Last Week’s Observations

Natural gas futures hit a new low on Apr. 5 after a steep slide on the announcement of a meager weekly withdrawal, which makes the storage 32% higher than a year ago and almost 20% up from the five-year average, according to EIA reports.

Overall movements of the natural gas prices look extremely bearish, despite a surge in natural gas exports continuing to increase from the Freeport LNG terminal.

On the other hand, Lower-48 state dry gas production also rose to 101.4 bcf (+6.0% y/y) last Thursday.

Moreover, on Wednesday, the U.S. Environmental Protection Agency said it is proposing tighter standards for mercury and other toxic emissions from coal plants for the first time in a decade.

Natural gas started this week with a bearish note with a gap-down opening and hit a low at $2.019, and continued to trade in a tight range.

Since I wrote my analysis, futures are constantly trying to test the psychological support at $2, and have found significant buying support below this level.

Now, hopes for positive developments on the front Russia-Ukraine war that was a hurdle for the free flow of natural gas amid worsening international relations between the superpowers, especially at a time when the whole world is struggling to control inflationary pressure, could raise the probability of free flow of U.S. natural gas to China and Europe.

Russia would prefer to concentrate on reconstruction activities, instead of supplying cheap natural gas and oil, after massive destruction in the last year due to its war with Ukraine.

Technically speaking, in the daily chart, futures could remain in a tight trading range for some time as the significant support is at $2, and the immediate resistance is at $3 till the focus tilts towards the summer demand in June 2023.

In the 1-Hour chart, the futures look ready to see a reversal on Friday and could try to sustain above the immediate resistance at $2.448 after holding above the 18 DMA, which is at $2.101.

In the 15-Minute chart, futures could see a reversal soon after a bullish crossover formation, which is about to be completed shortly.

This Week’s Observations

Natural gas futures started the week at the same levels where they closed the last week, followed by a monster move on Monday amid growing fresh bullish sentiments.

The changing geopolitical situation will take a little more time to be fully normalized, but growing hopes for a favorable scenario for a steep surge in demand is likely to be felt in natural gas prices - which could push futures to remain above the next psychological resistance/support at $3.

Let me explain: when I say a particular level of resistance or support, it means if prices trade below a specific level it works as a significant resistance, whereas, if it crosses this resistance with a sustainable move, it turns into psychological support.

Technically speaking, in the weekly chart, movements by natural gas futures have increased the visibility of this week’s candle after a bumpy move of approx. 10%, indicating renewed strength among the bulls.

A sustainable move above the 9 DMA, which is at $2.345, will continue this bullish move up to the next resistance at 18 DMA, which is at $3.089.

In the daily chart, the futures are holding above the 9 DMA at $2.114, indicating an attempt very soon to cross the next resistance at 18 DMA, which is at $2.221. Undoubtedly, if futures sustain above this resistance on Tuesday, it could generate one more eruptive move.

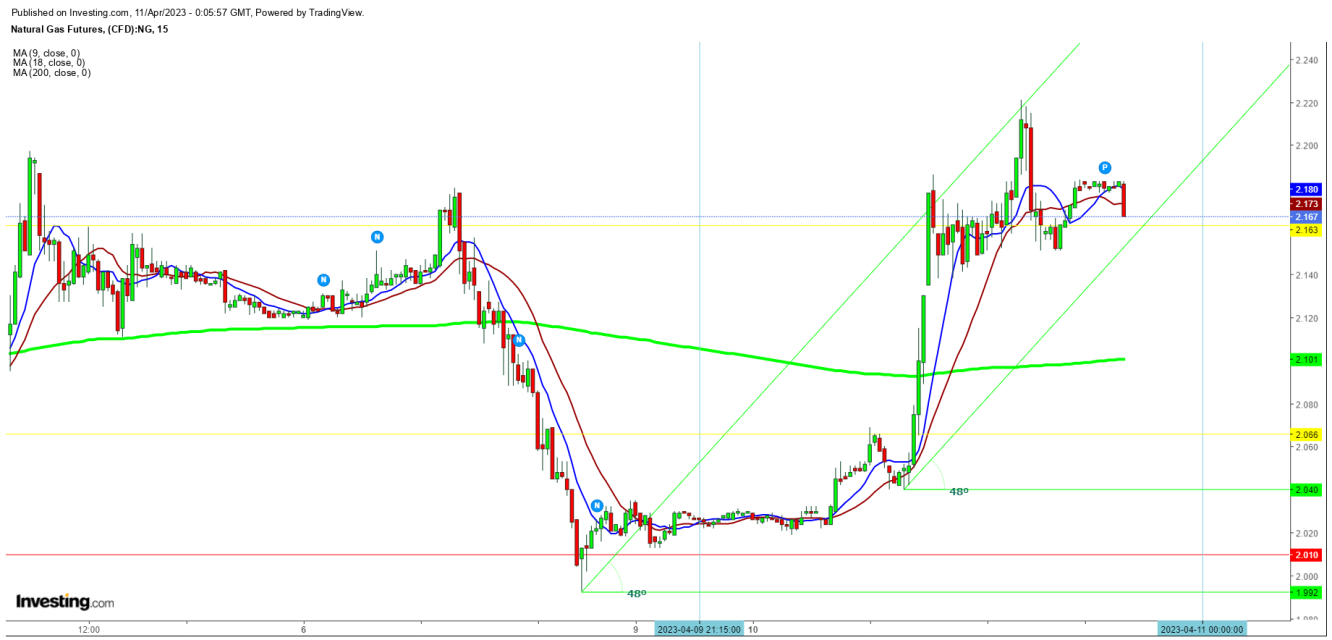

In the hourly chart, futures are trying to hold above the 200 DMA despite a surge in selling pressure, but a breakout above $2.222 will be the first signal for another bullish attempt on Tuesday.

In the 15-Minutes Chart, if the futures hold above the immediate support at $2.163 for a while, a short-covering rally will follow on Tuesday as it will find buying support in case of any downward move below the 200 DMA, which is at $2.123.

Disclaimer: The author of this analysis does not have any position in natural gas futures. Readers should take a trading position at their own risk, as natural gas is one of the most liquid commodities in the world.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI