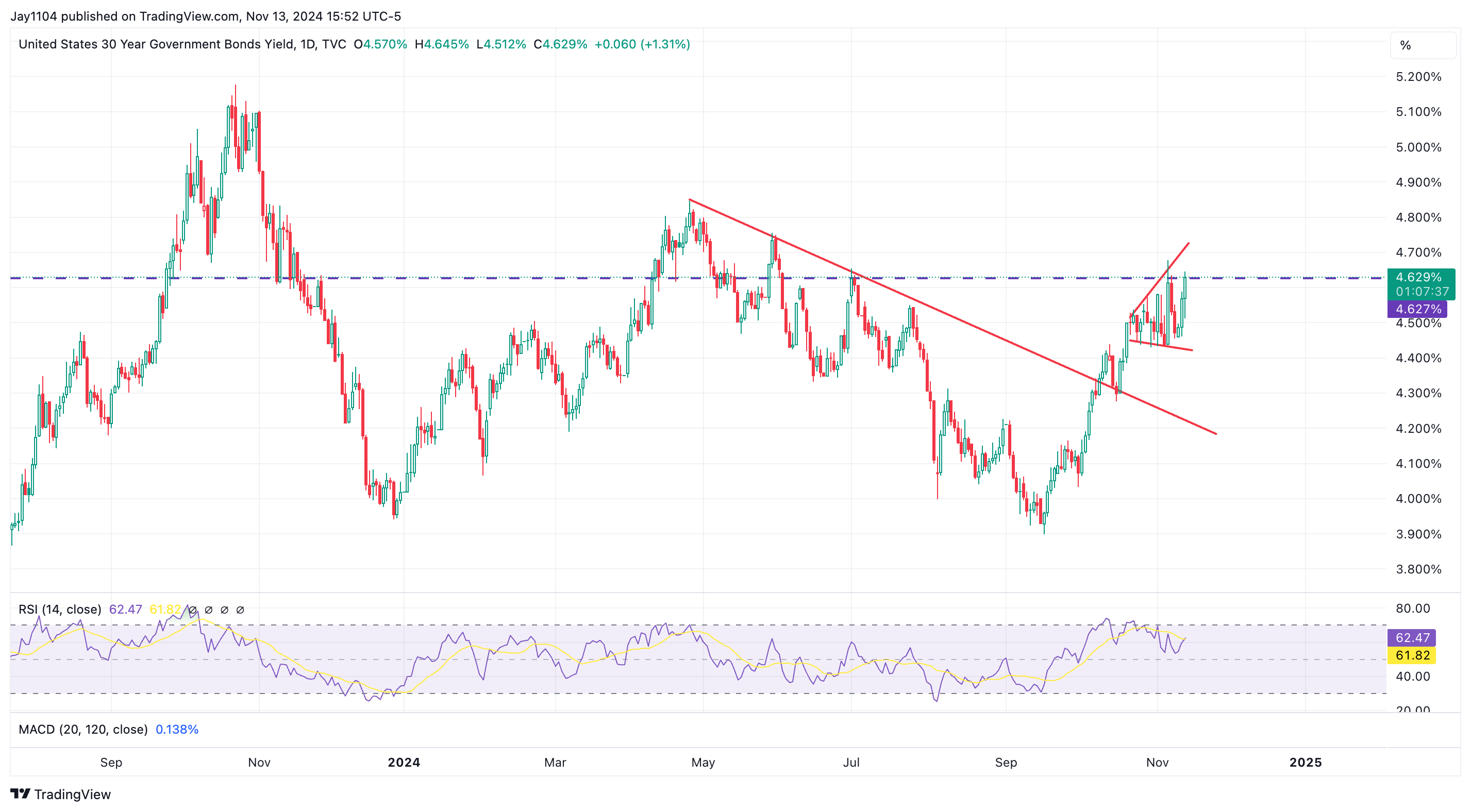

CPI came in as expected yesterday, but that didn’t stop long-end rates from rising, with the 30-year up six bps and the 10-year up two bps. The dollar index also continued to melt up after the data, showing that core CPI remains sticky after a 0.3% m/m increase.

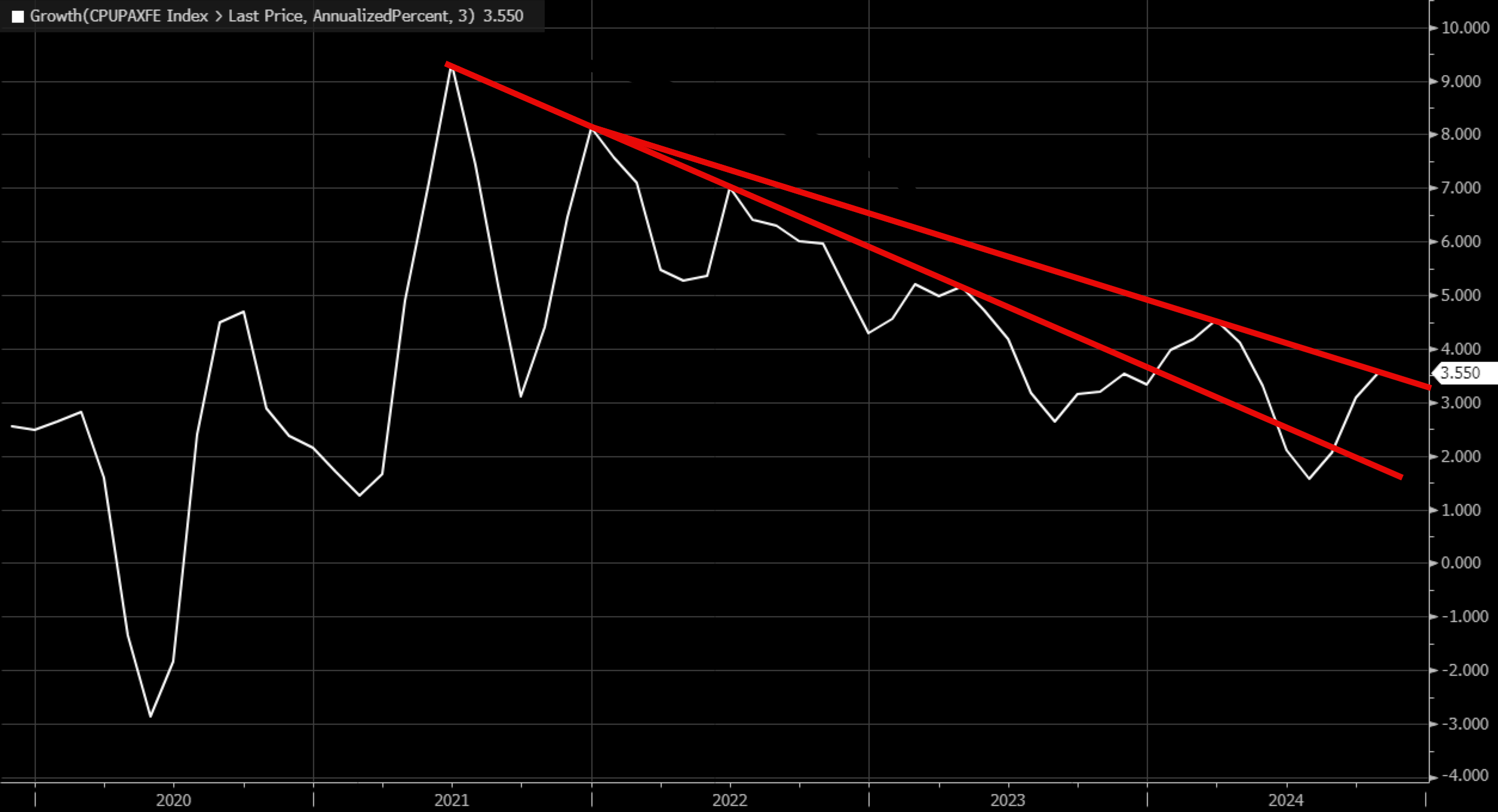

The bigger question for core CPI is whether some trend change is taking place. It’s unclear at this point, but the annualized 3-month rate of change for core CPI rose by 3.6%.

Whatever the case, the 30-year closed at its highest level since early July. This looks like an important potential breakout that, depending on today’s PPI report, could push the 30-year even higher.

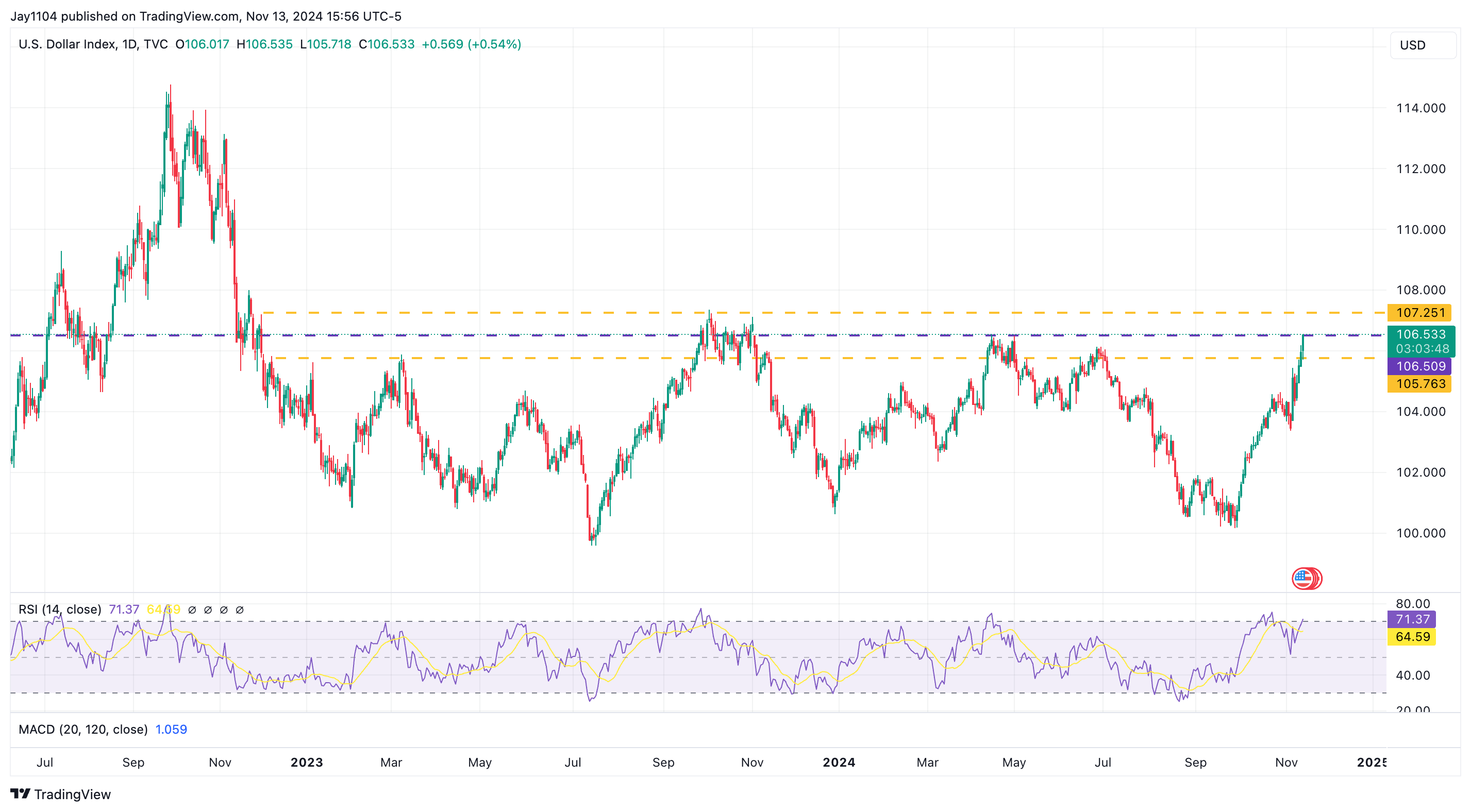

Meanwhile, the dollar index made its highest close since November 2023 and is approaching the 107.25 level, which is of incredible importance. A breakout means the highs of 2022 could be in play.

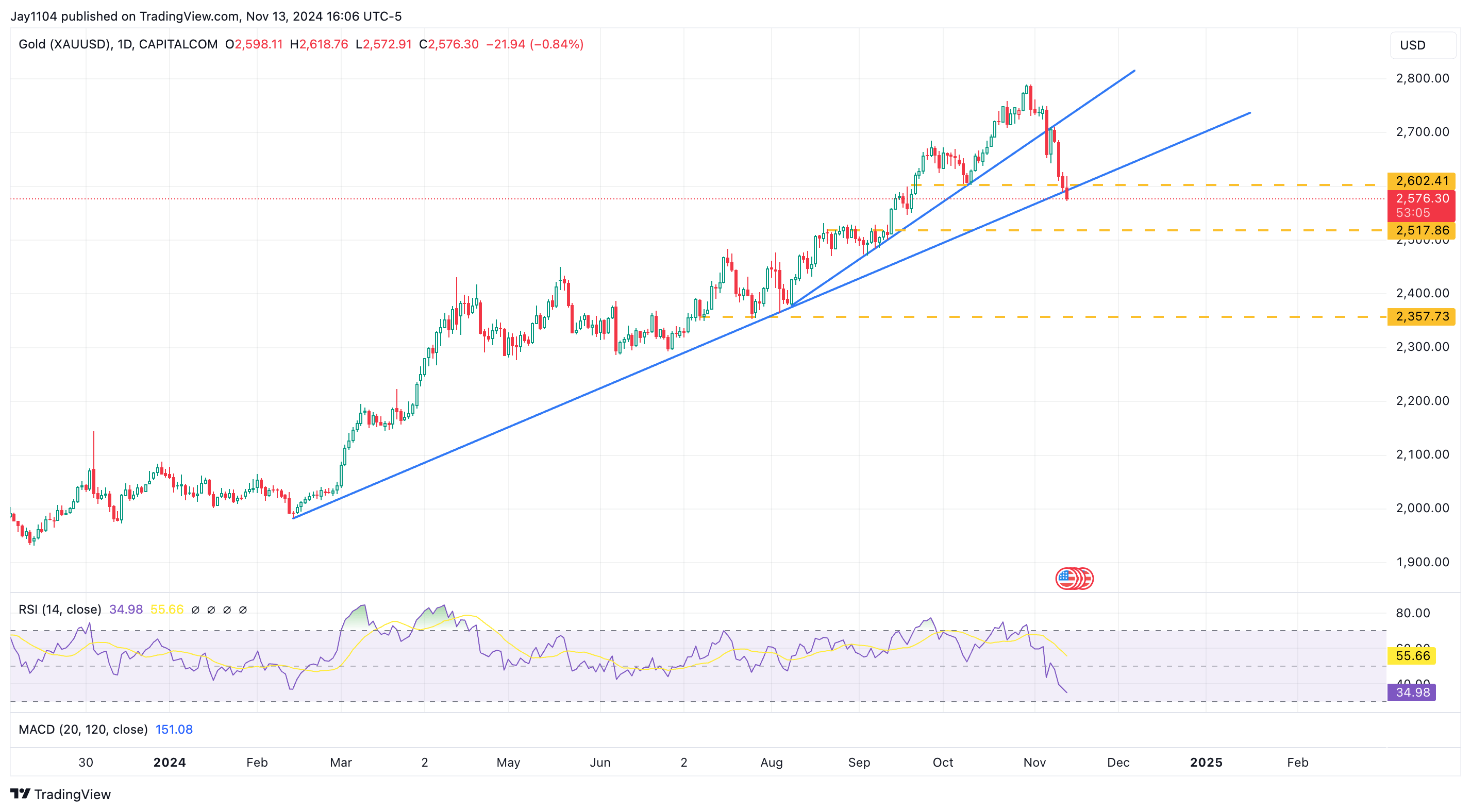

This is wreaking havoc across hard assets as real yields rise and commodities like gold and oil drop. Gold broke another support level yesterday and an uptrend and could open a path to $2,500.

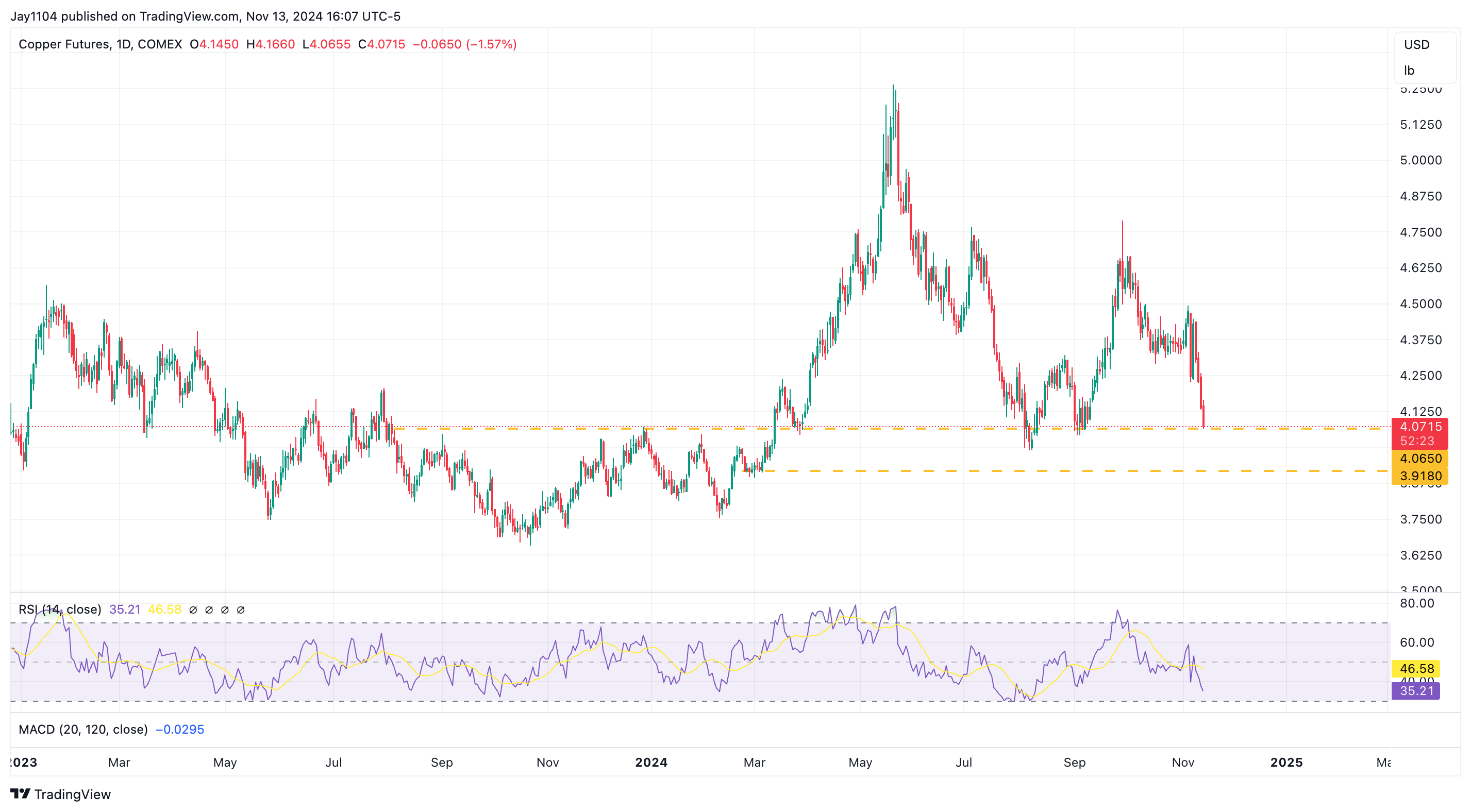

Copper is at support, too, and a break of $4.05 opens a path to around $3.90.

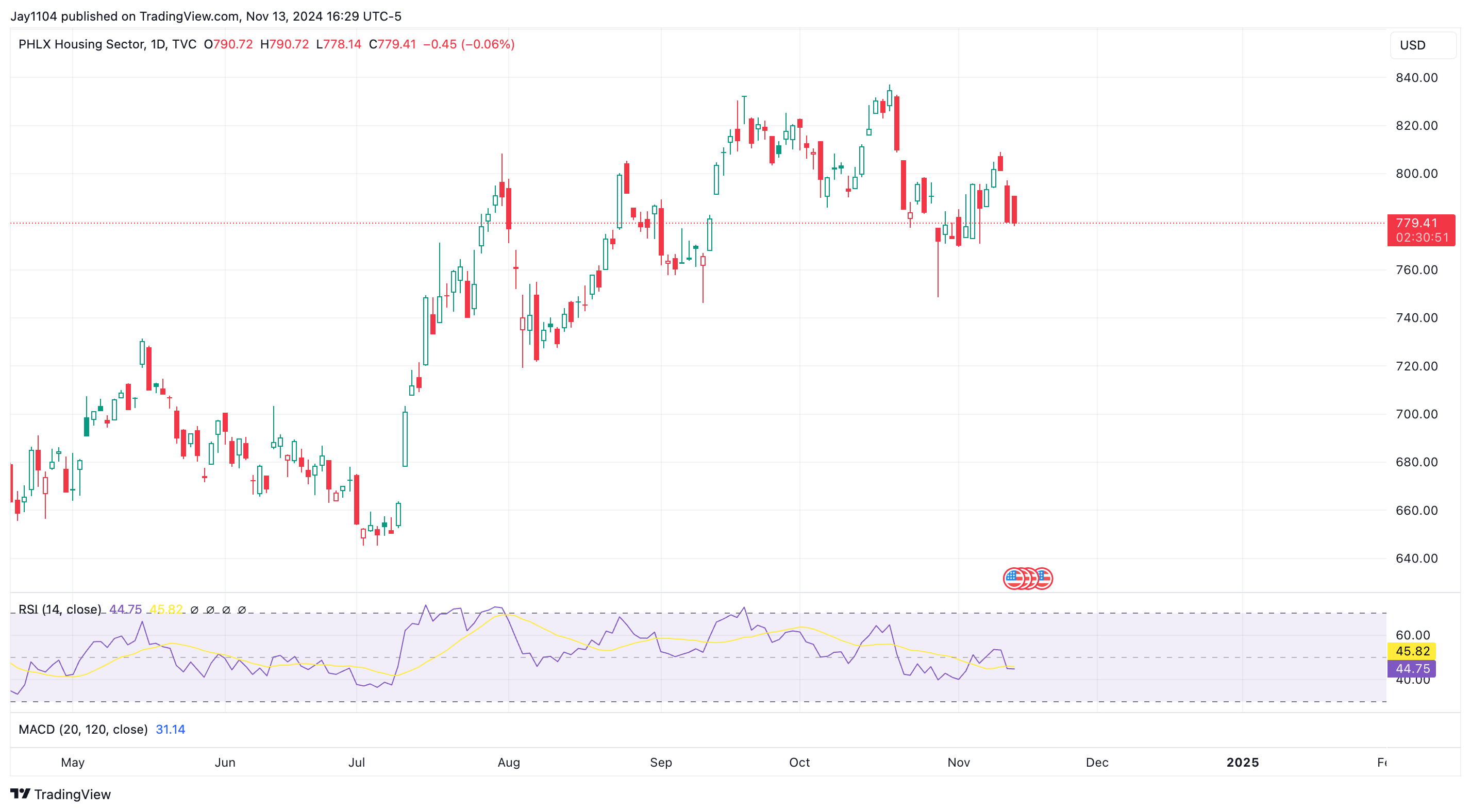

The Housing Index (HGX) saw a gain of nearly 1.4% evaporate over the day as rates rose. Rising rates will not be friendly to mortgages or the housing sectors.

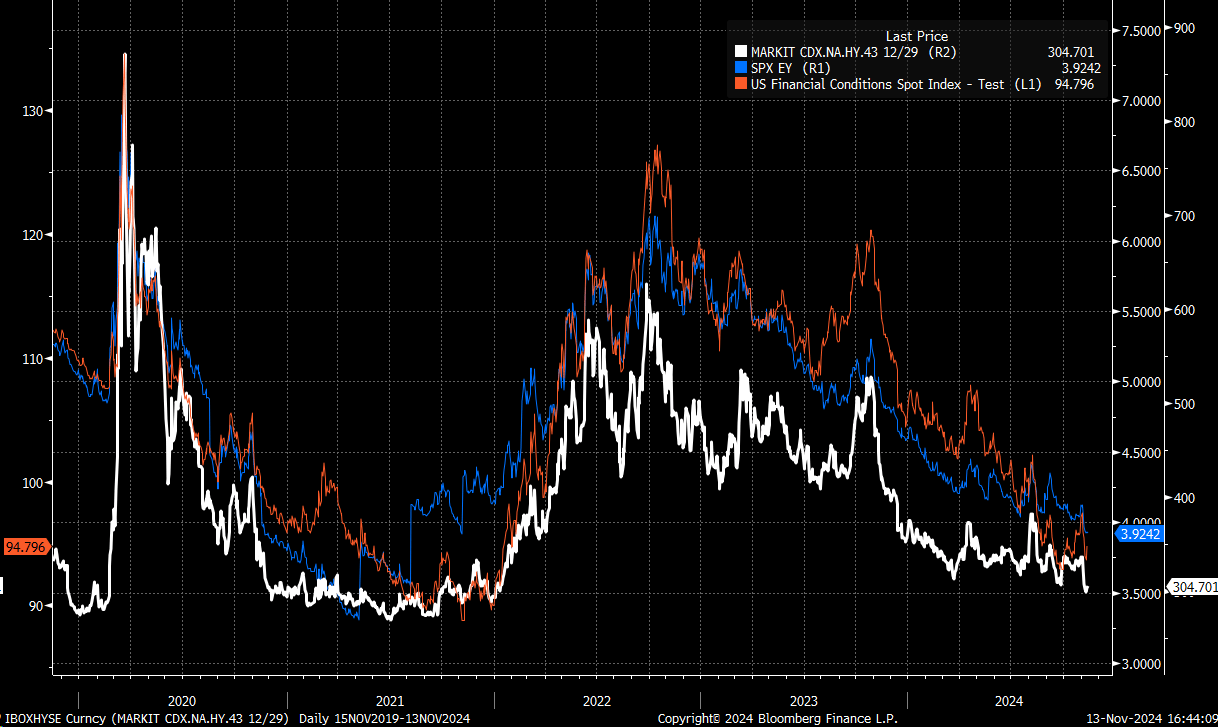

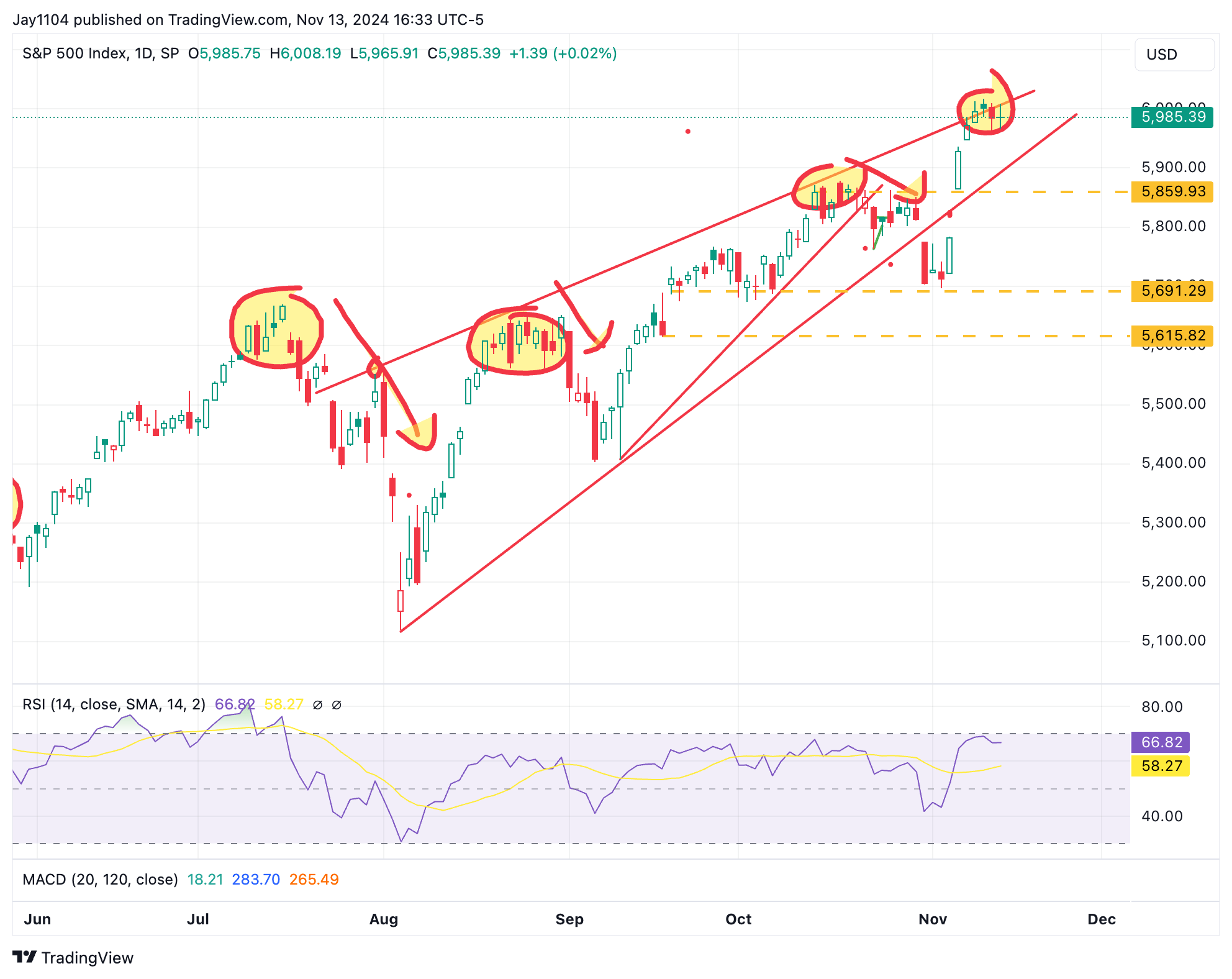

In the meantime, stocks have yet to get the memo that rates are rising and may head significantly higher from here. The S&P 500 was basically flat on the day and has stalled at resistance for now.

The only question that remains is when credit spreads snap and start to widen. When they do, that will be the point at which stocks begin to finally cave.