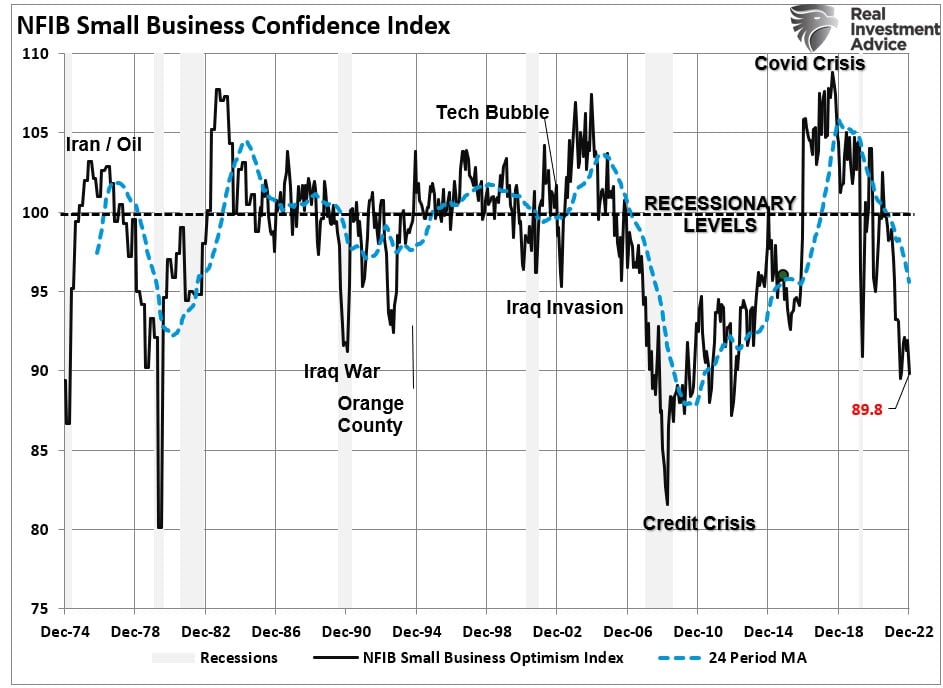

The most recent NFIB (National Federation Of Independent Business) survey is sending a strong signal of an economic recession. In 2019, the NFIB survey, combined with an inverted yield curve, suggested an impending recession. In 2020, those signals became a reality.

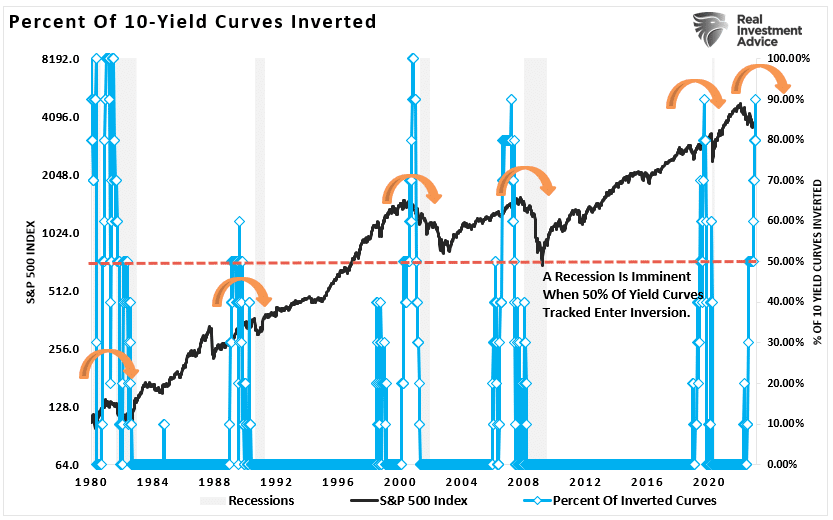

As in 2019, we see many of the same warning signals from the NFIB survey again combined with a high percentage of yield curve inversions. Notably, out of the ten yield spreads we track, which are the most sensitive to economic outcomes, 90% are inverted.

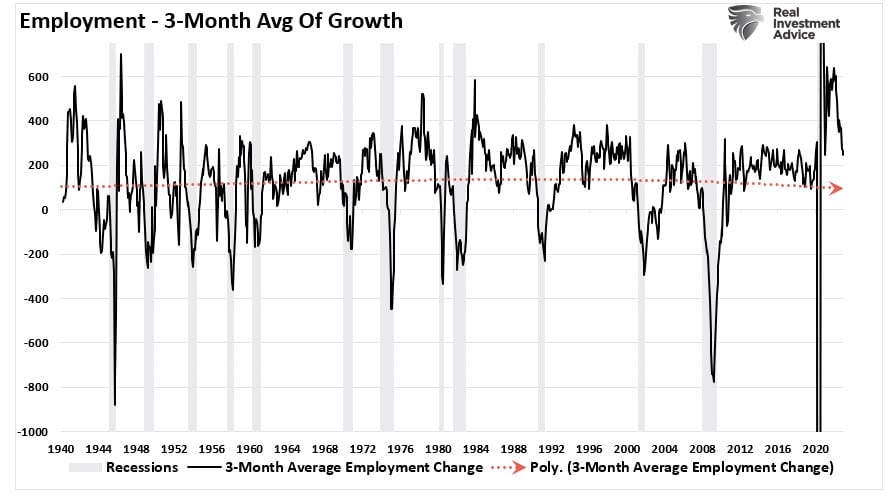

A surge of analysis suggests the economy may have a soft landing, or rather, avoid a recession, due to the solid monthly employment reports. It is worth noting that while those employment reports remain strong, we should consider the rapid decline in growth. As we have stated previously, the trend of the data is far more important than the monthly number.

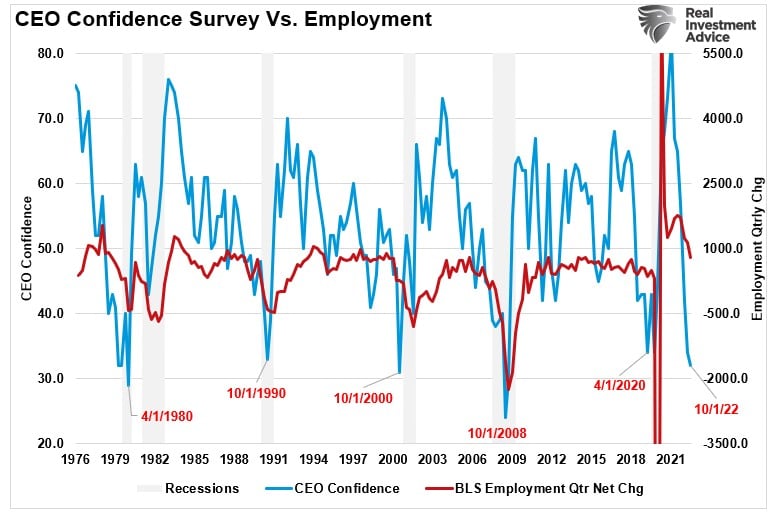

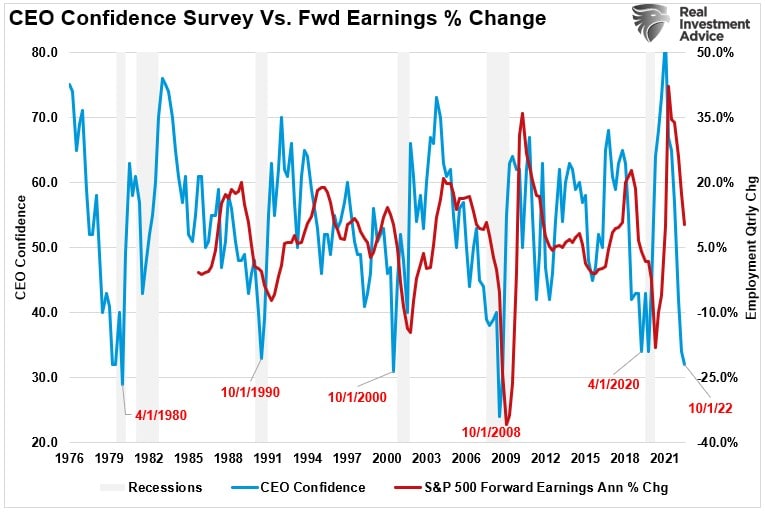

The rapid decline in the 3-month average of employment growth coincides with a drastic drop in CEO confidence, suggesting that unemployment will continue to rise as the year progresses.

These recession warning bells get further confirmation from the NFIB survey, which posted a sharp drop in December. Since small businesses employ roughly 50% of the working population, the survey can tell us much about the state of the economy versus the data from Government sources.

Non-Confidence

In December, the survey declined to 89.8 from 91.9 in November. While that may not sound like much, it is where the deterioration occurred that is most important.

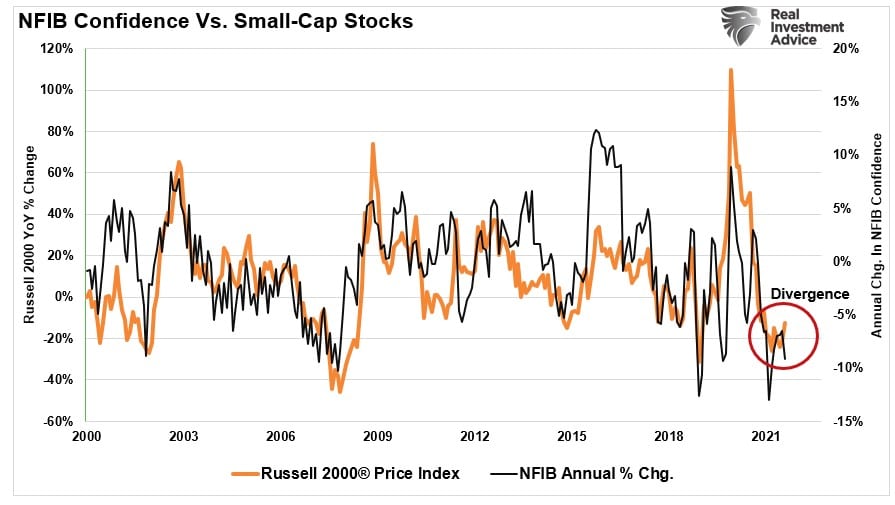

It is also important to note that small business confidence is highly correlated to changes in, not surprisingly, small-capitalization stocks. The deviation between small-cap stocks and the NFIB survey will eventually close; the only question is in which direction.

The stock market, and the NFIB report, confirm recession risk is rising. As noted by the NFIB:

“Overall, owners are not optimistic about 2023, sales and business conditions are expected to deteriorate. Owners will focus on their businesses, and do their best to deal with the fallout from all of the uncertainties in a year of slow growth and still-persistent inflation.“

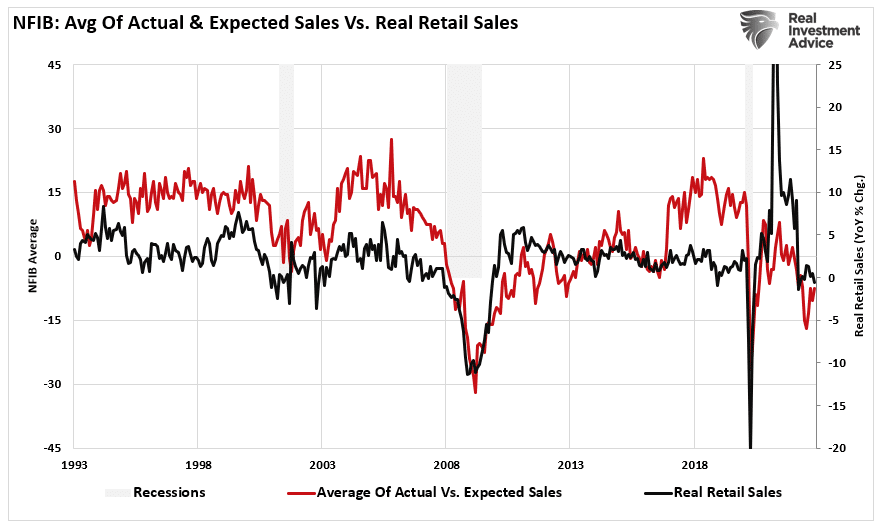

Such see this in the average of expected sales over the next quarter and actual sales over the last quarter versus retail sales. We will likely continue to see weakness in the consumer over the coming months. That slowing of demand has consequences.

The process of “dealing with the fallout” includes actions to mitigate risks imposed on businesses from slower economic demand. Such includes layoffs and terminations, wage cuts, inventory reduction, and reduced capital expenditures. The CEO confidence index highly correlates with earnings, suggesting further defensive corporate actions.

Before we dig into the details, let me remind you this is a “sentiment” based survey. Such is a crucial concept to understand.

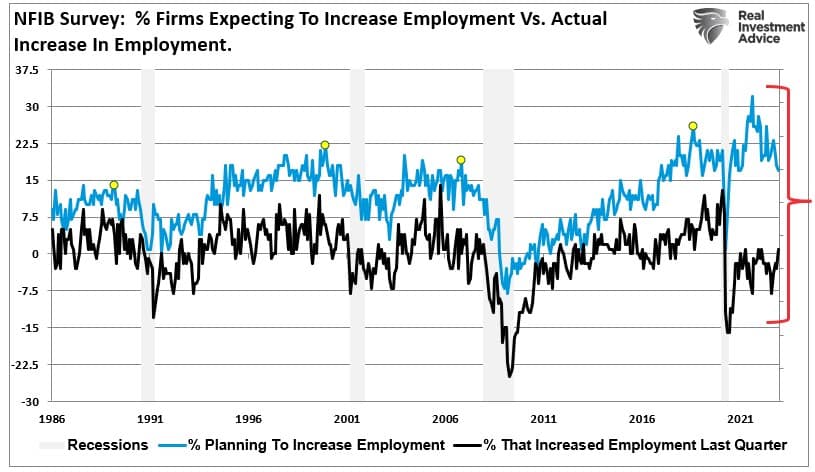

“Planning” to do something is a far different factor than actually “doing” it.

For example, the survey stated that 17% of business owners are “planning” to increase employment in the next few months. That sounds positive until you look at the trend, which is negative. Furthermore, there is a massive gap between those “plans” and what occurred. Such is one of the many problems with the “job openings” data reported each month. Just because they have a job opening does NOT mean they will fill it.

Since business owners are sensitive to economic risk, the rise in NON-Confidence in the NFIB survey suggests that more defensive actions are probable in the months ahead. Such is particularly evident when it comes to the overall economic outlook.

Sentiment Going Negative

Notably, the NFIB is a “sentiment” based survey like many surveys. Such is a crucial concept to understand. As noted, the risk of investing based on improving expectations is problematic as reality can be far different.

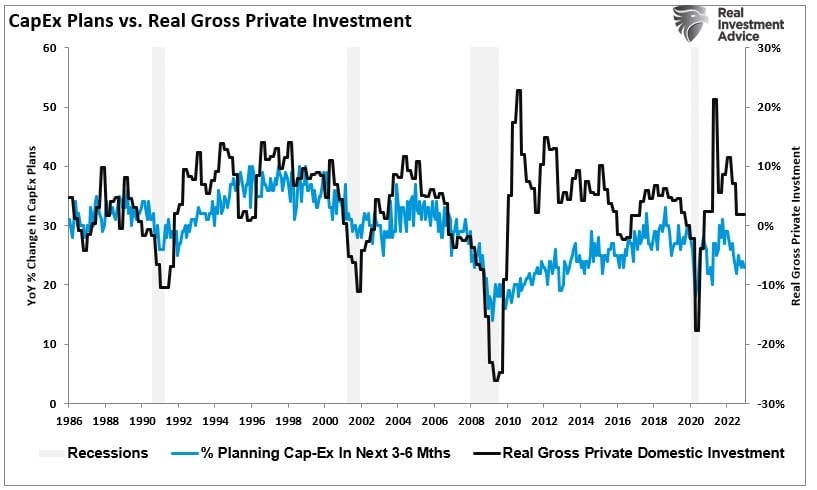

Another good example is capital expenditure plans. “Business investment” is a crucial component of the GDP calculation. Small business “plans” to make capital expenditures, which drive economic growth, correlate highly with Real Gross Private Investment. There are two critical points in the chart below.

- CapEx plans continue to erode after each recession.

- The current decline in CapEx plans is approaching the lows of the economic shutdown and recession.

As I stated above, “expectations” are very fragile. The “uncertainty” arising from inflation, Russia/Ukraine war, and tighter monetary policy continues to weigh on business owners. As noted in the survey:

“Owners continue to call inflation their top business problem, lamenting the cost increases for their inputs (inventory, supplies, labor, energy, etc.) which compel them to raise their selling prices to cover the costs.

The negative impact of the dramatic increase in interest rates has not been fully felt, and more rate hikes are almost certain early in the year.”

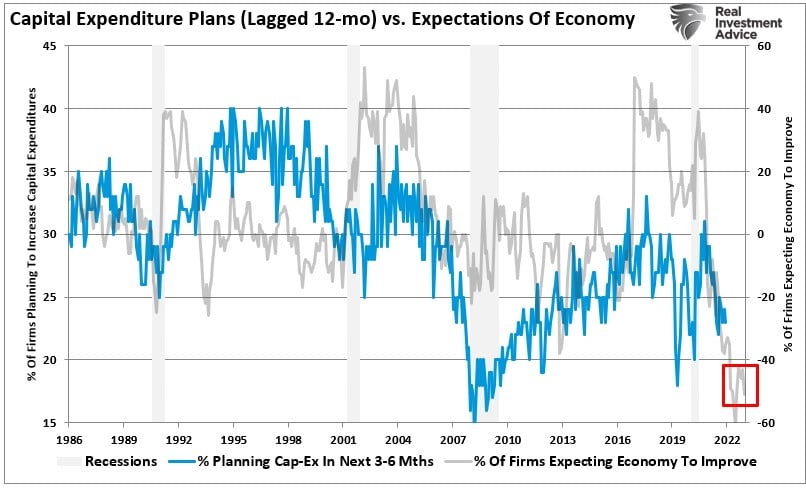

Despite the rash of analysis suggesting a soft landing scenario for the economy this year, the NFIB survey does not share that sentiment. As noted, the linkage between the economic outlook and CapEx plans confirms that business owners are concerned about committing capital in an uncertain environment. While the most recent survey showed hope about the “economy,” they remain unwilling to “bet” their capital on it.

Not surprisingly, there is a high correlation between capital expenditure plans and economic outlooks. Since business owners are the “boots on the ground” for the economy, their perspective tends to be a very accurate leading indicator. Notably, their current outlook does not support the idea of avoiding a recession in 2023.

Don’t Ignore The Data

We again see many of the early warning signs of an economic downturn. While such doesn’t guarantee a recession, it does suggest the risks of an economic downturn are markedly higher.

As noted above, in 2007, the market warned of a recession 14 months before the recognition.

In 2019, it was just 5-months.

No one knows the timing of the recognition of the next recession. However, with economic growth slowing, the Fed still hiking rates, and inflation weighing on consumers, a “soft landing” seems overly optimistic.

The last time the NFIB Signals were this weak, the Government started sending checks to households, and the Fed introduced $120 billion in monthly “QE.” Furthermore, Treasury bond rates fell to 0.5% as the Fed scrambled to buy junk bond ETFs.

No two recessions are ever the same. However, if the economy does falter, and companies continue to take more defensive actions to offset the risk of the decline, it is difficult to fathom how stock market prices avoid repricing lower to accommodate for falling earnings.