Less than two months after closing its most recent, c £100m (gross) upsized equity placing, LXi REIT (LON:LXIL) has substantially deployed the equity proceeds in accretive acquisitions. Further assets are in solicitors’ hands. Full rent collection underpins the FY22 DPS target, a new high level since listing in February 2017, and we forecast portfolio growth and inflation-protected rents to drive further growth in DPS and net asset value.

Share Price Performance

Business description

LXi REIT is an externally managed UK REIT investing in high-quality, smaller lot size (£5–15m) assets, let on long index-linked leases to strong financial covenants across a range of sectors with defensive characteristics. It aims to provide a secure and growing income with capital growth over the medium term, with a total return of at least 8% pa.

Earnings, DPS cover and net asset value enhanced

On 1 July, LXi closed its c £100m (gross) equity placing, upsized from £75m, with c £3m raised in a PrimaryBid offer targeted at retail investors. A substantial portion of the proceeds have been swiftly deployed into acquisitions amounting to £80m, at an accretive average yield of 5.25%. All are let on long leases to strong tenants, in robust sectors, with inflation-linked or fixed uplift rents. The unaudited EPRA NTA per share at 1 June was 130p, up 3.4% since end-FY21. It included valuation gains across the portfolio, particularly industrial assets and recently (pre-placing) acquired assets, reflected in a portfolio net initial yield of 4.7% (end-FY21: 4.9%). Our updated forecasts include our expectation of an additional £80m of deployment funded by existing debt, taking LTV towards 30%. Our FY23e ‘cash’ EPS increases c 3%, enhancing DPS cover and EPRA NTA per share by c 5%.

Diversified and active long income strategy

With 95% of end-FY21 rents subject to fixed or index-linked, upward-only increases, LXi offers significant income protection against inflation. An end-FY21 average 22-year unexpired lease term and strong tenants add to income visibility and should smooth out volatility in capital values. The company’s multi-sector approach differentiates it from many specialist peers, spreads risks and broadens its universe of investment opportunities. The experienced investment advisor continues to demonstrate an ability to source attractively priced assets to enhance income and net asset value – often off-market, smaller lot size, sale and leaseback transactions and forward-funded development schemes. Capital recycling provides firm evidence of this, generating capital gains and allowing redeployment into accretive acquisitions at higher yields.

Valuation: Covered, growing, inflation protected DPS

The FY22e DPS represents an attractive prospective yield of 4.1%, with strong prospects for inflation-protected growth. We forecast DPS to be fully covered by cash earnings and well covered by EPRA earnings, supporting the c 14% premium to unaudited 1 June 2021 EPRA NTA per share.

Substantial progress made with deployment of equity proceeds

In June 2021, LXi announced its intention to raise additional equity under its existing placing programme. Reflecting the strength of investor interest and scale of suitable acquisition opportunities identified by the company, the issue was upsized from c £75m to £100m and closed in early July, with c 75.2m new placing shares issued at 133p per share. An additional c 2.8m shares were issued in a PrimaryBid offering, aimed at retail investors and on similar terms. In aggregate, c 78.0m new shares were issued, c 12.5% of the number previously outstanding, raising gross proceeds of c £104m. Including the new c 100.4m shares issued in March 2021 (at 124.5p), LXi has now issued c 221.6m of the 400m shares authorised by shareholders to be issued between 16 March 2021 and 17 February 2022.

LXi has a strong track record of quickly deploying additional equity resources into predominantly off-market investments that have been identified in advance. The proceeds of the March equity raise were deployed swiftly within eight weeks and, leading up to the most recent placing, increased debt facilities had also been substantially deployed. The c £80m of acquisitions just announced substantially deploys the recently raised equity, continuing this pattern, and with additional pre-let forward funding and sale and leaseback transactions in solicitors’ hands we expect full deployment to be quickly achieved.

The acquired assets in detail

The acquisitions are all let on long leases to strong tenants that operate in defensive sectors. Starting rents are low and inflation-linked or subject to fixed uplifts, and in each case the assets benefit from being ‘mission critical’ for the tenant and/or having a favourable investment to vacant possession value ratio. Full details of the acquired assets are available on the company’s website (www.lxireit.com) and in summary they comprise:

■ Life Science and Biotech campus in York: this substantial and internationally renowned facility is let to Capita on a long lease, with 25 years unexpired until first break. The low starting rent increases five-yearly in line with RPI (capped at 3.5%). Capita derives 75% of its income from UK government agencies, with the remainder from high-growth SMEs.

■ Media studios and corporate HQ in Glasgow: the facilities, well-located in Glasgow’s media and tech hub, were acquired through an off-market transaction and are let to STV, Scotland’s equivalent of England’s ITV (LON:ITV) and listed on the London Stock Exchange. The asset is a ‘mission-critical’ site for STV, reflected in a recently agreed 20-year unbroken lease. The low starting rent increases five-yearly at a fixed 1.5% pa.

■ Waste recycling and storage facility in Aberdeen: the facility is let to Biffa with an unbroken 14-year remaining lease length and rents that increase annually in line with CPI (collared at 2% and capped at 4%). This is Biffa’s only facility in Aberdeen and LXi has already commenced discussions with it about increasing the lease length.

Attractive capital recycling

Alongside the acquisitions, LXi reported the disposal of a Lidl food store, acquired through a forward funding transaction in 2017, following an unsolicited approach. The sale price of £7.75m reflected a low exit yield of 3.8%, a 38% premium to the acquisition price, which reflected a net initial yield of 5.5%. The sale proceeds will be recycled into higher-yielding opportunities within the continuing pipeline.

Estimates increased

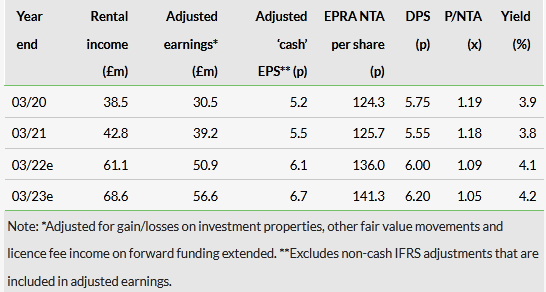

We have updated our estimates to include the £104m (gross) of equity recently raised and our expectations for its deployment, on a geared basis, including the acquisitions detailed in this note. A summary is provided in Exhibit 1. Our DPS forecasts are unchanged, although we note the increasing level of cover by ‘cash’ earnings in FY23 (1.08x), which raises the possibility that FY23 DPS growth may be faster than we assume.

Click on the PDF below to read the full report: