I have been laying out my case for an imminent reversal in the stock averages in recent issues. Last week’s title was an ironic Up, Up and Away? Seems my hot air balloon has run out of propane! And once again the timing was spot on as shares reversed sharply on Wednesday and into Thursday and bounced yesterday. That makes last week’s highs excellent candidates for the top of wave 2 and the kick-off to a hugely destructive third wave down.

The next FOMC meeting next Wednesday could well point the way. Already there is much Hubble and bubble surrounding this event among the conventionally-minded analysts and commentators.

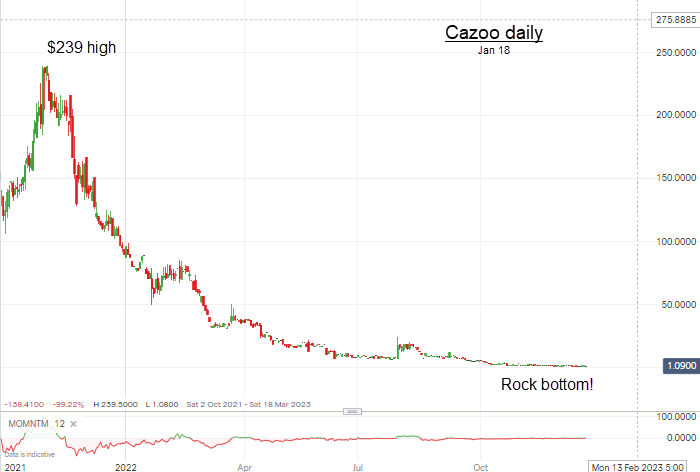

I am starting to see a lot more examples of failures in the cutting-edge businesses that were once heralded as the Next Big Thing. Here is Cazoo, the innovative UK used car dealer that was launched as a Special Purpose Acquisition Company (SPAC) in the USA that issues shares on the basis that the company has no plan for what it will do if anything.

Naturally, investors must have tons of faith to buy these kinds of IPO shares but in 2021 they were selling like hotcakes; such was the bullish mania at the time for equities of any kind. Cazoo IPO’d in 2021and the shares quickly shot to an astounding $239. The market for used cars was red hot.

But what investors failed to realize is that the business model was easily copied relatively cheaply – and copied it was with rivals offering cheaper deals. And a moment’s thought that used car prices being higher than new was not sustainable. This is the result:

Yes, folks, they have crashed to worthless as reality struck (hard).

And with the auto industry now entering a very tough period with used car prices falling hard with today’s used EV prices in free-fall, this should be the start of something really big.

Here is one measure of the coming crisis in the auto sector

We will see a tsunami of US auto re-possessions this year. Very expensive cars (SUVs and EVs?) have been purchased on loans with ‘free’ money last year but with interest rates on the rise, I see many now having to go to work on bicycles (just like in the old days)! Not good in a city like LA.

One other negative for EVs is the revelation that re-charging an EV now costs more than filling up a diesel or petrol car. And the promised roll-out of charging stations seems to be on hold. Here is the chart of a prominent US charging operation

And not to mention the posterchild of EVs – Tesla – is trading near lows of 75% below its ATH. As I have been flagging for many months, the EV ‘revolution’ is in deep trouble. And now concerns are mounting that the grid systems will not be able to cope with the added demand if EVs become universal – which the UK government in its infinite wisdom has mandated in its Net Zero fantasy.

In their messianic rush to ‘save the planet’ at all costs, politicians have set in stone the destruction of Western economies – and the environment. The severe pollution and landscape damage from mining the rare earth minerals that have been known for years is now being noted prominently in the MSM – and by politicians ever eager to follow the focus groups..

Our UK politicians have been trumpeting that the UK is a leader in saving the planet – our CO2 emissions have been cut drastically – but of course, we have lost most of our energy-intensive industry and become a services economy and exported our manufacturing to places like China who are still building scores of coal-fuelled power stations a year. Coal demand is at record highs, as is price. Is that what the eco-zealots intended?

Yes, the UK is leading the world, but to a dystopian future. Even if the UK totally eliminates all CO2 production (much less than 0.5% of the global total), the earth’s climate will carry on regardless.

Also, estimates for the necessary electricity grid upgrades run into the trillions. And with UK taxes already at the highest since WW2, our glorious leaders have set the stage for even higher levels of tax and borrowing if this plan is not shut down. With the tax-and-spend Labour party about to win the next General Election, all this seems assured. Interesting times lie ahead and I believe this is the year that the brown stuff will hit the fan.

Timing is (almost) everything

Last week I wrote on this theme and I will expand on it a little more this week as it is such an important topic for all traders/investors. As we all know, we can be generally correct in forecasting a direction for the market in the time frame desired, but get the timing horribly wrong and that leads to losses. Being right with poor timing is the same as being wrong in my book.

So we have these options when we line up a trade:

- We get the direction right and the timing right – – win!

We get the direction right and the timing wrong – lose

We get the direction wrong and the timing right – lose

We get the direction wrong and the timing wrong – – big lose

So statistically, we have only a 25% chance of getting a potential win. But not quite. Say you have the direction and timing right at the start. You start to make money. But suddenly, the market turns tail while you are walking the dog or in the overnight session and boom – your stop loss is hit and there is another loss to chalk up.

So in the real world, your statistical odds of success on a particular trade are much less than 25% – say 10 -15%. These are not terrific odds, are they? So why do we persist in chasing the dream?

As a diversion, my record of forecasting has been mixed – as has everyone's. My worst prediction ever was that rock ‘n roll would never catch on as it had only three basic chords and any dunce could play that on a cheap guitar (I was a serious trumpet student at the time). My excuse is that I was only 12 or 13 then.

That glaring miss has guided my forecasting attitude ever since and I am acutely aware that any of my current roadmaps on markets can be totally wrong. But I am prepared for that and can take evasive action if needed.

But one of the great aspects of professionally trading financial markets is that we can at any time change our minds – unlike betting on horses (which I do not advocate except for fun). Once you have placed a bet on a horse, that is that. We can also choose the timing of our trades and their exits.

So with these odds stacked against us, we must have a very reliable method of analysis to place the odds of success much more in our favor. That is the purpose of my Tramline methods that I developed a few years ago.

But no technical method of analysis is complete without some grasp of the state of the market, such as a reading of the current bullish/bearish sentiment/mood. We have several technical oscillators to help there. And a reading of the MSM also comes in handy.

My basic rule is to trade against the majority – at the right time.

Basically, if the market has rallied and you conclude that there is a generally bullish/positive mood with great recent ‘bullish’ economic data or Fed statements or wonderful company earnings, then that is a good time to look for a reversal. My Tramline methods can help you do that. Here is a current example in the Nasdaq as laid out on Monday morning:

I was looking for a wave 2 top last week to the 11,600 area. That was the place to put out a short, but with what stop? That is a vital question. Put it too close and you are almost guaranteed to be taken out on a random fluctuation. Put it far away and you can only trade a small bet size and your potential win would be minuscule and not worth the trade.

So you must compromise. So say you short at 11,550 on Tuesday with a 60-pip PS (typical). Then the next day it spikes up to above 11,610 to take out your stop. A loss. Do you despair?

No, hopefully, you have faith in your forecast and decide to re-enter on Wednesday afternoon at a much lower 11,500 but this time you need to use a wider stop – say 100 pips. But that cuts your bet size down- and that is the price you must pay for missing the higher trade.

So now you have a short at 11,500 with 100 pt PS on Wednesday afternoon. The market continues hard down to a low of 11,250 on Thursday afternoon. Nice. You start to feel good about your trade. But you are trading professionally and move your PS to BE just in case. That guarantees a no-loss trade – a most desirable result if your trade fails.

And on Friday, the ‘just in case’ happened and the market rocketed into the close. But you had moved your PS to BE (Club rules) as insurance against this event! Here is the action on the chart

Your first attempt may or may not work, and that is your psychological test and may put you off from another attempt (a weak player). But if you persist (showing fortitude), your second attempt may succeed (or your third). Your timing may be off the first time but succeed on later attempts.

That is the nature of trading in a professional manner. Minimize your losses and let profits run.

So let’s say you have a winning trade after a few losers. How do you handle it? Do you do what a lot of traders do and just take the profit when you feel like it? You justify that with the notion that “it cannot move much farther than that!”

But of course, it does. Now, what do you do? Jump straight back in or let it go? You have a big problem in deciding. If you get back in and it immediately goes against you, you have lost. And if it keeps on going in your direction, the market becomes even more overbought/oversold and vulnerable to a sharp snap-back.

So how do you handle it? You see, this way of trading keeps you constantly on your toes and is very exhausting – and frustrating.

My way is to set price targets when you enter a trade and to take at least some profits when the target is reached. If the target is not hit then you stay with the trade until stopped out at BE (Break Even). Worst case: you have lost nothing. Another sensible way is to set trailing stops as the market moves in your direction.

To me, that is a relaxed way to trade and over time you will catch several trades that do hit their targets- and add to your account balance. Your losses along the way have been managed.

We had a good example of this in action last week when we had a Dow short with over 1,000 pips in profit. I advised members to take at least some profit – here is the action

Yes, a tidy trade and I am not embarrassed by not picking the Friday low! We did nail the high, though.

Crude oil is defying lower inflation expectations

Last week I laid out my case that oil prices had completed their major correction and were about to head strongly northwards. Here is the Brent chart I posted

At the $80 region, it has corrected by a Fib 50% and kissed my major trendline. If it held this support and failed to break below the kiss, then the odds were high that a major third wave was kicking off.

Brent closed yesterday at $88 – well above the $75 December low. Hmm.

Naturally, with most onboard with the ‘deflationary’ argument for this year as is being splashed around the MSM, this recovery in oil prices would put a crimp in this argument. But inflation data is heavily lagged and any increase in the numbers would only show up weeks/months hence. For now, I expect the official data to continue to show a drop-off in inflation numbers.

This focus on the short term has drawn most investors to embracing deflation – and is setting up the next crash as the data will defy that expectation and signal more inflation.

And on Wednesday the Fed meets to stir things up again. Will they or won’t they?