Mirriad Advertising PLC (LON:MIRI) is shifting up a gear, with its AI-driven, in-content advertising gaining credibility with brands, agencies and platforms, helped by December’s £26m fund raise. A Tier 1 global content platform signed up in Q420 (subject to an NDA) and in June, Tencent (HK:0700) upgraded to a full commercial contract. A major global food and beverage company has been working with Mirriad to insert assets into content and has extended the co-operation. The offering is being positioned as an integral element of marketing budgets, with the additional prospect of ad insertion into live TV. We initiate forecasts showing scaling revenues and reducing EBITDA loss.

Share price performance

Business description

Mirriad generates new revenue for content producers and distributors by creating new advertising inventory in content. Its patented, AI and computer vision technology dynamically inserts products and innovative signage formats after content is produced. Its market-first solution seamlessly integrates with existing subscription and advertising models, and dramatically improves the viewer experience by limiting commercial interruptions. Mirriad operates in the US, Europe and China.

Activating the buyers

With the ever-growing challenges of reaching ad-avoiding audiences and with third-party cookies being withdrawn from FY23, brand owners are looking for more innovative solutions to engage with their target audiences. To take full advantage, Mirriad needs to integrate with a programmatic advertising ecosystem. Good progress is being made but there remain some elements to be added internally, via M&A or partnerships. Identification and monetisation of ad inventory (the ‘space’ where a product or ad can be appropriately inserted) must be seamless, scalable, and readily compatible with agencies’ working practices, especially for live (or near-live) content. Mirriad’s initial commercial breakthrough with Tencent provided proof of concept and copious efficacy data on core industry KPIs of brand recognition and purchase consideration. Broaching the US market is key and signing a global Tier 1 entertainment company looks to have been the bridgehead. The recent framework agreement with a major global food and beverage company after successful proof-of-concept trials steps up commercial credibility. Adding music video and, in time, live TV and sports gives brands the ability to target by audience and mood.

Modelling of campaigns and revenue share

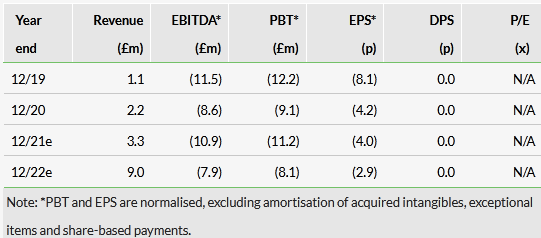

We are now initiating forecasts, modelling revenues on assumptions on numbers of campaigns, campaign value and the proportion allocated to Mirriad under revenue-share arrangements, but caution that this stacking of assumptions means a wide range of possible outcomes. December’s £26.2m gross fund raise has given the resource to meet management’s ambition on scaling up both technology and sales.

Valuation: Discounting good revenue growth

Traditional multiples are helpful given the limited visibility. A reverse DCF suggests the current share price is factoring in FY23–30 revenue CAGR of 31%, assuming EBITDA margins reach 25% for that period (WACC: 10%, 2% terminal growth).

Investment summary

Company description: Contextually relevant ad insertion

Mirriad has developed and, crucially, protected the technologies and methodologies to digitally insert advertisements and products into linear and digital content, post-production (as opposed to traditional product placement, which is done at the time of filming) protected by a series of patents. This enables brands to reach audiences at scale, through a medium that consumers have been shown to like and which studies have shown increases impact. The group’s new scene-selector capability allows for automated identification of inventory, informed by context both physical and emotional, which will allow agencies and advertisers to select the most advantageous opportunities for their insertions. While the focus to date has been mostly in film and TV, music video is a clear extension with great potential. The next stage is built around the opportunity in live events. Accelerating towards the programmatic opportunity, Mirriad has developed a platform to give its customers live, on-screen visibility of the content’s audience, demographic and geographic reach potential.

Click on the PDF below to read the full report