During the first half of the financial year to the end of March 2022, Lowland Investment Company (LON:LWI) lagged a modestly rising market due to its high weighting in mid and smaller capitalised UK companies. These companies found themselves out of favour with investors in a risk-off environment, fuelled by the war in Ukraine, rampant inflation, rising interest rates and slowing economic growth. For all of this, earnings per share for the period was 1.72p, some 34% higher than in this period last year but still below the pre-COVID-19 pandemic level of 2.22p. After a very strong outperformance in 2021, subsequent returns might be expected to consolidate, but the managers feel the portfolio is well-positioned to make further gains in income and capital over the coming years.

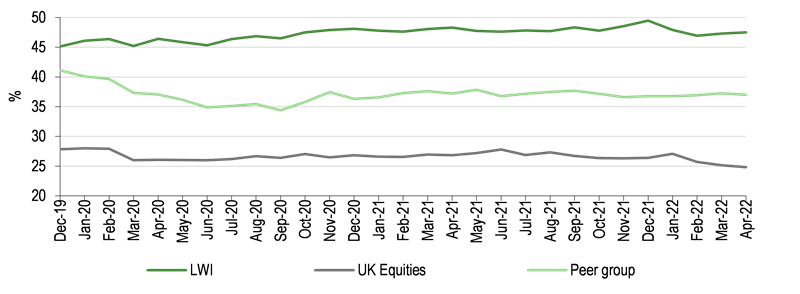

Exhibit 1: Percentage of UK domestic earnings generated within portfolio

Fund objective

Lowland Investment Company aims to give investors a higher-than-average return with growth in both capital and income over the medium to long term by investing in a broad spread of predominantly UK companies. LWI measures its performance against the total return of the broad UK stock market, although its portfolio make-up is markedly different from that of its benchmark index.

Bull points

■ Experienced management team.

■ Disciplined investment process.

■ Exposure to the whole breadth of UK equities.

Bear points

■ Procyclical positioning can polarise returns.

■ Small-cap bias can result in volatility.

■ Volatility necessitates a long-term holding period.

Why consider Lowland?

The UK has arguably been one of the most unloved stock markets over the last 10 years. A combination of the mix of industries listed (and those that are not) in the UK and events such as Brexit have conspired to see investors look elsewhere for their equity exposure. This has affected the performance of the wider UK stock market compared to other regions, particularly the United States. This has resulted in substantial regional valuation differences, even after the technology sell-off since Q1 this year. LWI not only provides more exposure to UK domestic earnings than its peers and the wider UK market, but it is also at a discount in price to its expected earnings. There are many market uncertainties, but LWI provides a diverse range of holdings with substantial valuation support and thus could be an excellent way for a contrarian to invest in a good quality, but cheaply valued portfolio of UK-listed dividend-paying companies.

The analyst’s view

LWI provides investors with a multi-cap portfolio of predominantly UK dividend-paying companies. It is diversified by holdings but is not quasi-passive, with substantial sector and stock positions taken resulting in high levels of tracking error and volatility. Balanced with other strategies, it could provide welcome diversification benefits to a portfolio. Fund managers Henderson and Foll are a well-established team applying a proven mildly contrarian investment process across the whole gamut of UK equities.

Click on the PDF below to read the full report: