The shocks continued to roll through the markets on Thursday as the ECB and the BOE pushed back on the market expectations for rate cuts. This creates more questions than answers as to why the Fed decided to show its hand now.

Unfortunately, we will have to wait ten more years to find out what happened because that is when the historical transcripts will be released and all the details of what took place, but we can speculate for now.

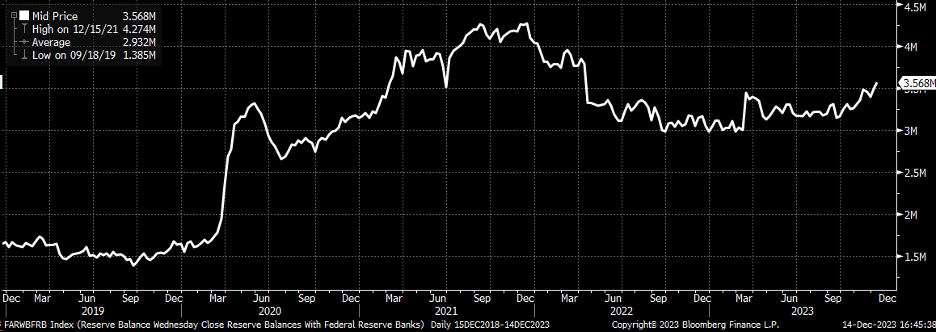

One thing that occurred to me today was that the reverse repo facility has largely blunted the Fed’s QT efforts, and perhaps the effects of telling the market it plans to lower rates will get money to finally move out of the facility so that the reserve balance can drain from the system. Instead, all this excess liquidity remains, is probably lent out, and finds its way back into stocks.

But now, with expectations for rates to go down, that could cause investors who have been playing the money market game to start moving that money out while Janet continues to issue Trillions in debt. If the estimates are correct, the Treasury is expected to issue $816 billion in the first quarter alone. The reverse repo facility, as of today, is $769 billion, down from over $2.2 trillion.

Many people may have missed that Powell mentioned the plan to reduce the portfolio and keep QT running to reduce reserves in the system and that once the reverse repo facility levels out, reserves will then be able to come down. Right now, reserves are rising and falling, kind of like the market.

The repo rate at the Fed changes with policy and is currently at 5.3%. So, if there is a fear that rates will be going lower, it would seem to make sense to see some of that money move into places yielding higher rates while they can.

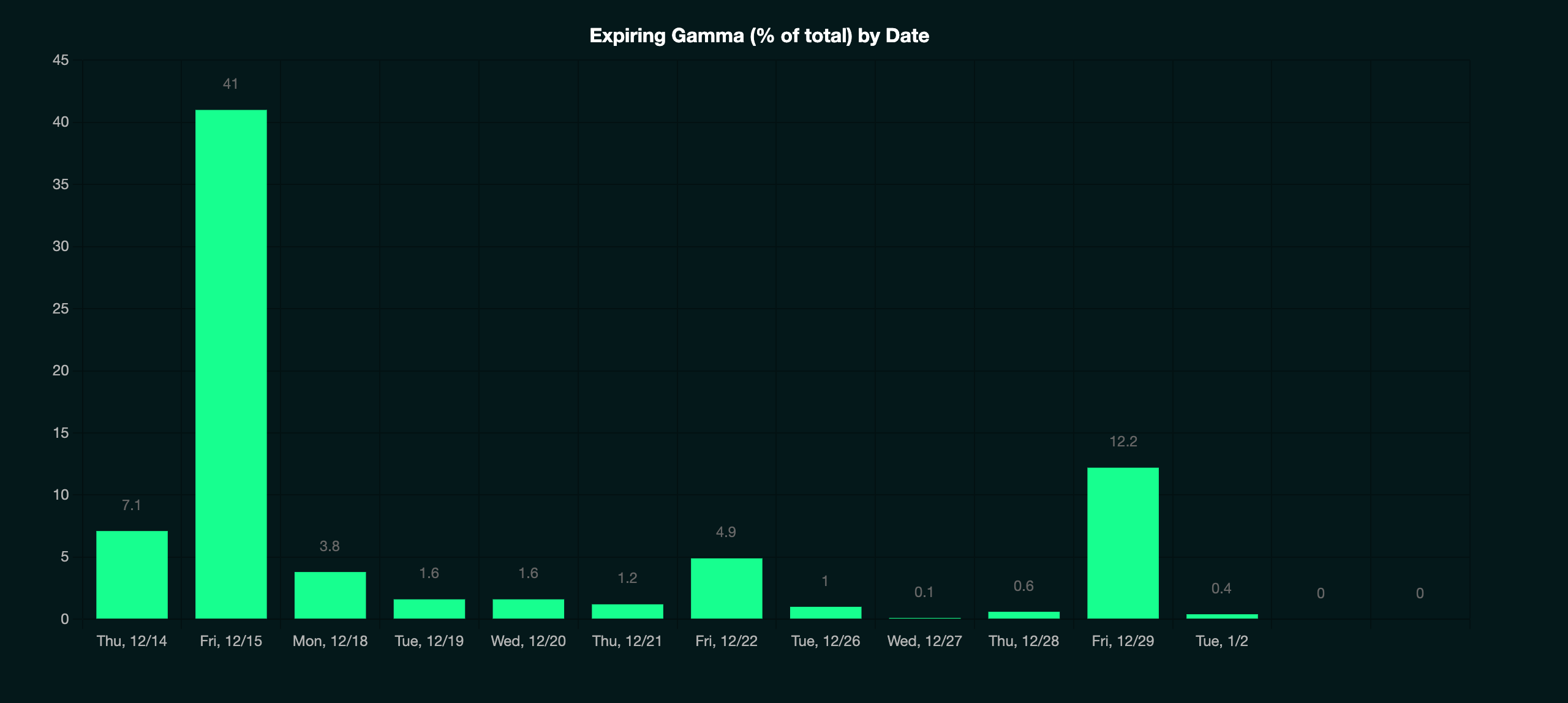

Anyway, today is a very big option expiration. The biggest of the year, and there will be a lot of gamma rolling out of the market, 41%, which means some stability leaves.

Source: Gammalabs

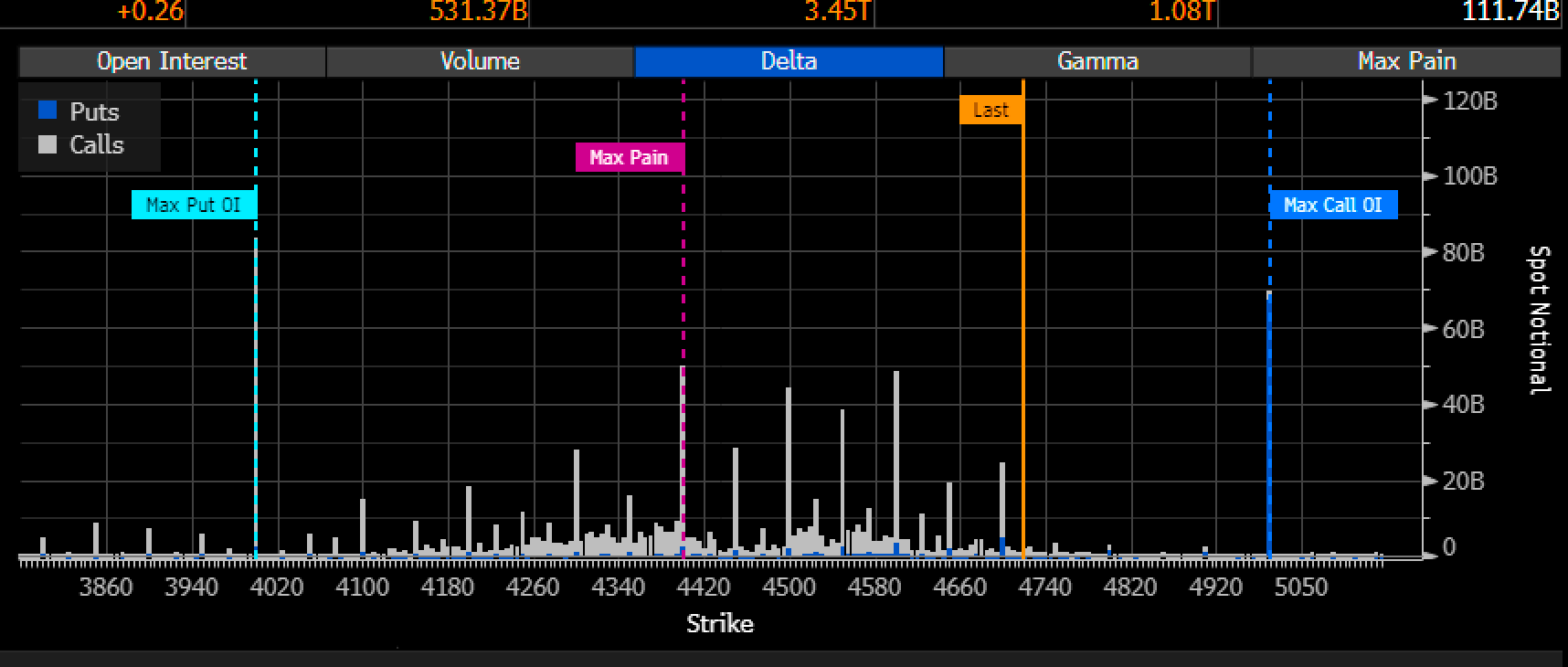

Now, I don’t have the total amount of net notional delta due to expire, but visually looking at this chart, it would seem that a lot more call deltas are due to expire today than put deltas.

Also, I cannot see how the market makers are positioned, and we don’t know how many calls customers sold. Still, I’m guessing that the market makers will have a decent amount of futures and stocks to unwind following today’s options expiration, just for the S&P 500 of course.

Source: Bloomberg

I don’t have much else to add. Structurally, the rally feels to me like it is built on sand. Based on my work, it was a very negative gamma-induced rally that took the market initially higher, followed by systematic flows, which led to vol compression and volatility selling, being capped off by opex. So, until we get through today, it is very hard for me to know how much of the rally is real and how much is just mechanics.

I get that this may be difficult for some people to grasp, but I have a process, and unfortunately, sometimes it means getting things wrong. That may very well be the case this time. I’m just playing the cards I have been dealt.