Manx Financial Group Plc (LON:MFX) offers a combination of relatively fast growth potential and low valuation. Operating income doubled between 2016 and 2020 with only a 1% decline in the pandemic year. MFG’s key assets are Conister Bank, a specialist SME and retail lender, Edgewater Associates, the largest Manx independent financial advisory business, and Manx FX, a currency broker and provider of international payment processing facilities. The ROE ranged between 12% and 17% in FY14–19 and 9% in the challenging 2020/H121. The bank is well capitalised and funded. MFG restarted paying dividends after 16 years in 2021. The shares do not have a very demanding rating at 0.49x 2020 P/BV and 5.7x depressed 2020 earnings, presenting strong share price upside potential as earnings recover.

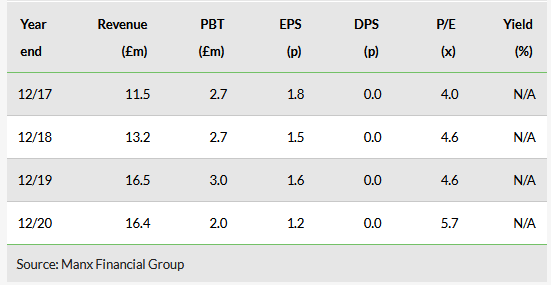

Historical data

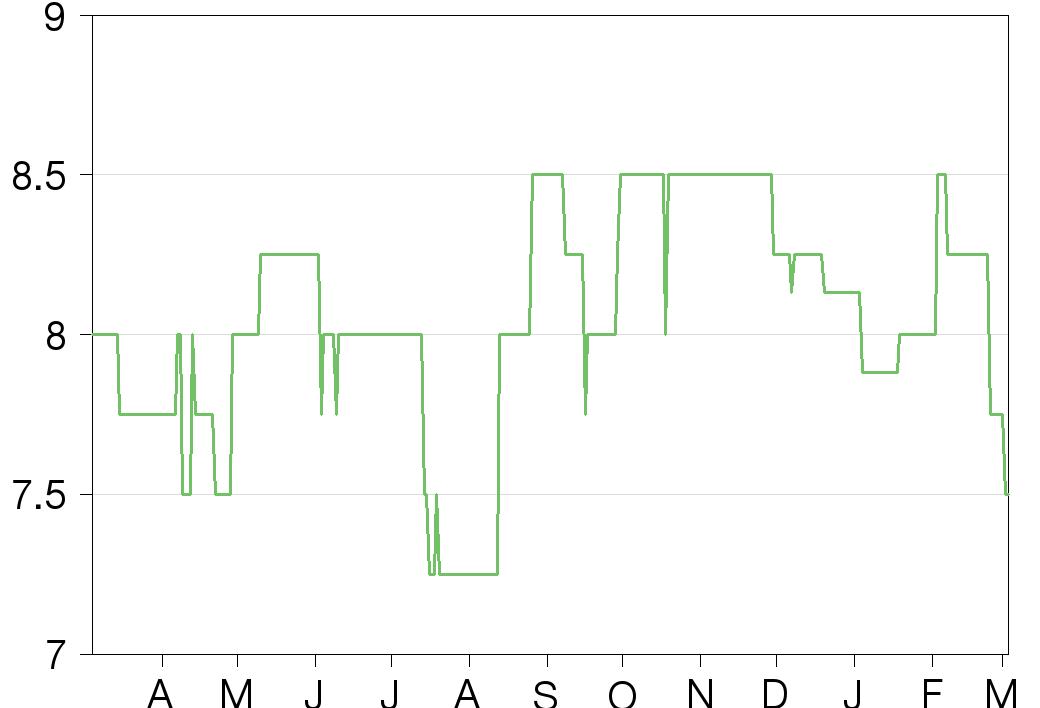

Share price graph

Business description

Manx Financial Group is an independent banking group founded in 1935, domiciled in the Isle of Man. Its 100% owned bank, Conister Bank, is regulated by the UK’s Financial Conduct Authority (FCA) as well as the Isle of Man Financial Services Authority. MFX also owns Edgewater Associates, the largest independent financial advisory services company in the Isle of Man.

Bull

■ Good profit track record.

■ Balance sheet is well capitalised and funded.

■ Small size allows bank to be nimble.

Bear

■ Small market cap.

■ Limited brand awareness.

■ No broker forecasts.

Weathered the COVID-19 storm well

Conister Bank, MFG’s largest business, accounting for 78% of revenue in H121 and more than half of its earnings, has been relatively resilient and benefits from 92% of its lending being secured or government backed. Edgewater reported a FY20 pre-tax loss of £94k (FY19: £219k profit) but broke even in H121. Manx FX has remained very profitable and has benefited from a high FX trading volume due to the volatility from the COVID pandemic and Brexit. Loan impairment charges from Conister Bank were an annualised 2.1% of average net loans in the past three half-year periods, but MFG’s resilient operating margins have allowed it to report a good level of profitability: the ROE was 9% in FY20 and H121.

Balance sheet allows for growth

Management aims to grow organically as well as take advantage of value-creating acquisition opportunities. The bank’s balance sheet is well capitalised and with good liquidity. Management has been moving to more prime, recession-proof sectors since the 2016 Brexit vote to both protect and allow for future loan growth. MFG is also seeking a UK banking licence to further expand its business.

Valuation: P/BV of 0.49x, trailing P/E of 5.7x

Although there are no consensus forecasts for MFG, the strong loan book growth bodes well for future revenue. MFG is trading at a P/BV of only 0.49x, which seems quite low given its track record of delivering ROE above its COE (COE; we estimate this at 10–11%). Its trailing FY20 P/E of 5.7x does not seem demanding, especially since FY20 earnings were depressed by credit conditions caused by the pandemic led recession. MFG’s trailing valuation multiples are at significant discount to peers.

Click on the PDF below to read the full report: