The volume in the S&P 500 futures yesterday was notably low. For the day, roughly 830,000 contracts were traded, compared to the 808k contracts traded on the 1/2 day of July 3.

This raises questions about the expected October selling, especially considering October typically marks the fiscal year-end for many mutual funds. So far, this year seems uneventful from that perspective, with volume continuing to decline.

Additionally, the S&P 500 futures managed to push through the upper boundary of the rising wedge pattern.

While this isn’t entirely unexpected, as it has happened before (notably in July, before the market turned lower into the August low), it doesn’t necessarily invalidate the pattern. It’s worth watching closely for signs of a similar reversal.

The volume levels in the NASDAQ futures were as weak as those in the S&P 500.

The key difference is that while the NASDAQ futures hit the upper trend line of the wedge, they failed to break through. Instead, they stopped right at the trend line, indicating potential resistance at that level.

The equity market’s performance has primarily mirrored Nvidia (NASDAQ:NVDA), which managed to reach a new closing high yesterday. However, it still needs to surpass its prior intraday high from mid-July.

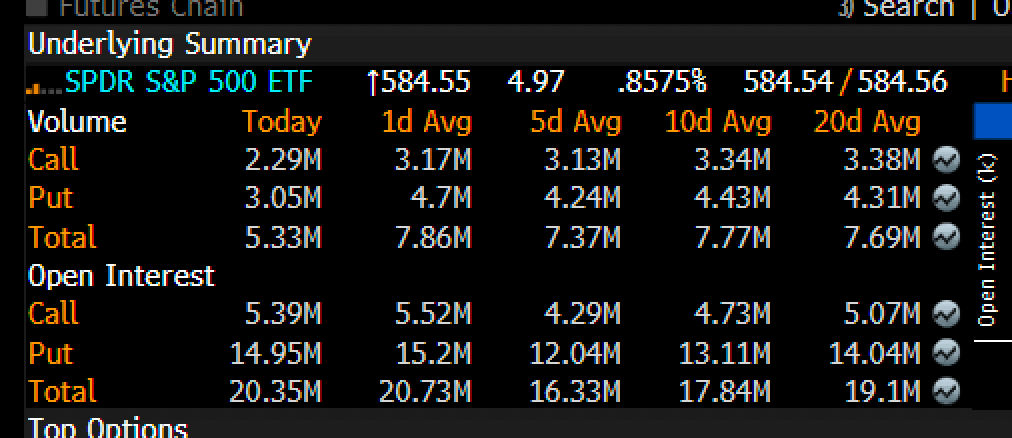

Notably, option volume was down significantly, with only 2.3 million call contracts traded compared to 3.2 million on Friday and an average of 3.4 million over the past 20 days.

This decline in volume may suggest that the stock isn’t as appealing at its current price levels as it was a week or two ago.

(BLOOMBERG)

The stock price climbed to around $139.60 early in the session, but it stalled at that level, which had previously served as resistance in July.

A wave of earnings reports starts coming out today, alongside VIX options expiration on Wednesday and stock options expiration on Friday.

Additionally, bond markets will be open, so I expect trading volumes to pick up as we head into a busy week ahead.