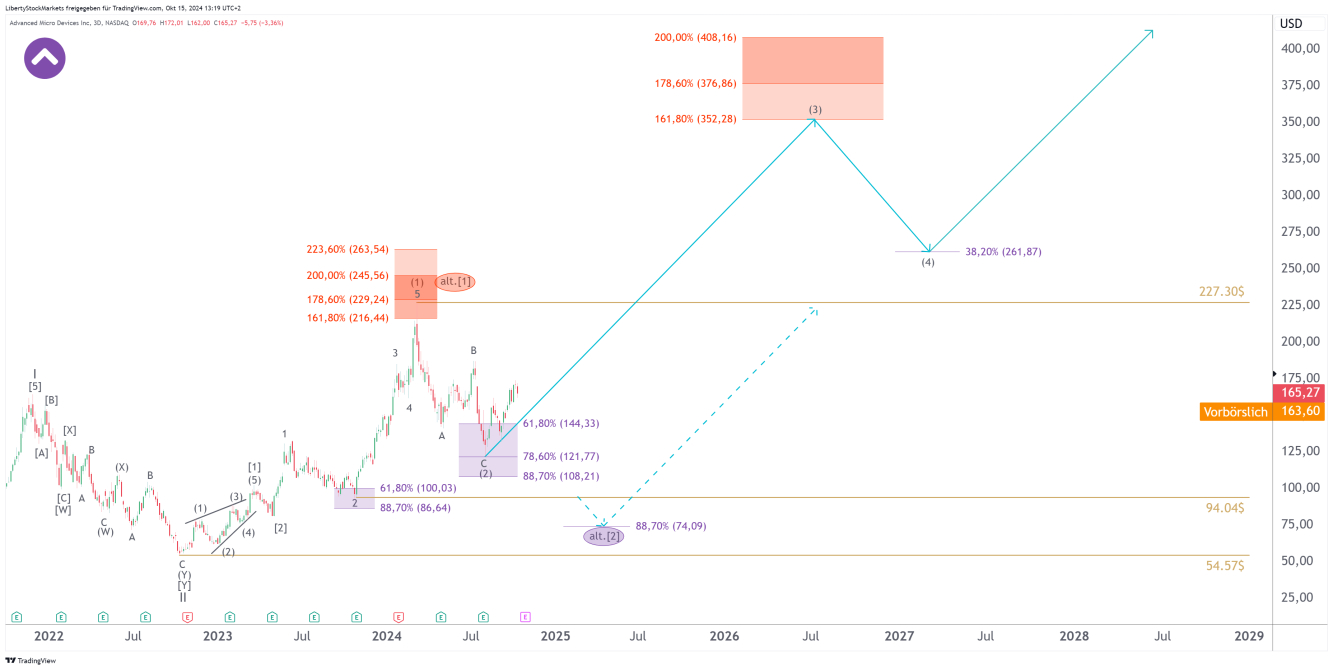

AMD

Anyone who underestimates AMD is making a big mistake. This stock has built up very strong fundamentals in recent years, on which extreme increases are possible. The stock is also performing exactly as we forecast. This applies not only to the high at $227.30, which we predicted with pinpoint accuracy, but also to the end of the correction in the range of our purple target field at $144.33 to $108.21. Since then, the price has been rising steeply again. We have taken this opportunity to buy more.

We see AMD as a hidden champion that, in Nvidia's wake, has what it takes to capture an increasing share of the market. We even see a significant threat to Intel due to its good positioning in the PC processor and data centre sectors. AMD is attacking on two fronts and is clearly gaining ground.

We believe that the stock is capable of a price increase of over 130% in the next major step. We estimate that the risk of a final sell-off to below $94.04 is lower.

We continue to write the story of this and many other stocks on our website. Not only do we provide daily analytical coverage, but we also work out further purchasing opportunities from which our customers benefit. If you would like to be part of this, then come to our website (link is at the top next to my profile picture) and use the voucher code LIBERTY to get our analysis and forecast packages up to 20% cheaper.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Nvidia, Intel or AMD – Which stock offers the greatest potential?

Published 15/10/2024, 14:51

Nvidia, Intel or AMD – Which stock offers the greatest potential?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.