Molten Ventures has already surpassed its £100m realisation target for FY25 (ending March 2025) with exits from Perkbox, Endomag, Graphcore and M-Files, which in aggregate represent £124m in exit proceeds. Consequently, Molten launched a £10m buyback programme in July 2024. All these transactions were agreed at or slightly above the previous carrying values. Molten’s H125 results will likely benefit from Revolut’s recent secondary sale, which values the fintech at US$45bn compared with US$33bn during the previous funding round in July 2021. Finally, several of Molten’s core holdings raised capital this year, providing additional validation points for Molten’s H125 carrying values.

European VC an attractive way to gain tech exposure

Despite the recent weakness in deal activity, we consider European venture capital (VC) as a compelling route to gain exposure to the European tech sector, especially given the limited options in European public markets, the fact that companies are staying private for longer and superior historical VC returns versus public markets. Furthermore, we note several government initiatives across Europe aimed at supporting the development of an innovative tech ecosystem, such as the UK’s Science and Technology Framework (launched in March 2023), the Mansion House reforms (unveiled in July 2023) and Germany’s €1bn VC start-up growth fund of funds, launched in November 2023, with the federal government and development bank KfW as anchor investors.

Why consider Molten Ventures now?

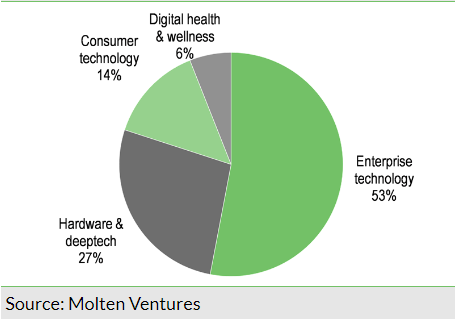

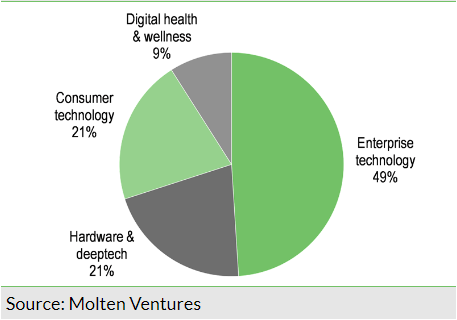

As a well-established listed VC player in Europe, Molten Ventures PLC (LON:GROW) provides exposure to a diverse portfolio of private high-growth technology companies across enterprise software, hardware and deeptech, and digital health and wellness, which are otherwise hard to access. Molten seized exit opportunities arising from the gradually stabilising European VC environment. Coupled with Molten’s new credit facility and holding-level cash and equivalents, this provides it with a good balance sheet position for further investments. Molten’s shares now trade at a discount of c 38% to the end-FY24 NAV of 662p per share.

- NOT INTENDED FOR PERSONS IN THE EEA

Four exits yielding £124m in realisation proceeds

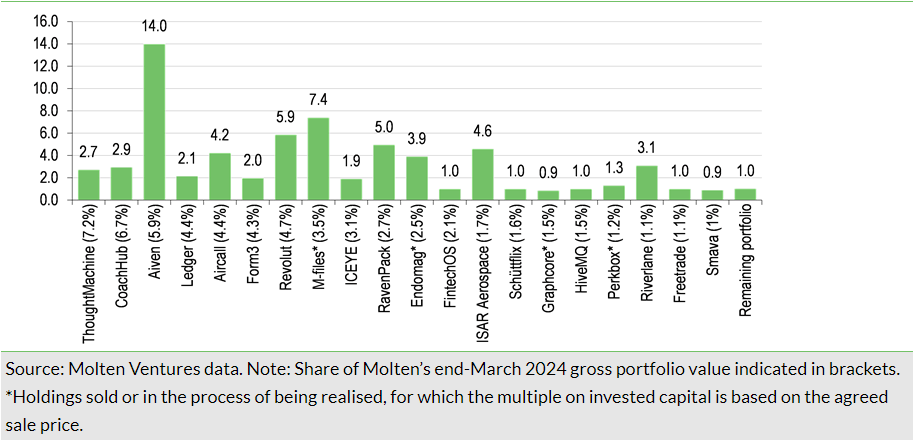

Molten has made significant progress on the realisation front, with completed exits from Perkbox, Endomag and Graphcore and the agreed exit of M-Files, which represent realisation proceeds of around £124m or 9% of Molten’s end-March 2024 gross portfolio value (close to management’s through-the-cycle target of 10% per year). We consider it a strong result in the context of the still subdued exit value across the broader European VC market of €4.1bn in H124 (excluding the Puig public listing), down 39% y-o-y and 79% below the 2019–23 average first-half activity, according to PitchBook data. Molten’s most recent exit is the full realisation of M-Files (a provider of generative AI-powered intelligent informational management and knowledge work automation solutions) through a majority recapitalisation investment led by two private equity firms – US tech-focused Haveli Investments and European software-focused Bregal Milestone. The deal is expected to close in Q424.

Both Endomag and Perkbox were sold at a modest uplift to their last carrying values at end March 2024, implying multiples on invested capital (MOICs) of c 3.9x (quite a healthy return since the initial investment in 2018) and c 1.3x (a rather moderate but nevertheless positive return). Graphcore, a machine-learning semiconductor company, was sold to SoftBank for a price in line with its end-March 2024 carrying value, resulting in a 0.9x MOIC. The loss on this investment was limited by the downside protection embedded in Molten’s preference shares. Finally, The M-Files exit values Molten’s stake (subject to minor adjustments) at £47.7m, in line with the end-March 2024 carrying value, and translates into a healthy 7.4x MOIC since Molten first invested in the business in 2013.

Proceeds from these realisations, coupled with Molten’s new £180m three-year debt facility (upsized from £150m previously) and holding-level cash and equivalents (£57m at end March 2024), should provide it with a good liquidity position to pursue further investments and execute share buybacks. Molten launched a £10m share repurchase programme on 26 July, in line with its recently updated capital allocation policy of earmarking at least 10% of realisation proceeds to buybacks.

Several further mature holdings in the core portfolio

We believe that Molten has several further core holdings, which so far have delivered an attractive, unrealised return and may therefore be ripe for an exit, for instance among Molten’s enterprise technology holdings, which made up 53% of its portfolio by fair value and 49% by count at end March 2024. In this context, we note that software-as-a-service has been one of the top VC verticals in recent years by deal value, was the top business vertical in terms of European VC exit activity in 2023 and ranked second in 2024 based on PitchBook data to end June 2024. Three of Molten’s enterprise tech holdings were already held at a MOIC well above 3x at end March 2024 and, combined, represented 13% of Molten’s gross portfolio value (see chart above):

- Aiven (held at 14.0x investment cost), a multi-cloud managed service provider for hosting and managing open-source databases and messaging-system solutions, which Molten classifies as an AI-first business.

- Aircall (4.2x), a cloud-based customer phone and communication platform for sales and support teams.

- RavenPack (5.0x), which provides AI-powered insights and technology for data-driven companies such as financial institutions (hedge funds, banks and asset managers).

That said, we note that Molten’s four key sectors (enterprise technology, consumer technology, hardware & deeptech and digital health & wellness) contributed one exit each to recent activity.

Revolut now valued at US$45bn vs US$33bn previously

Beyond enterprise tech, Molten’s core holdings that have so far delivered an attractive unrealised return include UK fintech Revolut (4.7% of end-March 2024 portfolio value) and ISAR Aerospace (1.7%), a developer and manufacturer of vehicles for satellite launch operations.

Molten’s portfolio update, released in August 2024, indicated that the recent secondary share sale announced by Revolut (which values the business at US$45bn vs US$33bn in the July 2021 funding round) implies a c £160m valuation of Molten’s stake, versus £65.1m at end March 2024 (when it was Molten’s seventh largest holding). This excludes any of Molten’s potential valuation adjustments. We note that Revolut recently achieved a major milestone as it obtained a UK banking licence, allowing it to directly hold deposits and in turn drive its lending business in the UK.

Molten had slightly increased its exposure to Revolut in February 2024 (which subsequently proved very timely, as discussed above) via the €8.5m secondary investment in a 19% stake in Seedcamp Fund III, a 2016 vintage fund with more than 80% of value held in six mature assets, which, apart from Revolut, include Pleo (enterprise software), Grover (technology rental), WeFox (insurtech), Thriva (healthcare tech) and Curve (payments technology). Revolut’s new valuation implies that Molten has to date achieved a MOIC of c 14.5x, which, all else being equal, would represent a c 7.6% increase in Molten’s end-March 2024 NAV. However, these figures will need to be adjusted for carried interest deductions, any potential valuation adjustments and corporate tax on capital gains of 25% in the H125 accounts (for the period end March to end September 2024). We believe that the Seedcamp Fund III investment, coupled with Revolut’s subsequent valuation uplift, shows that there may be attractive opportunities for Molten in the European secondary VC market not only in the discount to NAV at which the secondaries are acquired, but also in undemanding valuations embedded in the NAV of these secondaries.

We understand that Revolut is contemplating an IPO, although management indicated in July that the company is at least a year from listing. Similarly, the CEO of Thought Machine (Molten’s largest holding at end March 2024) recently suggested that an IPO is unlikely before 2027. While Molten’s recent realisation activity has been encouraging, we note that the scale of further exits may be conditional on a more meaningful recovery in the European VC market, which remains tepid for now, albeit some green shoots of recovery have been visible, for example in terms of VC deal value in Q224 and European IPOs.

Several core portfolio holdings raising capital in 2024

We note that several of Molten’s core portfolio holdings recently completed new funding rounds:

- CoachHub (6.7% of Molten’s end-March 2024 gross portfolio value), a global talent development platform, raised US$200m in a Series C round in January 2024.

- ICEYE (3.1%), a synthetic aperture radar satellite operator for earth observation, raised an oversubscribed US$93m growth funding round in April 2024.

- FintechOS (2.1%), an end-to-end financial product management platform, which grew its revenue and operating profit by 40% and 170% y-o-y in 2023, respectively, raised a US$60m Series B extension funding round in May 2024 led by Molten Ventures.

- Isar Aerospace closed a £220m Series C funding round in July 2024.

- RavenPack (3.0%), a big data analytics provider for hedge funds and banks, raised US$20m in July 2024 to launch its new AI platform Bigdata.com.

- Quantum computing company Riverlane (1.1%) successfully raised US$75m in a Series C round in August 2024, valuing Molten’s stake above the £15.8m end-March 2024 carrying value.

- Form3 (4.3%), a provider of a cloud-native, account-to-account payment platform, completed a US$60m Series C extension funding round in September 2024, which follows an investment from Visa (NYSE:V) announced in September 2023.

Overall, we calculate that 68% of Molten’s core holdings by value at end March 2024 have now either been sold (in line or slightly above the last carrying value) or completed a funding round or secondary sale in 2023 or 2024, providing further validation points for their interim carrying values (due to be reported in the fourth quarter of 2024) based on recent market activity. Moreover, Molten is extensively using market comparables, primarily revenue multiples, to value its holdings that have not completed a funding round recently (57% of Molten’s end-March 2024 holdings were valued based on peer multiples). This emphasis on updating portfolio carrying values is important given that valuations of late-stage (ie more mature) investments across the VC markets were more vulnerable in 2022/23 and as there was recently an uptick in down rounds across the European VC market. That said, we also note that pre-money valuations of late-stage and venture growth ecosystems in Europe showed in aggregate only small declines in H124 (according to PitchBook) and Molten saw a stabilisation and recovery in portfolio valuations in the six months to end March 2024, as discussed in our previous note.

______________________________________

General disclaimer and copyright

This report has been commissioned by Molten Ventures and prepared and issued by Edison, in consideration of a fee payable by Molten Ventures. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom