Lepidico (ASX:LPD) is awaiting the delivery of Phase 1 control estimates from its EPCM contractor ahead of making a final investment decision (FID) on its Karibib integrated lithium mine and chemical plant project in September. Within this context, it has now almost completed the resourcing of its executive management team with four major recent appointments at a time when the price of lithium chemicals has continued to hover close to record highs (in sharp contrast to most other metals).

One of the first of the new wave

After a two-year hiatus during the period of the coronavirus crisis, in which almost no new lithium projects were announced, Lepidico’s Karibib project is one of the first projects to be at the point of an FID in the current cycle.

Phase 2 Plant project thinking develops to next phase

While it is approaching an FID on its Phase 1 Plant project, Lepidico has also been refining its strategy in relation to the development of a full-scale Phase 2 Plant, possibly to be located in Europe, Namibia, the UAE, or the US. Where before this had been conceived of as a fully integrated, owner-operated project, it is now being thought of as a centralised processing facility taking concentrate from third-party lepidolite mines as well as an expansion at Karibib in or near the Atlantic basin, putting Lepidico in a unique position to develop a global market for lithium mica concentrate outside China.

Valuation: Ticking upwards

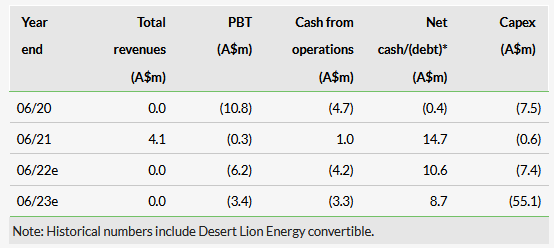

We have put our estimate of project timing back by six months to take account of longer lead times for securing key contracts and the delivery of equipment. Nevertheless, our core valuation of Lepidico has increased to 6.66 Australian cents per share (cf 6.64c/share previously) plus a potential, risk-adjusted 0.63–1.55 cents for a conceptual 20,000tps LCE Phase 2 Plant to take the total aggregate conceptual valuation to 7.29–8.21 cents (fully diluted). While our valuation of the Phase 2 Plant has, at first glance, fallen since our last note, this change reflects our assumption that Lepidico will now buy in approximately two-thirds of the material required to feed the plant rather than mining it. While this change in business model has increased our forecast of the plant’s opex, it exposes it to much faster increases in valuation as third-party ore resources are made available to its operation. The change also potentially shortens the route to development of the enlarged plant by two to three years. Note that this valuation does not attribute any value to Lepidico from any other potential development options (eg third-party technology licensing).

Business description

Via its Karibib project in Namibia and unique IP, Lepidico is a vertically integrated lithium development business that has produced both lithium carbonate and lithium hydroxide from non-traditional hard rock lithium-bearing minerals using its registered L-Max and LOH-Max processes.

Click on the PDF below to read the full report: