Both organic and M&A-driven growth were evident in H121, as net revenues rose 93% to €109.0m, with 36% organic revenue growth year-on-year in Q221, and adjusted EBITDA increased by 127% to €28.7m.

Having completed the KingsIsle transaction, in January 2021, to bolster the games division, Media and Games Invest (DE:M8G) announced a second major deal in June 2021, the €140m acquisition of Smaato, a mobile-first adtech platform to drive the growth of MGI’s synergistic media business. This deal marks the move in the group’s focus from games to media. Management raised its FY21 revenue guidance to €234–254m and adjusted EBITDA guidance to €65–70m, an EV/FY21 adjusted EBITDA multiple of 14.0x at the mid-point, assuming pro forma net debt of €148.1m (post-Smaato).

Due to its superior growth both prospective and historically (45% five-year revenue CAGR in FY15–20), MGI trades at a justified premium to its European games peers.

Powerful growth across media and games in Q221

In Q221, MGI’s revenues rose by 90% to €57.1m (Q220: €30.0m), with Q221 adjusted EBITDA increasing by 127% to €15.3m (Q220: €6.7m) thanks to a strong contribution from the KingsIsle acquisition (completed in January). Q221 saw 36% organic revenue growth year-on-year against a tough comparator in Q220, with the surge due to the COVID-19 pandemic. H121 net revenues rose 93% to €109.0m (H120: €56.6m), with adjusted EBITDA increasing 127% to €28.7m (H120: €12.7m).

Scope for future M&A: 1.0x leverage, €246m of cash

In Q221, MGI raised over €270m, including c €90m of equity, a €150m bond issue and a €30m RCF, to fund the two acquisitions (Smaato, KingsIsle) as well as further M&A. This left MGI with end June net interest-bearing debt of €44.1m (31 December 2020: €61.m). Leverage fell to 1.0x at end H121, but is expected to rise again to between 2–3x with the close of the Smaato transaction in Q321. The group reported cash and cash equivalents of €246.1m as at 30 June 2021 (31 December 2020: €46.3m), leaving plenty of scope for a full M&A pipeline.

Valuation: Premium justified by superior growth

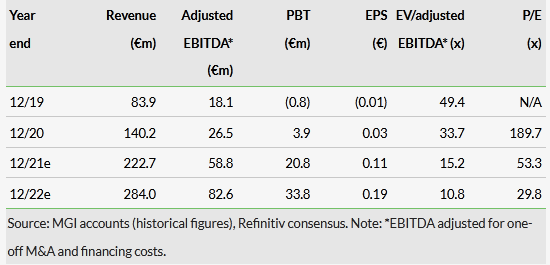

Following the acquisition of Smaato in July 2021, management’s FY21 revenue guidance was raised to €234–254m (a 67–81% y-o-y increase) with adjusted EBITDA guidance of €65–70m (a 123–141% y-o-y rise). At the midpoint of this guidance (adjusted EBITDA of €67.5m) and assuming pro forma net debt of €148.1m (post-Smaato), MGI is trading on c 14.8x FY21e EV/adjusted EBITDA and 4.1x FY21e EV/revenue. This is a small premium to MGI’s European games peers, despite MGI’s superior growth rate, but a material discount to its US adtech peers.

Consensus estimates

Share price graph

Bull

- Management with proven M&A track record.

- Business underpinned by long-term games growth trends, with a synergistic media platform.

- 45% five-year revenue CAGR from FY15–20.

Bear

- Undergoing a period of rapid transformation and with €246m of cash at H121, this will continue.

- MGI’s games portfolio remains PC focused, with mobile still substantially under-represented.

- The media segment lags the games business.

H121 results: Strong performance from both segments

MGI is a rapidly scaling and profitable games and digital media group, increasingly realising the synergies between the two segments to deliver strong top- and bottom-line growth.

In Q221, MGI’s revenues rose by 90% to €57.1m (Q220: €30.0m), with Q221 adj EBITDA rising by 127% to €15.3m (Q220: €6.7m) thanks to a strong contribution from the KingsIsle acquisition (completed in January 2021). Q221 saw 36% organic revenue growth year-on-year against a tough comparator in Q220, the start of the COVID-19 pandemic. H121 net revenues rose 93% to €109.0m (H120: €56.6m), with adjusted EBITDA increasing by 127% to €28.7m (H120: €12.7m).

The strong organic growth (Q221: 36%) was driven by game launches and content updates in the games segment, as well as new products like ATOM in Media, supported by M&A (eg KingsIsle, LKQD). Although COVID-19 has led to a structural step-up in engagement and an uplift in revenues since Q220, this demand boost was less evident in Q221 and appears now to be tailing off.

Click on the PDF below to read the full report: