The recent market meltdown has caused traders to question where to go from here. Tuesday’s bounce is a natural reaction following a significant pullback, but it doesn’t mean the turbulence is over. It’s likely markets will test the lows once again as there are still concerns to be resolved, especially with regards to the outlook of the US economy.

The stock market has been the main focus this week, but the FX space has also been seeing strong moves. The standout pair for a few weeks now has been USD/JPY, which first started to signal the turn in momentum almost a month ago, when the June US CPI came in lower than expected. The 25bps rate hike delivered by the BoJ also helped the Japanese Yen recover some ground as it undid some of the carry trade that has been fuelling the selloff in the currency in the past two years. Because of this, the Yen was one of the strongest currencies last week.

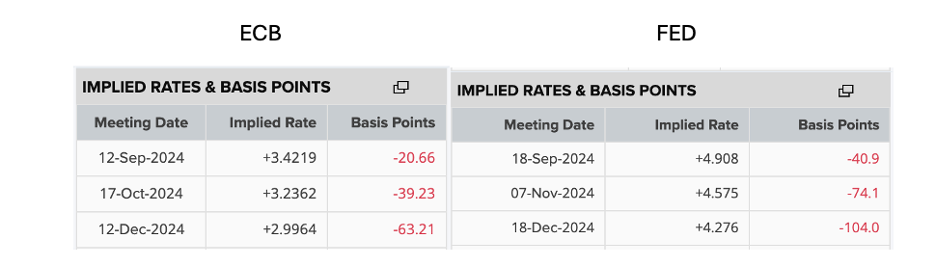

But another currency has been gaining ground in the shadows. Aside from the Yen, the euro has been strengthening against most major currencies these past few days. To some extent, the euro is considered the default currency to turn to when the dollar is underperforming, but there seems to be more to it than that. Given the ECB chose to cut rates much sooner than the Fed to give itself more wiggle room to act in the future, it could be that markets are playing into the rate differential expectations. Current pricing shows the Fed cutting rates by 103 basis points by year-end, versus just 63 bps from the ECB. This is also because the Fed’s current rate is higher, but nonetheless, more easing from the Fed would play in favour of the euro when it comes to rate differentials.

This led EUR/USD to briefly surpass 1.10 on Monday for the first time since the beginning of year. The momentum has been unable to hold as the dollar has recovered some ground since then, but we could see further bullish appetite if the pair is able to hold above 1.09 over the coming days. There will be more crucial data released in the US next week, specifically the CPI data for July, do markets are likely to remain pretty sensitive no any further signs of cooling in the US economy. For now, it seems like the bias in EUR/USD has turned upwards as markets anticipate a more aggressive cutting cycle from Fed over the coming months as it tries to catch up.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

Another euro pair that has been making moves is EUR/GBP which is up almost 2.5% in the past week. Historically it has been a very choppy pair, but the bullish drive in the euro has been attracting attention. Again, it may be that investors favour Lagarde’s pre-emptive cutting strategy over the Bank of England’s more lagging approach. That said, markets are pricing in less rate cuts from the BoE during the remainder of 2024, with only 41 basis points priced in.

How both the Eurozone and the UK economy evolve will be key to determine the next drivers for EUR/GBP. The stronger-looking economy will likely end up on top, but the pair is likely to remain choppy going forward. So far, buyers have been unable to hold above 0.86, finding resistance at the same place it did in May.

EUR/GBP daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Analysis: euro rally cools off against USD and GBP

Published 07/08/2024, 11:26

Market Analysis: euro rally cools off against USD and GBP

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.