Nabaltec's (DE:NTGG) H121 results show that the recovery that commenced in Q420 has been sustained. Revenues were only 2% behind pre-pandemic levels in Q221, resulting in a record EBIT margin. Management has raised FY21 guidance. Performance at the upper end could potentially result in record revenues this year. Guidance is supported by strong demand for boehmite, which is used in electric vehicle (EV) batteries, as management expects its sales of this material (10% of FY20 sales) to jump by around 50% in FY21.

Strong H121 recovery

The recovery observed in Q420 and Q121 continued throughout Q221. As a result, group revenues rose by 14.8% year-on-year during H121 to €93.9m, with sales in the Functional Fillers segment growing by 13.5% to €65.6m and revenues in the Specialty Alumina segment increasing by 18.3% to €28.4m. EBIT (including exceptional costs) increased by €8.4m year-on-year to €10.5m, giving an EBIT margin (as a percentage of total performance) of 11.3%.

Management raises FY21 guidance

While incoming orders still tend to be short-term in nature, reflecting continued uncertainty in the market, management is confident about the future. Based on the assumption of strong economic and industry performance, in July management raised guidance to 11–14% revenue growth with an EBIT margin of 10–12%.

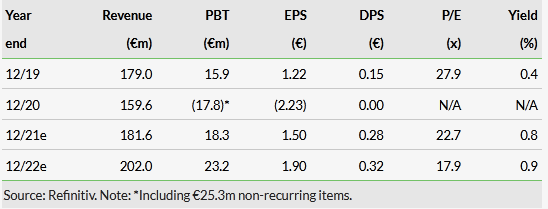

Valuation: Trading at a discount to peers

At current levels, the shares are trading on prospective consensus multiples that are lower than the respective means of our sample of European chemical companies on all metrics (eg year 1 EV/EBITDA of 9.6x versus 12.7x). This seems undeserved given that consensus estimates show Nabaltec growing at a faster rate than the sample mean over the next three years. The combination of lower than average multiples and higher than average growth indicates there is potential for share price appreciation once there is greater visibility on the group’s pace of recovery in the United States and on its ability to continue to grow boehmite revenues.

Consensus estimates

Share price graph

Bull

- Demand for boehmite boosted by growth in EVs.

- Demand for halogen-free flame retardants driven by safety of people, property and environment.

- Established customer-base in the United States supports recovery in region.

Bear

- Naprotec product approvals further delayed in FY21.

- Demand for speciality alumina dependent on health of global steel industry.

- Low free float.

The recovery observed in Q420 and Q121 continued throughout Q221. As a result, group revenues rose by 14.8% year-on-year during H121 to €93.9m, with sales in the Functional Fillers segment growing by 13.5% to €65.6m and revenues in the Specialty Alumina segment increasing by 18.3% to €28.4m. Q221 revenues were only 2% behind Q219 levels (€47.9m versus €49.0m). Exports as a proportion of total sales increased slightly, from 74.0% of total sales to 74.4%.

The cost of materials as a percentage of total performance (revenues adjusted for change in inventories and own work capitalised) increased from 47.4% to 48.3%, reflecting €1.3m of exceptional costs related to a hike in energy prices following the February snowfall in Texas. Personnel expenses were only €0.3m higher year-on-year as the reduction in the number of employees following cost-cutting measures introduced in April 2020 was offset by a return to working normal hours during Q121. Other operating expenses increased by only €0.2m, attributable to higher freight costs. Depreciation fell by €1.4m to €6.3m because of a substantial write-down in the value of property, plant and equipment at the Nashtec site in the United States during FY20 (see below). EBIT (including exceptional costs) increased by €8.4m year-on-year to €10.5m in H121, giving an EBIT margin (as a percentage of total performance) of 11.3% (12.7% stripping out exceptional costs). The Q221 EBIT margin was a company record at 13.5%.

Strong cash flow

Net debt decreased by €16.6m during H121 to €16.5m. Capital expenditure (capex) was €3.4m, which was half the previous year’s level when there was investment in the completion of the Naprotec facility in the United States and expansion of boehmite production in Germany. The low H121 capex, which was substantially lower than depreciation, reflects management’s caution regards investment at present. It noted that capex this year will be less than €10m while flagging the potential for greater investment in capacity, particularly in boehmite production, in FY22. Cash generated from operations (€20.4m in H121 versus €13.7m in H120 after deducting tax) benefited from an €5.8m reduction in working capital, primarily the result of higher trade payables and to a lesser extent a reduction in inventory. We note that the company started to build up inventories of work in progress and finished goods during Q221, having reduced levels during the pandemic.

While incoming orders still tend to be short-term in nature, reflecting continued uncertainty in the market, management is confident about the future. Based on the assumption of strong economic and industry performance, in July management raised guidance given in February of 6–9% revenue growth during FY21 with an EBIT margin of 8–10% to 11–14% revenue growth with an EBIT margin of 10–12%. We note that performance at the upper end of current guidance would result in record revenues this year.

Examining the different elements informing this guidance, we note that the company is already working close to capacity for Functional Fillers products at its site in Germany and brought additional capacity online in Q221 for making reactive aluminium oxides, which are part of the Specialty Alumina segment. The situation is different in the United States. Utilisation of the Nashtec site, which manufactures non-halogenated, flame-retardant fillers, had reached around 70% of installed capacity by March 2020 but utilisation subsequently fell below 50% because of the adverse impact the pandemic had on sales. Management notes that production here has now stabilised at a ‘solid’ level, supported by an established customer-base. This follows a substantial write-down in the value of property, plant and equipment at the site in FY20 since management expected that it would take longer for revenues attributable to the Nashtec site to recover fully compared with the German operations because a higher proportion of sales in the United States are attributable to the automotive industry. Production at the new Naprotec production facility for refined hydroxides at Chattanooga was starting to ramp up in March 2020 so that work could commence on gaining customer approvals. However, customer qualifications have taken substantially longer than usual. Initially this was because of travel restrictions imposed in response to the pandemic. Now it is because potential customers are focused on addressing raw material supply issues, making the qualification of new flame retardant materials a low priority.

Boehmite for EVs a key growth driver

Looking beyond the current return to normality, we expect that demand will be driven by increasing adoption of boehmite. This material is used as a separator coating in lithium-ion batteries. Demand for boehmite is growing quickly, driven by increasing adoption of EVs (see our report EV Outlook#2 – Driving better performance from EV batteries). The transition to EVs is expected to continue. A report issued by Meticulous Research in May 2021 predicted that the global EV market will reach 233.9m units by 2027, growing at a CAGR of 21.7% during the forecast period of 2020 to 2027. Boehmite sales accounted for €16.0m (10%) of Nabaltec’s revenues in FY20. Management expects sales of the material to jump by around 50% this year, following a 48% rise in FY20. Sales are still primarily to customers in South Korea, Japan and China. However, in early FY21 Nabaltec made its first sales to a European customer of boehmite for separator coatings. This activity is small-scale at present, but management hopes it will increase significantly as proposed European gigafactories come on-line.

Valuation

Edison Investment Research provides qualitative research coverage on companies in the Deutsche Börse Scale segment in accordance with section 36 subsection 3 of the General Terms and Conditions of Deutsche Börse AG for the Regulated Unofficial Market (Freiverkehr) on Frankfurter Wertpapierbörse (as of 1 March 2017). Two to three research reports will be produced per year. Research reports do not contain Edison analyst financial forecasts.

Click on the PDF below to read the full report: