- Netflix's third-quarter 2023 results will be announced on Wednesday after the stock market closes

- The company has implemented a policy prohibiting the sharing of accounts outside the household

- Will that reflect in the earnings, making the stock correction a buying opportunity?

The global entertainment landscape has undergone a transformative shift with the rise of streaming platforms, effectively eclipsing traditional media such as television. Leading this digital revolution is Netflix (NASDAQ:NFLX), providing audiences access to an extensive library of movies and series for a modest subscription fee.

As we approach Wednesday, expectations are running high for the release of Netflix's third-quarter results, a key event in light of the platform's recent policy shift regarding password sharing.

Introduced in May of this year, this change aimed to curb the unauthorized sharing of accounts and appears to be having the desired effect, as user numbers continue to grow – a change that is poised to manifest itself in the forthcoming third-quarter figures.

Yet, intriguingly, despite Netflix's robust user growth, its stock has been navigating a broad correction phase, prompting speculation that the conclusion of this adjustment may yield results exceeding current forecasts.

In the lead-up to the results, all eyes are on Netflix's projected earnings per share, which currently stand at an estimated $3.48, alongside revenues totaling $8.53 billion.

Notably, the forecast has experienced a remarkable 24 upward revisions, with only 3 instances of downward revision, indicating a high level of market anticipation.

Source: InvestingPro

It should be noted that since October last year, we can see a clear upward trend in earnings per share, which corresponded with the share price rising to the vicinity of $485 at its peak in July.

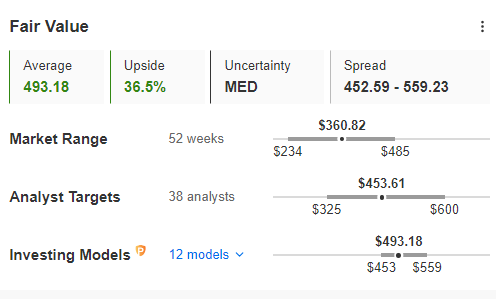

The fair value upside target remains at just over 36%, which translates into the possibility of breaking out to new highs this year.

Source: InvestingPro

However, there is a lack of signals from the chart in the form of a strong demand impulse that would generate an upward technical formation, which may not happen until Thursday.

New User Growth Set to Accelerate

Netflix's pivotal move to enact new account-sharing rules this May ignited widespread curiosity about how these changes might affect the trajectory of new user growth. The initial months provided compelling validation for this decision, with the second quarter witnessing a substantial surge of 5.9 million new subscribers, doubling the previous forecasts.

Unsurprisingly, this robust influx significantly bolstered revenues on a global scale. An optimistic tone was struck by Greg Peters, one of Netflix's executives, who emphasized the likelihood of this positive trend persisting for several more quarters.

It's worth noting that the ability to share accounts beyond a single household is still available, albeit at an additional cost of $7.99 per month in the US. Meanwhile, discussions are gaining momentum regarding potential price adjustments for the ad-free package in the near future.

Technical View: Netflix Stock's Correction a Buying Opportunity?

Starting around mid-July, Netflix's stock prices began a southward trajectory, aligning with a broader correction across the US stock market. Presently, the selling pressure has approached the local support level situated in the price range around $350 per share. As of now, there hasn't been a distinct market response, and any potential movement might hinge on the revelation of third-quarter data, which will only emerge following Wednesday's session.

Source: InvestingPro

As the rebound scenario takes shape, buyers' primary objective will be to surpass the key level of $400 per share, potentially paving the way for another assessment of the region around $480. However, if buyers cannot maintain the tested support, there is a possibility of a descent towards the $300 range, contingent on significant disappointment in the disclosed data. Nonetheless, this outcome appears less probable at the moment.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered investment advice.