- Is China's economic stimulus sufficient to drive growth?

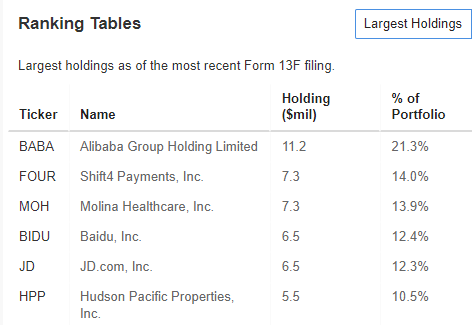

- A recent F13 report reveals that nearly half of Scion Asset Management's portfolio consists of Chinese companies

- Alibaba holds the largest share in the portfolio

- Are you looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Michael Burry is a well-known figure in financial markets, famous for accurately predicting the 2008 real estate market collapse, a story prominently featured in the movie The Big Short. As a result, investors closely monitor the market movements of Scion Asset Management through the mandatory F13 report.

Currently, Burry is making a strong bet on China, committing nearly 50% of his capital to companies within the country. The crown jewel of his investments is Alibaba (NYSE:BABA), in which he holds a 21.3% stake, with the InvestingPro index suggesting an upside potential of over 60%.

In recent weeks, the Chinese stock market has experienced robust growth, as evidenced by the iShares MSCI China ETF (NASDAQ:MCHI), which has gained more than 27% over the past month.

Source: InvestingPro

Stimulus Packages and Market Corrections

All thanks to the announced stimulus package aimed at addressing challenges in achieving the 5% y/y economic growth target, with the World Bank forecasting a more modest 4.8% y/y.

However, the recent market correction indicates that the current measures, primarily an interest rate cut expected to free up $142 billion in borrowing capacity, may not suffice.

Nevertheless, indications suggest that further actions from Beijing are on the horizon, with additional packages expected from the Finance Minister on October 12.

Chinese Companies With Huge Growth Potential

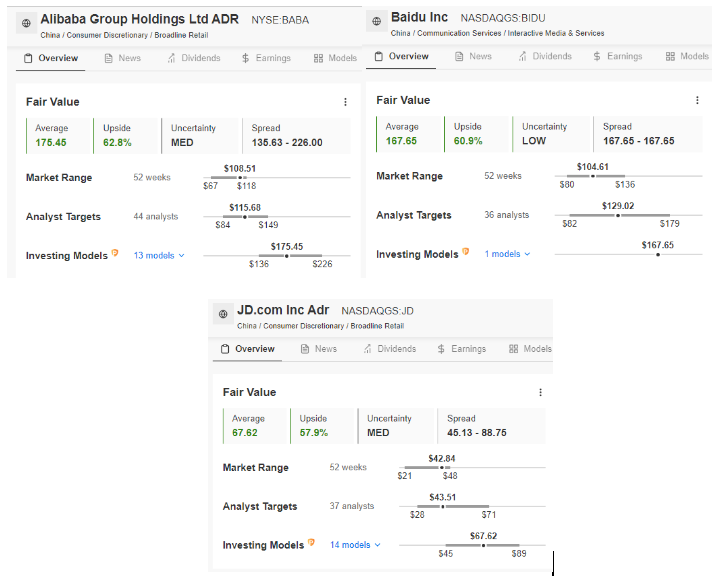

Among the six largest companies in Scion Asset Management's portfolio, three—Alibaba, Baidu (NASDAQ:BIDU), and JD.com (NASDAQ:JD)—are Chinese firms.

Source: InvestingPro

Considering their growth potential and financial health, there is considerable optimism surrounding these companies, with their fair value index potential hovering around 60%.

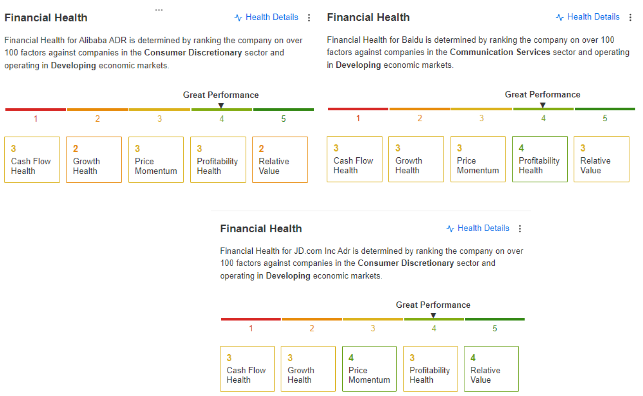

Source: InvestingPro

Fundamental Strength and Government Action

The fundamental outlook is equally strong, with the financial health index for these companies scoring 4 out of 5.

Source: InvestingPro

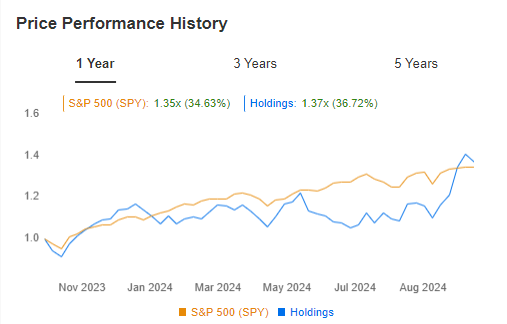

The underlying indicators reflect their strength, but the critical factor will be the Chinese government's next moves and the scale of its stimulus measures. If authorities remain determined, they could sustain the demand momentum initiated in the latter half of September on the Shanghai Stock Exchange. The portfolio's value, despite the recent correction, has outperformed the benchmark S&P 500 index for the first time since January.

Source: InvestingPro

Alibaba's Stock Performance

Given Alibaba's significant share in Burry's portfolio, it's essential to assess its current technical situation and growth potential. Following a dynamic bullish rally, the stock has slowed in a clearly marked supply zone near $120 per share.

Source: InvestingPro

A rebound is approaching a key support level around $102 per share; breaking this could push the price below the significant psychological barrier of $100. These levels are crucial for maintaining upward momentum, and a breakout could negate the overall bullish outlook. The primary resistance remains at $120, and surpassing this level would signal a continuation of demand-side dominance.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.