Mercia Asset Management (LON:MERCM) has completed the sale of its second largest holding, Faradion (a leading sodium-ion battery technology company), for £100m to Reliance New Energy Solar, a subsidiary of India’s Reliance Industries (NS:RELI). Mercia will receive total cash proceeds of £19.4m from the sale, including initial unrestricted cash proceeds of £18.6m, plus a further £0.8m ringfenced for three months. The sale value represents an uplift of approximately 50% over Faradion’s conservative carrying value of £12.9m at 30 September 2021, an NAV uplift of c 1.5p per share. Based on the unrestricted cash proceeds, the sale delivers a 4.2x return on Mercia's direct investment cost of £4.4m and an IRR of c 72%.

Share price performance

Business description

Mercia Asset Management is a regionally focused specialist asset manager. Its stated intent is to become the leading regional provider of supportive balance sheet, venture, private equity and debt capital in transaction sizes typically below £10m.

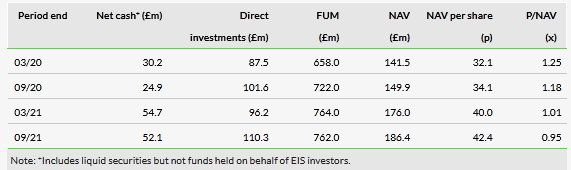

As set out in our recent note, Sustainable model remains undervalued, at today’s closing price of 40.25p, Mercia’s shares trade at a c 5% discount to the group’s H122 NAV of 42.4p, before considering the incremental value of the third-party funds business (we estimate 7p per share at 4% of funds under management). Alternatively, as a profitable specialist asset manager, Mercia trades on a P/E of 8x annualised H122 earnings. After a tripling of the H122 interim dividend, we estimate the shares might offer a prospective FY22 yield of c 2%.

The group had net cash of £52m at 30 September 2021, which will be supplemented by the proceeds from the sale of Faradion.

With a proven model, we anticipate Mercia will make further progress in 2022, potentially including further M&A.