MGI continued to perform strongly in FY21, beating initial guidance and ending up at the top end of the revised guidance. FY21 results showed revenue growth of 80% y-o-y to €252m, with 38% organic growth. Adjusted EBITDA increased 144% y-o-y to €71m, with margins of 28%. In June 2021, the acquisition of Smaato marked the group’s shift to become media led, with MGI evolving to become a content-owning, games-focused adtech platform, with closest peers including Applovin, Azerion and IronSource. Future growth will be both organic and from M&A, with management looking to drive synergies between MGI’s ad platform (Verve) and its content (gamigo). Management’s FY22 guidance is for revenues of €290–310m, with adjusted EBITDA of €80–90m.

Share price graph

Business description

Media and Games Invest is a fast-growing and profitable content-owning games-focused adtech platform. It combines organic growth with value-accretive acquisitions to deliver strong and sustainable earnings growth.

Bull

■ Proven buy-and-build model has delivered a five-year revenue CAGR FY16–21 of 45%.

■ Business with synergistic media/games platform, underpinned by long-term growth trends.

■ Has consistently beaten FY20/21 guidance.

Bear

■ After its rapid transformation, the adtech-led model still needs to be understood by investors.

■ MGI’s games portfolio remains PC focused, with mobile still substantially under-represented.

■ Media segment (Verve) margins remain below those of the games segment (gamigo).

Media and games growing vigorously

MGI is a fast-growing and profitable media and games company, combining a specialist ad-software platform with first-party games content. However, for the first time, in FY21 the media segment overtook games to represent the majority (FY21: 55%) of group revenues. With an adjusted EBITDA margin of 38% for games versus 20% for media, games still contributed most group profits in FY21. However, given relative growth rates (media delivered 115% growth y-o-y in FY21, vs 50% growth for games), media’s contribution is expected to grow in future years, with strong organic growth coupled with targeted M&A.

M&A focus on mobile, 2.8x leverage, €180m cash

Net interest-bearing debt amounted to €199m at 31 December 2021 (FY20: €62m), with net leverage of 2.8x (FY20: 2.1x) following the acquisitions of KingsIsle and LKQD in Q121, as well as Smaato in Q421. Interest cover fell to 3.2x in FY21 (FY20: 4.1x). Absent major M&A and with a full-year contribution from Smaato in FY22, management expects net leverage to fall and interest cover to rise in FY22. Management anticipates further small M&A deals in FY22, with a focus very much on the high-growth mobile sector, now valuations have fallen.

Valuation: Material discount to adtech peers

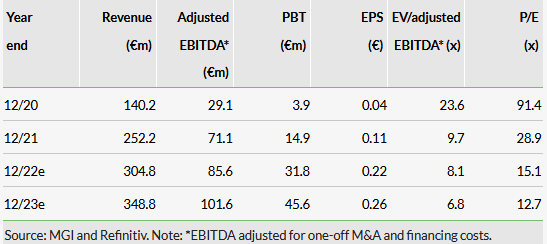

MGI has achieved annual revenue growth of over 70% y-o-y for each of the last three years, contributing to a five-year revenue CAGR of 45% for FY16–21. In FY20 and FY21, management has also consistently beaten guidance. On this basis, we are confident in management’s FY22 guidance of €290–310m, with adjusted EBITDA of €80–90m. At the midpoint of this guidance, MGI is trading on 2.3x FY22e EV/revenue and 8.1x FY22e EV/ adjusted EBITDA, in line with our games peer group but at a material discount to MGI’s adtech peers.

Consensus estimates

Click on the PDF below to read the full report: