By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The U.S. dollar traded higher against all of the major currencies Monday except for the Japanese yen as another wave of risk aversion hit the markets. Stocks fell another 4.5% with the Dow ending the day down over 1,1100 points. At first, it appeared that stocks would recover as the S&P 500 briefly turned positive but as the day progressed, they fell quickly and aggressively. There was no specific catalyst outside of stops being triggered at 25K and when that happened the Dow briefly plunged below 24K, but concerns about the negative impact of rising yields has been the primary driver of the sell-off that began on Friday. Further losses are likely before a bottom is found. A strong non-manufacturing ISM report and the swearing in of a new Federal Reserve Chairman who promises continuity failed to reassure investors. Nonetheless, service-sector activity expanded at its fastest pace in 3 months with the employment component of the report hitting a record high. These numbers along with the ISM manufacturing index, which hit its highest level in 14 years reinforces the underlying strength of the U.S. economy. The only question is how much pain 2.8% 10-year yields will bring to the economy and only time will tell. USD/JPY needs to close above 110.50 to usher in a new uptrend – otherwise the bears still remain in control.

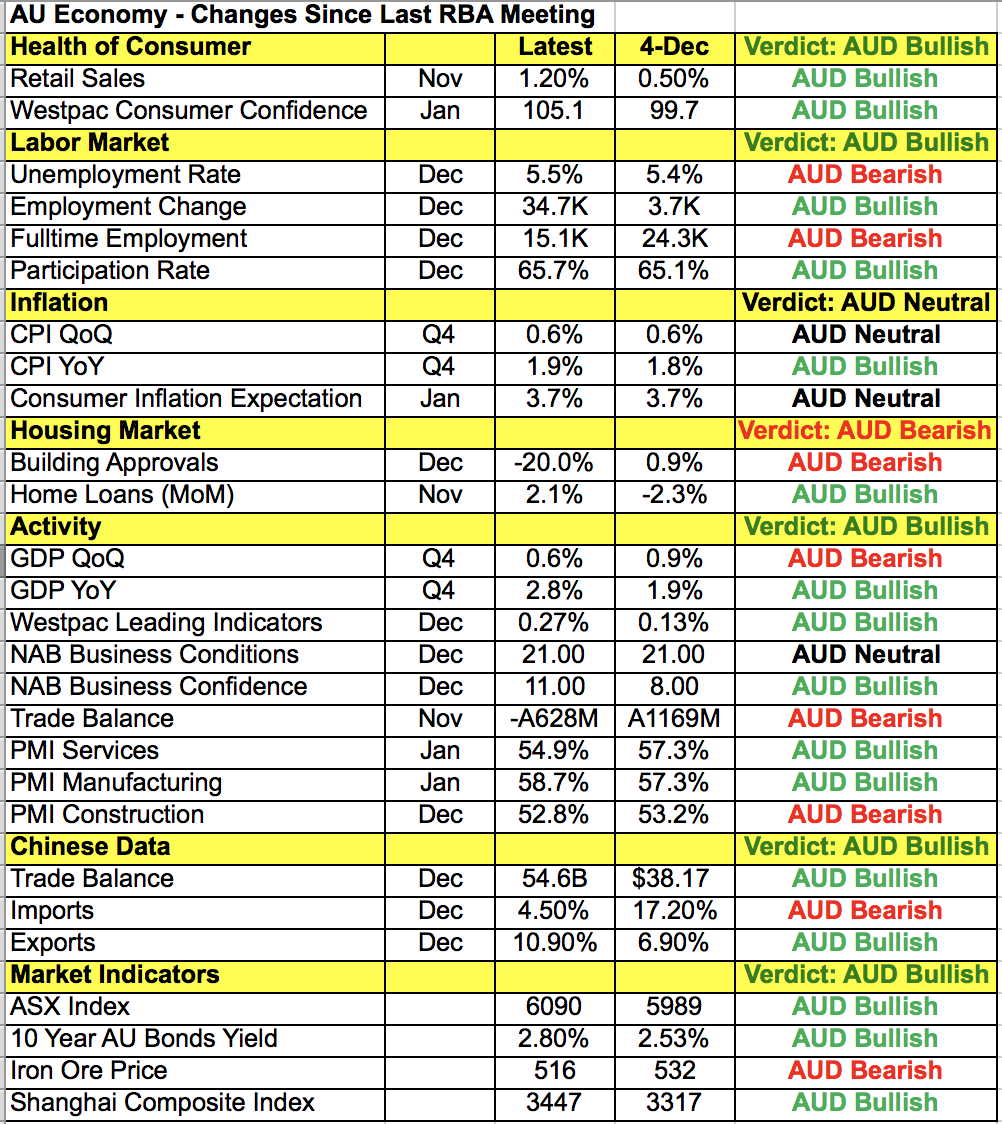

Tonight is a busy one in Australia with retail sales, the trade balance and a Reserve Bank rate decision on the calendar. The latest consolidation in the Australian dollar reflects the market’s hope that the RBA will remain optimistic. Data hasn’t been terrible as evidenced by last night’s economic reports. Service-sector activity expanded at its fastest pace in 6 months, inflation ticked up according to the Melbourne Institute Inflation index and job advertisements increased a whooping 6.2% at the start of the year, which is the largest one-month rise since 2010. All of these reports along with the improvements seen in the table below suggest that a 2018 rate hike remains in play but the currency is strong (up 4.5% since the last meeting) and the RBA may not want to drive it higher by talking about tightening just quite yet. Nonetheless, the Australian economy continued its recovery since its last meeting and China is performing better than expected. If the RBA talks rate hikes or emphasizes the upside risks to growth and inflation, AUD/USD will bounce back to .7980-.8000. However if they express greater concerns about the currency and its impact on the economy, AUD/USD could slip down to .7850. The New Zealand and Canadian dollars will also be on the move. There’s a New Zealand dairy auction on Tuesday along with Canada’s trade balance and IVEY PMI reports. USD/CAD’s recovery stopped short of 1.25 and softer data may be needed to drive the pair above this key resistance level.

Monday's worst-performing currency was sterling, which sold off hard ahead of the Bank of England’s Quarterly Inflation Report and monetary policy announcement. Investors are worried that the BoE will be less optimistic given the slowdown in manufacturing, service and construction sector activity. Monday’s slide in the PMI services index culminated in a trifecta of weaker PMIs this month that could deter the central bank from talking rate hikes, which will be their next move. The UK also ruled out a customs union with the EU that would keep them more closely bounded. This is also an important week for Brexit as members of the cabinet’s “Brexit war committee” meets Wednesday and Thursday to discuss this very issue. While GBP/USD found support above 1.40, we believe this level will break ahead of the BoE rate decision.

Euro ended the day lower against the U.S. dollar but is still hovering around 1.24. The latest Eurozone economic reports were mixed. The service and construction PMI numbers were revised higher, led by improvements in Germany but retail sales dropped more than expected toward the end of the year. ECB President Draghi’s comments also failed to have a meaningful impact on the currency with the central-bank head simply saying, “while we can be more confident about the path of inflation, patience and persistence with regard to monetary policy is still warranted.” This week is less about the euro than other major currencies but its quiet strength should persevere particularly against sterling and the commodity currencies. EUR/USD itself should extend its losses. German factory orders are scheduled for release Tuesday and a rebound is expected after the previous month’s decline.