Norcros’s compelling investment case was underpinned at the half year where underlying operating profit was down less than 3% despite material revenue pressure. Group operating margins rose 60bp, the UK business reported record underlying profits and Norcros continued to take market share in both the UK and South Africa. We believe that Norcros’s key strengths are underappreciated and that legacy issues, notably the pension deficit, have been resolved. We retain our estimates and value the shares at 246p, implying c 50% upside.

H1 pressures, but strategic progress evident

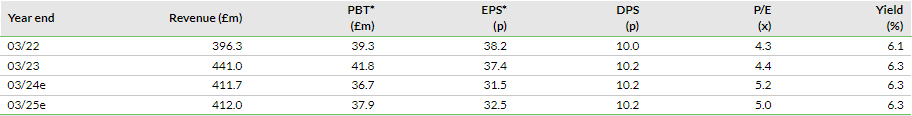

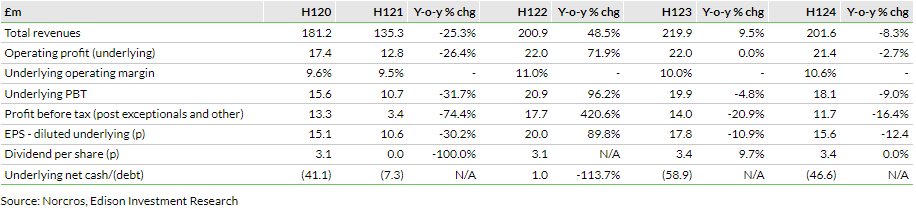

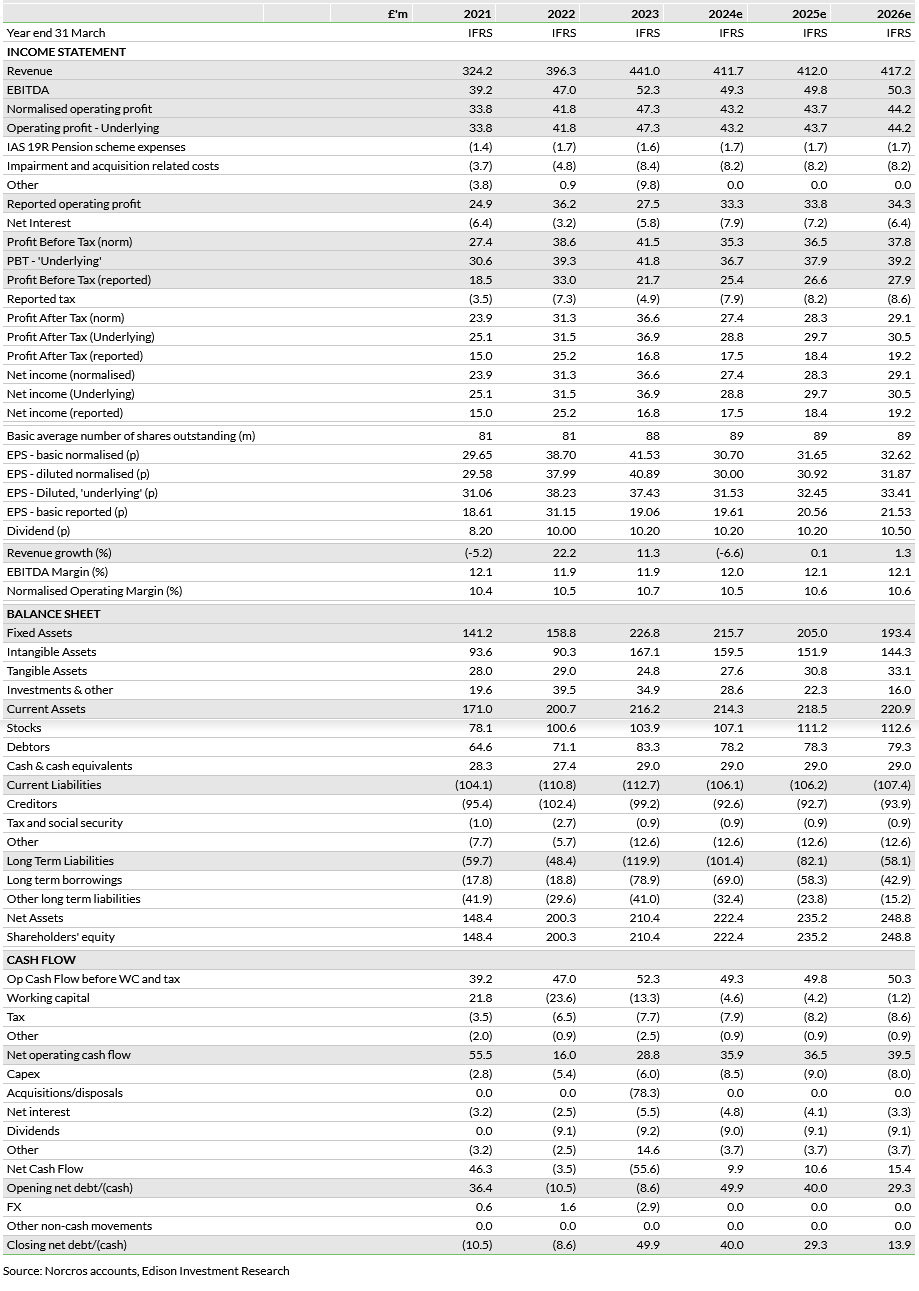

H1 revenue declined 8.3% y-o-y at the headline level to £201.6m, but was down only 4.1% on a constant currency, like-for-like basis. Underlying operating profit was down only 2.7%, largely reflecting the decline in revenue, but the underlying operating margin rose 60bp to 10.6% despite the revenue pressure due to strategic management action that included the closure of the adhesives operation and the 50% capacity reduction at Johnson Tiles. Underlying PBT declined 9.0% as interest costs rose and diluted EPS slid 12.4% to 15.6p. An interim dividend of 3.4p was declared, flat year-on-year. Strong cash generation contributed to the reduction of net debt, from £58.9m a year ago to £46.6m. The net debt to EBITDA ratio at the half year was 1.0x, which implies material headroom.

Compelling investment case underlined

Norcros’s successful growth strategy has remained consistent and largely unchanged for many years, focusing on the development of leading market positions with strong brands in highly fragmented markets. Its capital light structure and targeting of the more resilient mid to premium section of the repair, maintenance and improvement (RMI) market reduces volatility. The strong focus on new product development and its 25% ‘vitality’ rate (sales of products launched in the last three years), coupled with its leading supply chain, implies it is winning market share from smaller competitors. One new product example is the Triton Envi shower, a behind-the-wall digital shower with strong environmental credentials.

Profit forecasts and valuation maintained

While we have reduced our FY24 and FY25 revenue forecasts by c 7–8%, we have maintained our profit estimates and therefore our valuation of Norcros (LON:NXR). Our P/E based valuation implies a value of 236p/share based on our diluted underlying FY24 EPS estimate, while our DDM implies a value of 255p/share. The average is 246p, implying c 50% upside. Norcros is trading at the lower end of its long-term consensus forward P/E range on 5.4x (Edison forecast P/E: 5.2x), suggesting that a lot of negativity is priced in. As and when we begin to see recovery in the UK and/or South Africa, the company may well attract a higher multiple.

New record for UK profits despite tough markets

Norcros’s H124 results highlighted the resilient nature of Norcros. Although total revenue declined 8.3%, underlying operating profit was down just 2.7%, benefiting from strategic management actions (described below), which resulted in the achievement of record UK operating margins. We are maintaining our FY24 and FY25 profit estimates, though we have reduced revenue estimates, reflecting current trends. Norcros is a leading player in its field and, with the stock trading on a P/E of just 5.2x, we believe there could be significant upside from the current depressed price level. Furthermore, one of the key historical issues faced by Norcros, that of its historically large pension deficit, remains well under control as the fund has been in an accounting surplus for the last two years.

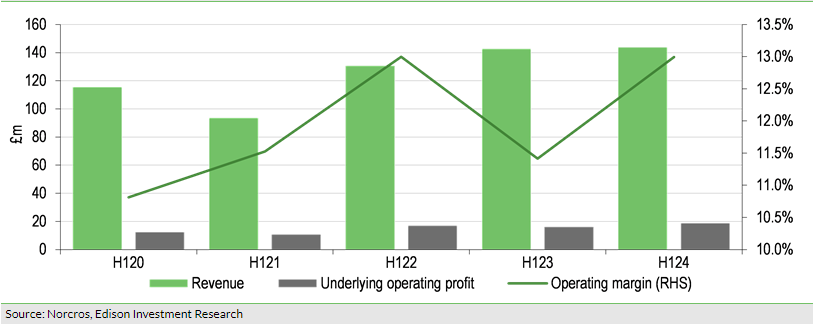

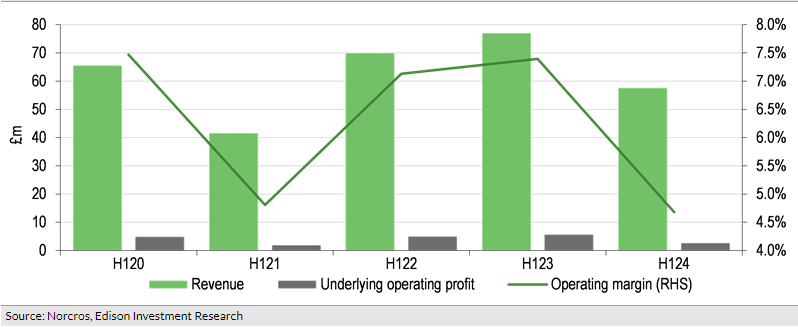

Group margins up despite issues in South Africa

H1 revenue declined 8.3% y-o-y at the headline level to £201.6m, driven down by a combination of modest revenue growth in the UK and weaker demand in South Africa. Revenue was down only 4.1% on a constant currency, like-for-like basis, but was up 11.3% versus H120 (a pre-pandemic period) in total terms. Underlying operating profit was down only 2.7% y-o-y, largely reflecting the decline in revenue, but was up 23% versus the same period in CY19 (fiscal H120). The underlying operating margin rose 60bp y-o-y to 10.6%, despite the revenue pressure, as the benefits of management action to exit the underperforming adhesives business and the 50% capacity reduction at Johnson Tiles were felt. The inclusion of the higher margin Grant Westfield business was a further positive.

Underlying PBT declined 9.0% as interest costs rose due to the higher average levels of net debt during the period reflecting M&A financing and higher interest rates, and diluted EPS slid 12.4% to 15.6p. An interim dividend of 3.4p was declared, flat year-on-year. Net debt was reduced from £58.9m a year ago, reflecting the acquisition of Grant Westfield, to £46.6m. Net debt stood at £49.9m at 31 March 2023. The net debt to EBITDA ratio at the half year was 1.0x, which implies material headroom to the committed £130m revolving credit facility.

UK profits hit record, South Africa hit by power outages

In the UK, which now accounts for 71% of revenue, Norcros generated revenue of £143.9m, up 0.8%. On a like-for-like basis, and excluding Grant Westfield (acquired in May 2022) and Norcros Adhesives, which was closed, revenue slipped just 0.8% with lower volumes almost completely offset by price increases. In particular, the key brands of Triton, Merlyn and Grant Westfield performed well, driven by new product launches, excellent stock availability and great customer service, although Vado was negatively hit by delayed new product launches. RMI demand remained the key driver of revenue. Export revenue increased driven by demand from Ireland, France and the Middle East.

H1 operating profit rose 14.7% or £2.4m, to £18.7m, a record level, and implied that margins rose 160bp to 13.0% in the period. The growth reflects the efforts made to improve the brand portfolio.

The South African business, which makes up 29% of revenue, fell 25% in absolute terms and declined by 11% on a constant currency basis, as higher levels of energy rationing hit consumer confidence and demand. The ‘loadshedding’ has had a minimal impact on Norcros’s own operations and retail stores as they have been equipped to operate during these periods of interruption. Despite the headwinds, Norcros maintained its market share gain momentum by focusing on product development and customer service in the region.

TAL, the leading adhesives business in the region, was able to grow market share, as did House of Plumbing despite flat revenues in a challenging market. Johnson Tiles and Tile Africa were both affected by market slowdowns, particularly in the new housebuilding sector. The market turbulence mentioned resulted in a decline in operating profit, from £5.7m to £2.7m, which implies a decline in margins from 7.4% to 4.7%.

Despite the tough market conditions, Norcros continues to take market share and should benefit from the national roll out of House of Plumbing in South Africa. We anticipate it should also begin to see the market stabilise as energy constraints become less of an issue.

Valuation suggests c 50% upside

Following the H124 results, we have essentially maintained our profit estimates and therefore our valuation of Norcros. Our P/E based valuation implies a value of 236p/share based on our diluted underlying FY24 EPS estimate of 31.5p/share, while our dividend discount model (DDM) implies a value of 255p/share, and if we take the average of the two, we arrive at 246p, implying c 50% upside. Norcros is trading at the lower end of its long-term consensus forward P/E range on 5.4x (Edison forecast P/E: 5.2x), suggesting that a lot of negativity is priced in. As and when we begin to see recovery in the UK and/or South Africa, the company may well attract a higher multiple.

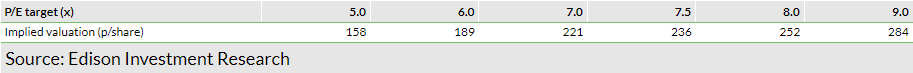

Simple forward P/E multiple valuation implies 236p/share

The chart below details the progression of Norcros’s forward P/E over the last cycle. The range at the extremes is a low of 4x reached briefly post COVID-19 and again in 2022, and the high is c 12x at the end of 2013, before the Brexit hiatus. Over this period and outside the extreme ratings, the ‘real’ range has arguably been 6–9x and the average over the whole period is 7.4x.

If we apply the 7.4x forward P/E multiple to our estimate of FY24e diluted underlying EPS of 31.5p, we arrive at a value of 236p/share, implying c 45% upside to the share price. Arguably, this method gives little credit for future potential acquisitions, which are part of the company’s strategy and may be forthcoming.

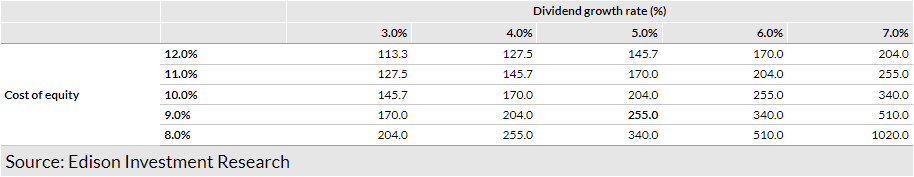

Dividend discount model implies a valuation of 255p

Our DDM valuation of 255p lends support to the P/E valuation above of 236p/share. We have maintained the base dividend of 10.2p/share, which is more than three-times covered by diluted and underlying earnings. We are confident that forecasts are likely to rise in the longer term given the numerous growth channels available to Norcros, justifying our 5% long-term dividend growth estimate. We remind readers that dividends grew 10.7% pa between 2015 and 2019, which further supports our dividend growth assumptions.

General disclaimer and copyright

This report has been commissioned by Norcros and prepared and issued by Edison, in consideration of a fee payable by Norcros. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom