Meta is planning to acquire a stake in EssilorLuxottica, the world's largest eyewear manufacturer. This news comes just in time before the publication of the quarterly figures. The company will present the figures on Wednesday, 31 July 2024. Expectations are very high. The company was able to shine with very good figures in the last quarter. The same is expected this quarter.

Let's start with the chart analysis

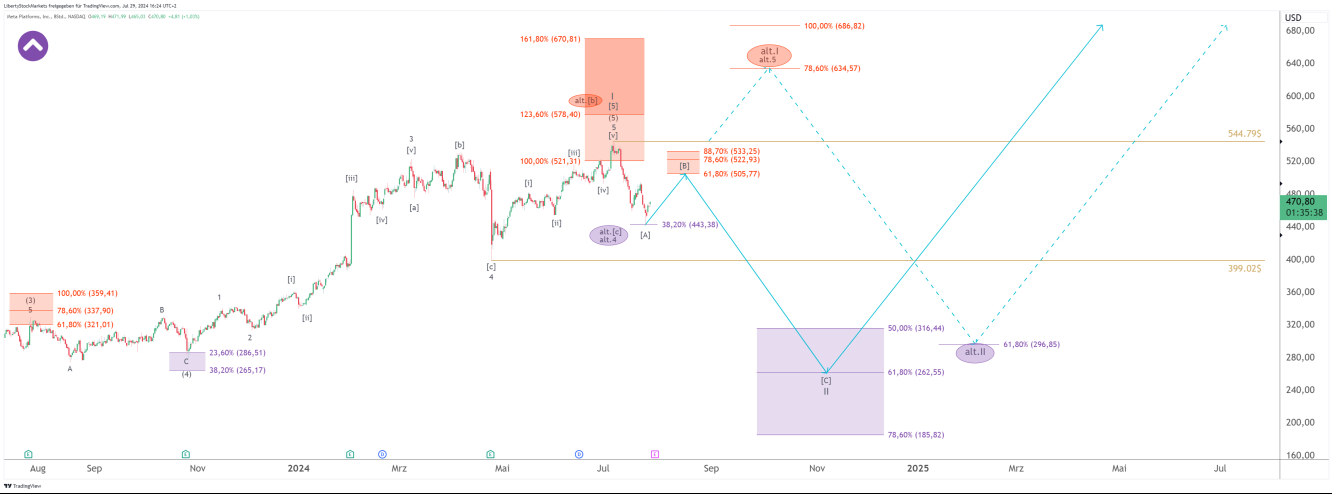

If the company can build on its recent successes and once again present very good figures, we can even imagine a final upward exaggeration of the price.

In our forecast, we also assume that we will initially see rising prices. The first downward movement of the correction is likely to be over. Now the price should enter a countermovement, the ideal target of which we see in the range of the red box at $505.77 to $533.25. We expect a downward trend reversal there, and thus the final sell-off to the zone of the violet box at $316.44 to $185.82.

The countermovement does not have to reach the red box. If the price drops directly below $399.02, the downward movement will continue. A stronger countermovement will probably come later.

Alternatively, buyers could flood the market in response to positive quarterly figures, which could push the price even lower into the red box. We see the maximum target in the area of the red circle at $634.57 to $686.82.

The end result would be the same. The stock builds a significant high and then enters a larger correction, the target of which would also be in the area of the purple box in the alternative.

In our view, trading is not currently advisable due to this situation, as both scenarios are close together and ultimately lead to the same outcome: a correction with a price target significantly below the current price level. We will wait for the correction and buy the stock at the bottom of it.

You can find out more about us and our analysis work by visiting our website. You can access it via the link next to my profile picture at the top of this text. Our website is now also available in several languages. Just take a look.

Back to the glasses

Technology in the face is not only the goal of Apple (NASDAQ:AAPL)'s Vision Pro, but also of the Facebook (NASDAQ:META) group Meta, which has been working in this direction for years and is now pursuing big plans with the manufacturer of Ray-Ban and Oakley.

Meta plans to acquire shares in the world's largest eyewear supplier, EssilorLuxottica. The CEO of the French-Italian industry giant, Francesco Milleri, expressed interest in a collaboration during a conference call with analysts on Thursday, but did not provide any further details. Meta did not initially comment on this.

The company is honoured by Meta's interest, said Milleri. However, the manufacturer of brands such as Ray-Ban and Oakley does not plan to increase its capital for Meta. According to the current situation, the technology group would have to acquire the shares on the stock exchange.

An investment of up to five billion euros under discussion

For several weeks now, there has been speculation in the market that Meta wants to acquire up to five per cent of EssilorLuxottica, which at current prices would be worth almost five billion euros.

The two companies have been working together on smart glasses for several years and plan to integrate even more artificial intelligence (AI) into their products. In 2021, Meta launched its first smart glasses under the Ray-Ban brand, which allow users to take photos and videos, listen to music and make calls. More recent models are equipped with the AI assistant MetaAI, which is based on the AI model Llama.

Meta and EssilorLuxottica have also worked together to develop a pair of glasses with a camera and speakers, which Meta sees as an important part of the future of AI. Such glasses enable the software to use AI to recognise what the person is looking at and to respond better to the situation, emphasises Facebook founder and Meta CEO Mark Zuckerberg. In addition, an AI chatbot can communicate with users via the glasses when they do not have a display in front of them.

Milleri also confirmed that Google (NASDAQ:GOOGL) had also expressed an interest in working with EssilorLuxottica. Nevertheless, the company feels very comfortable with its partnership with Meta.

To find out more about us and our analysis work, click on the link above this text next to my profile picture. Our website is now also available in several languages. Just take a look.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

META – a mega deal with the world's largest eyewear manufacturer

Published 29/07/2024, 15:45

META – a mega deal with the world's largest eyewear manufacturer

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.