Background

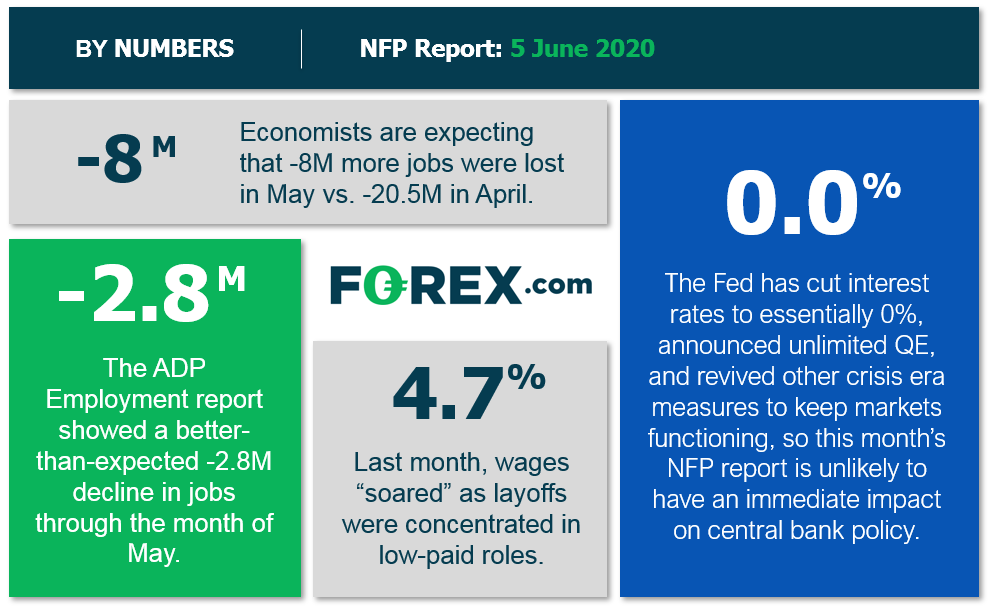

Last month’s highly-anticipated Non-Farm Payrolls report was clearly catastrophic, albeit not quite as horrible as many economists had feared. Beyond the shocking headline drop of -20.5M jobs, the report had a bizarre quirk: average hourly earnings actually rose 4.7%, the biggest single month spike on record.

Why did we see a record increase in wages for US workers in the midst of an unprecedented disruption to the labor market?

To put it simply, we didn’t. Rather, the widely-quoted average hourly earnings figure reflects only Americans who actually had earnings during the month, which were tilted toward the higher-paid, “white collar”, knowledge workers that were not among the initial wave of mostly lower-paid, “blue collar” workers who got laid off from the hospitality, travel, and restaurant industries.

Therein lies the big question for this month’s NFP report: Will the corporate layoffs extend to higher-paid “white collar” workers? These types of workers tend to be in more specialized roles that take longer to find positions (compare a laid off CFO to, say, a waiter or hotel maid) and are less likely to see their incomes replaced by unemployment insurance in any event, leading to a potentially larger, longer-lasting hit to the US labor market.

NFP Forecast

As regular readers know, there are four historically reliable leading indicators that we watch to help handicap each month’s NFP report:

- The ISM Non-Manufacturing PMI Employment component ticked up to 31.8, up from last month’s 30.0 reading, but still signaling a steep decline in employment.

- The ISM Manufacturing PMI Employment component also edged up, in this case to 32.1 in May from just 27.5 in April.

- The ADP (NASDAQ:ADP) Employment report printed at “just” -2.76M jobs, far better than last month’s revised -19.557M reading.

- The 4-week moving average of initial unemployment claims dipped to 2.28M, down from last month’s reading and more in-line with the figures we saw back in March.

In other words, the leading employment indicators remained at historically subdued levels through the month of May, suggesting that another abysmal NFP report is on tap, albeit likely not as abysmal as last month’s reading. Needless to say, traders should take any forward-looking economic estimates with a massive grain of salt given the truly unparalleled global economic disruption as a result of COVID-19’s spread. That said, weighing the data and our internal models, the leading indicators point to a better-than-expected reading from the May NFP report, with headline job growth potentially declining by “just” -5.5M jobs, though with a bigger band of uncertainty than ever given the current state of affairs

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As we noted above, the composition of the job losses (reflected in the average hourly earnings figure) will likely be even more important than the headline reading itself, especially if we see evidence of increasing job losses in the managerial ranks.

Potential Market Reaction

See wage and job growth scenarios, along with the potential reaction for the U.S. dollar below:

|

|

Earnings |

Earnings 0.5%-1.5% |

Earnings > 1.5% |

|

|

Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

-6M-10M jobs |

Slightly Bearish USD |

Slightly Bullish USD |

Bullish USD |

|

> -6M jobs |

Neutral USD |

Bullish USD |

Bullish USD |

In the event the jobs and the wage data beat expectations, FX traders may conclude that the US economy has put the worst of the COVID-19 economic disruption behind it. In that scenario, it may make sense for readers to sell EUR/USD, which is overbought after an impressive rally over the last two weeks. Meanwhile, a weaker-than-anticipated NFP reading could create a sell opportunity in USD/CHF, which is currently probing support at the multi-month lows in the upper-0.9500s.