FX Brief:

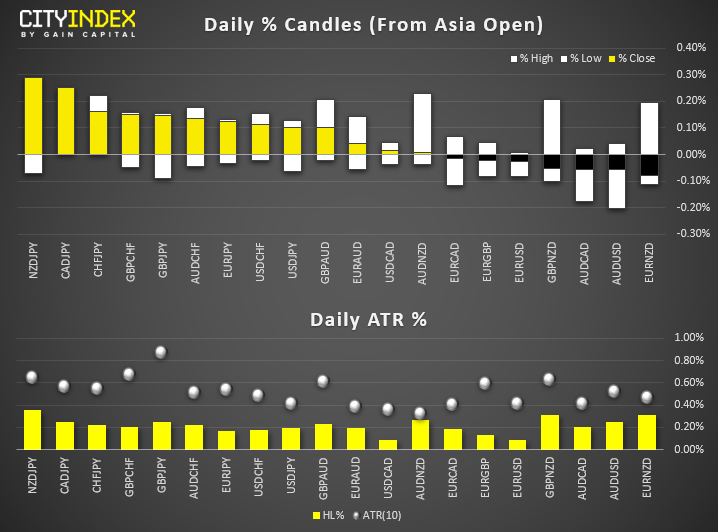

The US denied reports that they were preparing to remove their troops from Iraq, after an unsigned letter was leaked online suggesting the US were doing just that. The top US general later told reporters the letter was “poorly worded” and that they’re not withdrawing troops.Japan’s service PMI contracted at its fastest pace in over three years. This marks the second consecutive read below 50. New export business (and leading indicator for the headline print) was also at a 6-month low.Volatility remained lower overall and safe-haven currencies (JPY, CHF) weakened slightly as safe-haven demand receded. GBP and NZD are the strongest majors.Price Action:

Yen pairs held key levels yesterday, yet it remains touch and go as to whether we’ll see a risk-on follow through or this is merely the calm before the storm and demand for the yen returns.Gold has nearly closed the gap seen at this week’s open and is now hovering just above September’s high. A spinning top doji has formed on the hourly chart to suggest it is trying to carve out a swing low. If tensions escalate, bulls could look to enter if bullish momentum returns from current levels. Whereas a break below 1553.52 closes the gap and could singal further losses.The decline on has lost momentum and it’s trying to carve out a low above 0.8615 support and the 200-day eMA. One to watch for a potential rebound. is clinging onto support around 0.6930, a pivotal level gong forward. has found support around 0.6650 but, with a stronger trend structure than AUD/USD, suggests further downside for . has risen to a 7-week high, although needs to break 8,000 to confirm a range breakout. Until then, bears could look to fade into resistance if they’re to assume the range will hold.Equities Brief:

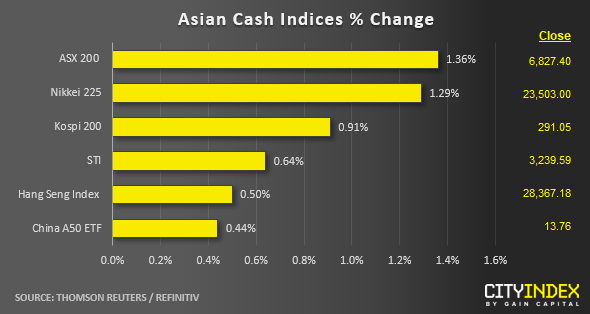

Key Asian stock markets have recovered partially from losses inflicted by the recent geopolitical turmoil seen in the Middle East in line with a retreat seen on prices of WTI and where both shed -1.22% and -0.50% respectively in today’s Asian session.The current rebound has been attributed without any new escalation in the Middle East with Iran still “silent” after Tehran issued harsh words of “verbal retaliation” against U.S. in the weekend to vouch for revenge. But nothing is certain at this juncture and the political climate in the Middle East can swing to the other side of pendulum easily.Japan’s services sector has continued to shrink together with the manufacturing industry. The finalised Jibun Bank Services PMI fell to 49.4 in Dec from 50.3 in Nov, its steepest contraction since Sep 2016. The weak print has been attributed by a sales tax increase and typhoon that have impacted negatively on business activity in Oct.General Motor has reported a decline in vehicle sales (-15% y/y) in China for the second consecutive year for 2019 due to a slowing economy and intensified competition in the key mid-priced sport utility vehicle (SUV) segment.Singapore has seen keen interest in the digital banking space where the regulator, MAS has received 21 applications to compete for five digital banking licences (two full-banking & three for wholesale banking) to be given out in Jun 2020. Major applicants include tied up between Grab and Singapore Telecommunications as well as Alibaba’s Ant Financial."Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."

Original Post