Stocks traded mostly sideways yesterday, even as rates and the dollar surged. However, the big news came yesterday when Jay Powell noted that it would take longer for the Fed to gain the confidence needed to start the rate-cutting process because the progress on inflation had stalled.

No, kidding.

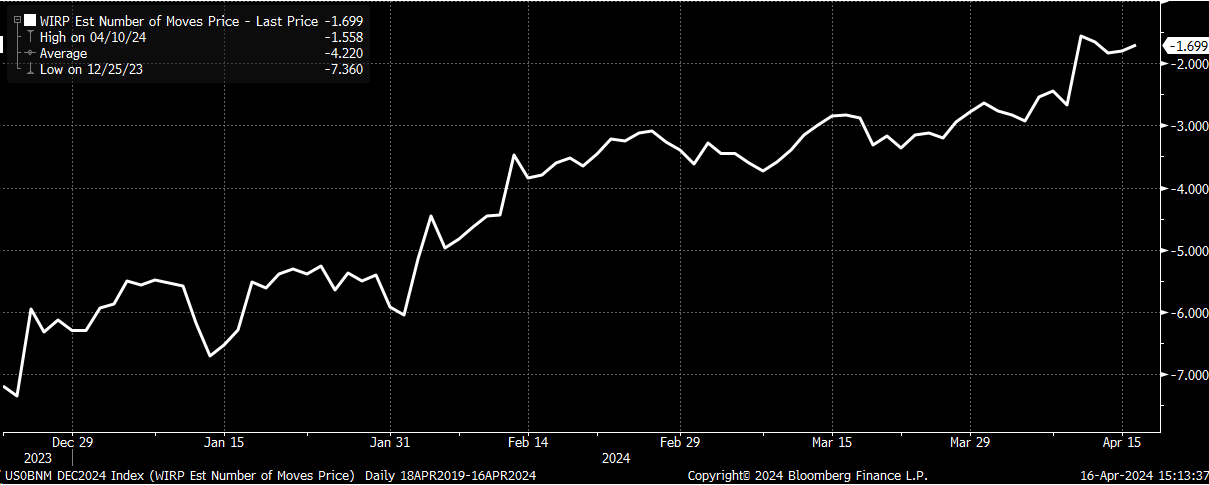

Now, the market sees the first rate cut coming in November, pricing in fewer than two rate cuts in 2024. I’m sure this must be a stunning turning event for readers of this commentary, but that is what is happening right now. It’s hard to believe that the Market saw more than 7 in December.

It seemed pretty evident to me, just looking through the data and watching the charts, that inflation would be a problem for some time longer. I guess that if the Fed could return to that December FOMC meeting and take back that SEP, it would.

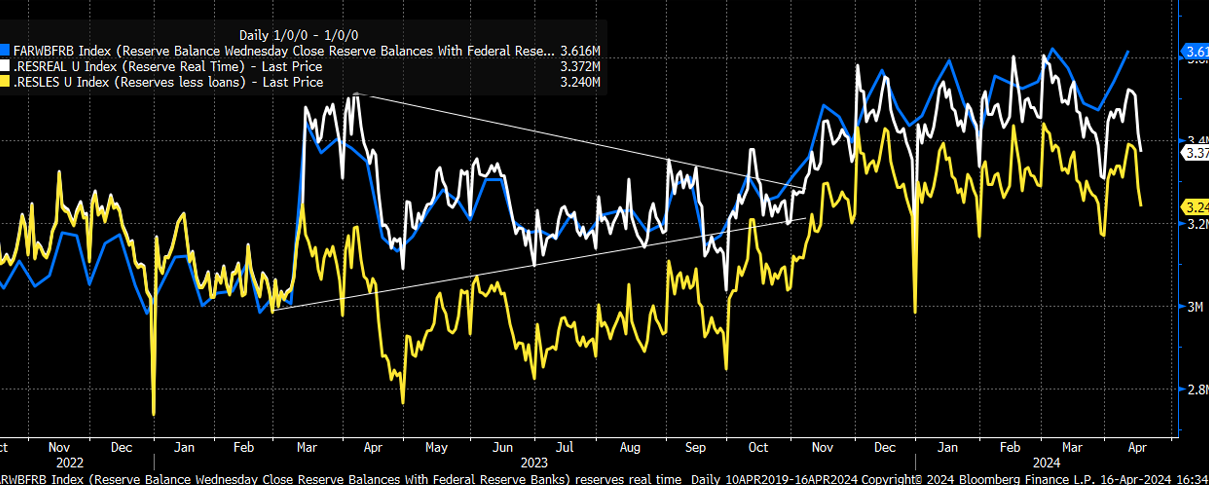

It was a horrible blunder, even at the time. Unless there was some hidden goal, such as draining the reverse repo facility, which is now nearly completed, it could even be complete; going back to, say, 2014, it used to average around 125 billion a day, and so it is possible that it may not go completely back to zero.

This all probably translates to a soft landing that may have been overhyped. If inflation has stalled and the economy is still strong, we may not have landed. Again, one could easily argue that given rising inflation expectations, monetary policy may not be as restrictive as the Fed thinks.

Meanwhile, the 10-year yield is approaching the 4.67% level, which looks fairly important from a technical basis. A move above that resistance can probably set up a move back to 5%, if not higher.

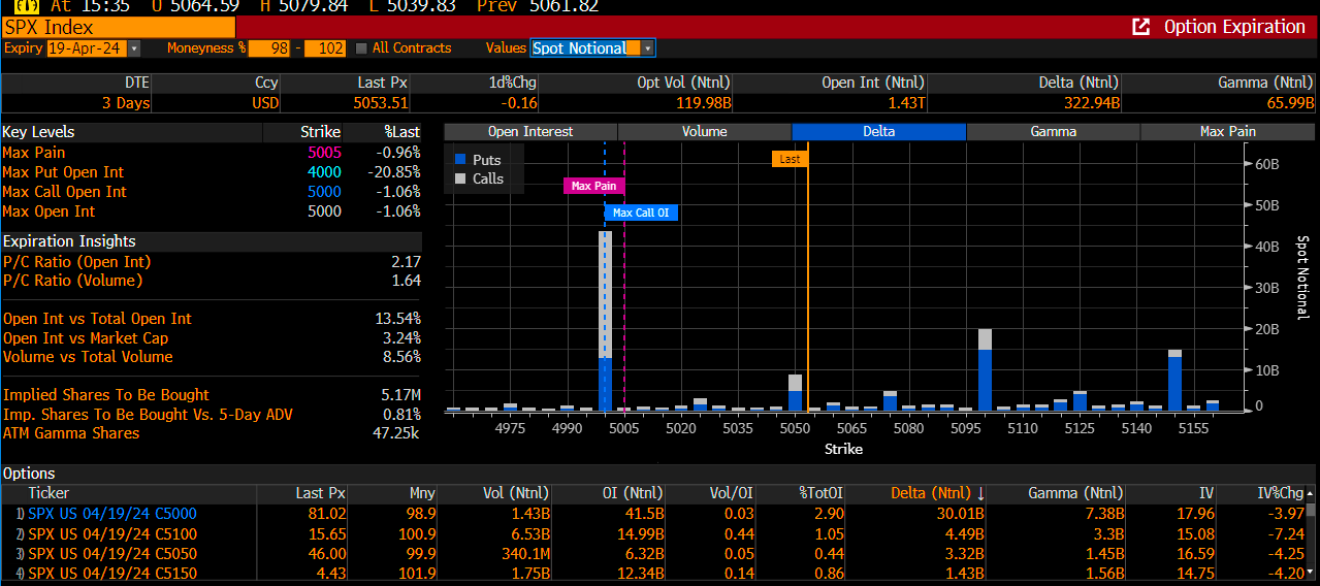

Meanwhile, the S&P 500 has about $30 billion in notional value call deltas expiring on Friday at the 5,000 strike price. I’m not exactly sure what will happen there because if the market keeps drifting lower, the delta value of those calls will decline. I would assume the market sold those calls, which means the market maker is long the index, and there is time decay, which will eat away at that premium, and some bring stock for sale.

It is an interesting scenario and one we haven’t seen much of that I can remember. One would think, though, that the 5,000 strike price could serve as a magnet pulling the index lower. Meanwhile, there is a $12 billion delta put position up at 5,100 and a $10 billion delta put position at 5,000.

That QYLD ETF covered call position in the NASDAQ 100, which the ETF typically buys back the day before opex is looking like it may be a non-even this month, as the notional value of the call is worth a mere $2.7 billion and is because the NASDAQ is now trading below that 17,900 strike price. Typically, this number approaches something in the $5 to $8 billion range.

The VIX’s opex is today morning, and 18 is the big level. Given that the calls are now in the money, I think it will be hard to see the VIX below 18 to start the day.

Finally, as taxes came in, the TGA rose to around $900 billion yesterday. That number will probably continue to climb over the next day or two and could top out at around $1 trillion. Last Wednesday, that value was at $672 billion, and so we are talking about a sizeable increase in the TGA of around $275 billion or so.

That is likely to push reserve balances down to around $3.4 trillion from around $3.6 trillion last week, which is a significant drop, and then factor in the declining BTFP, we could be talking about reserves that are scrapping someone in that $3.2 trillion to $3.3 trillion range, which puts us back to liquidity that was equal to the time around the spring of 2023. Stocks were much lower during that time.